SPY vs VOO

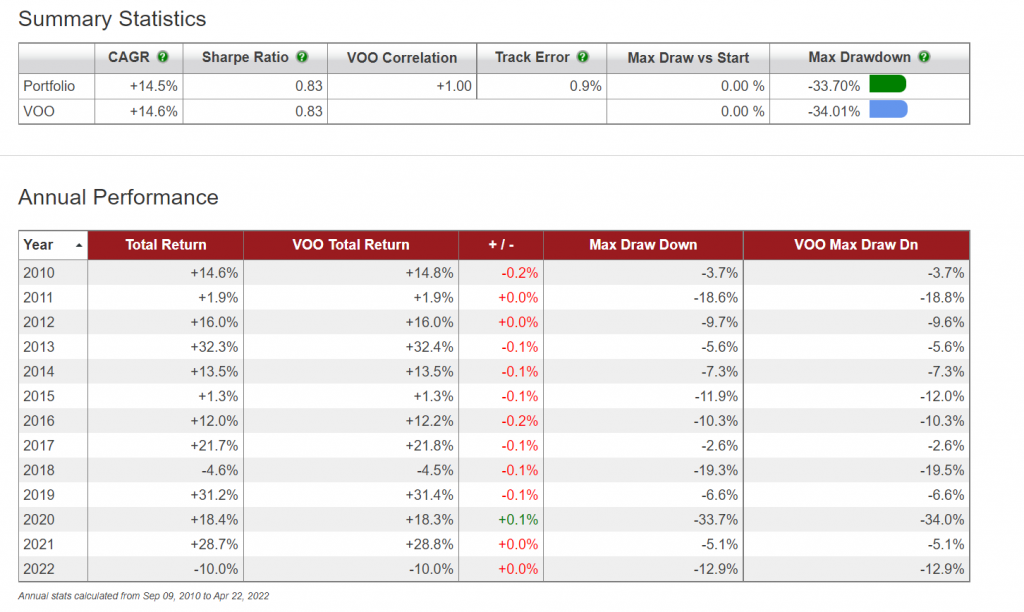

What is the best ETF to hold long term between SPY and VOO? Over the long term VOO slightly outperforms SPY by an average of 0.01% a year based on management expenses, yield, and likely the timing of how they track the underlying S&P 500 index when it changes holdings. VOO would be the best […]