The Stock Market Made A V-Shaped Recovery. What’s next?

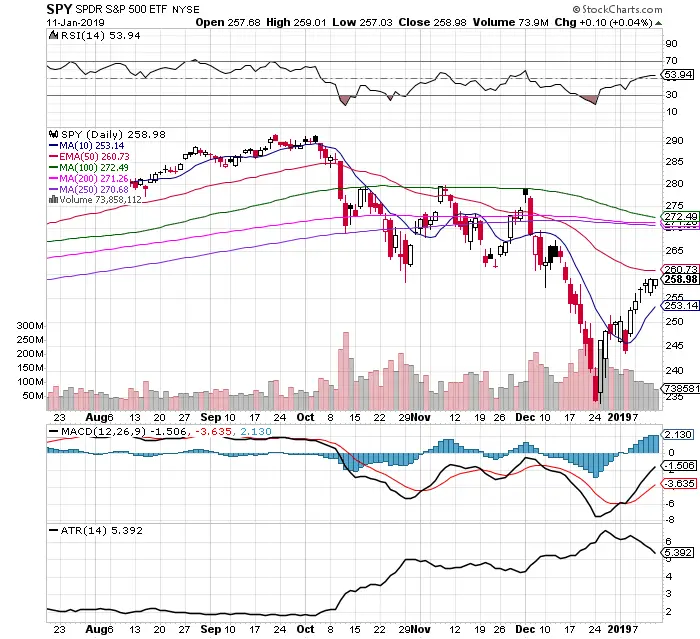

This is a Guest Post by Troy Bombardia of BullMarkets.co The S&P has now retraced more than 50%, which was the standard post-crash target outlined a few weeks ago. The stock market is exactly where it was a few months ago. This demonstrates the stock market’s “bullish bias” – it goes up more often than […]

The Stock Market Made A V-Shaped Recovery. What’s next? Read More »