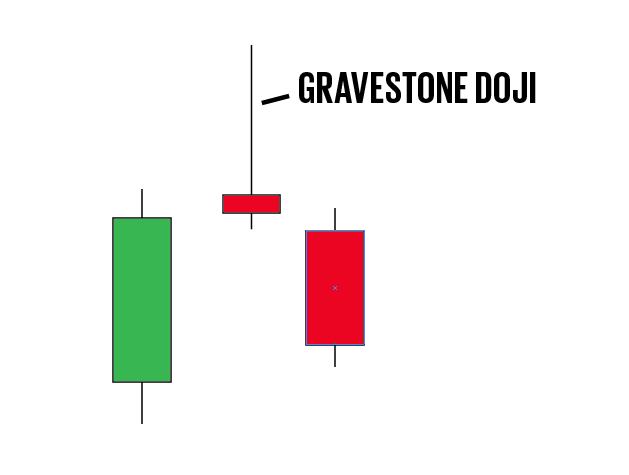

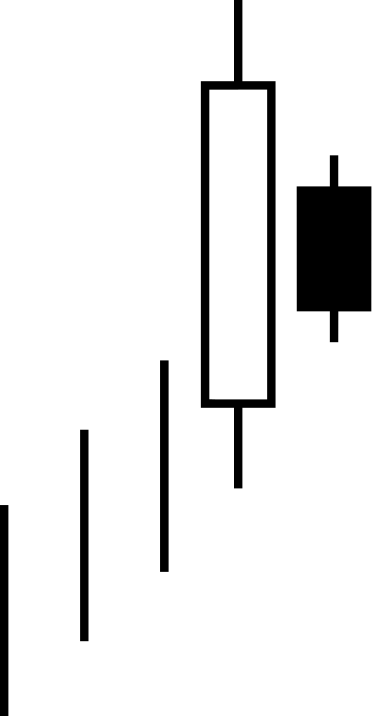

Gravestone Doji Candlestick Pattern

The gravestone doji candlestick pattern is a three candle pattern. It is created when a big bullish candle is followed by a candle with a long wick that has opening and closing prices in the time frame close to the same and price ends near the low of the time frame. The last candle in […]

Gravestone Doji Candlestick Pattern Read More »