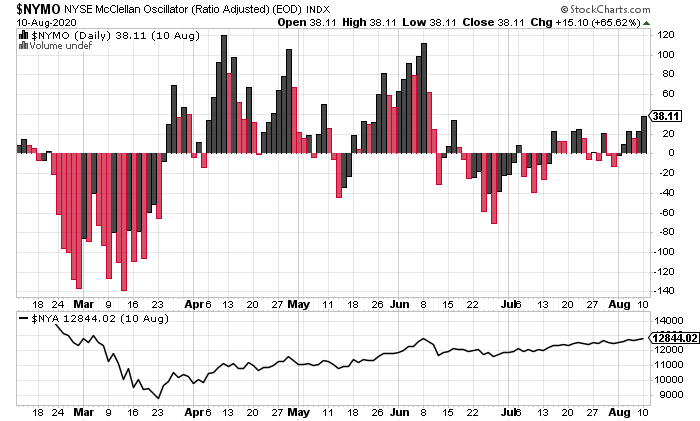

What is the McClellan Oscillator?

The McClellan oscillator is a market breadth technical indicator used by traders to analyze the New York Stock Exchange listings balance between the advancing and declining stocks over time. The McClellan oscillator quantifies the Advance-Decline Data on a stock market exchange, it could also be used on stock indexes, portfolio holdings, or any watchlist of […]

What is the McClellan Oscillator? Read More »