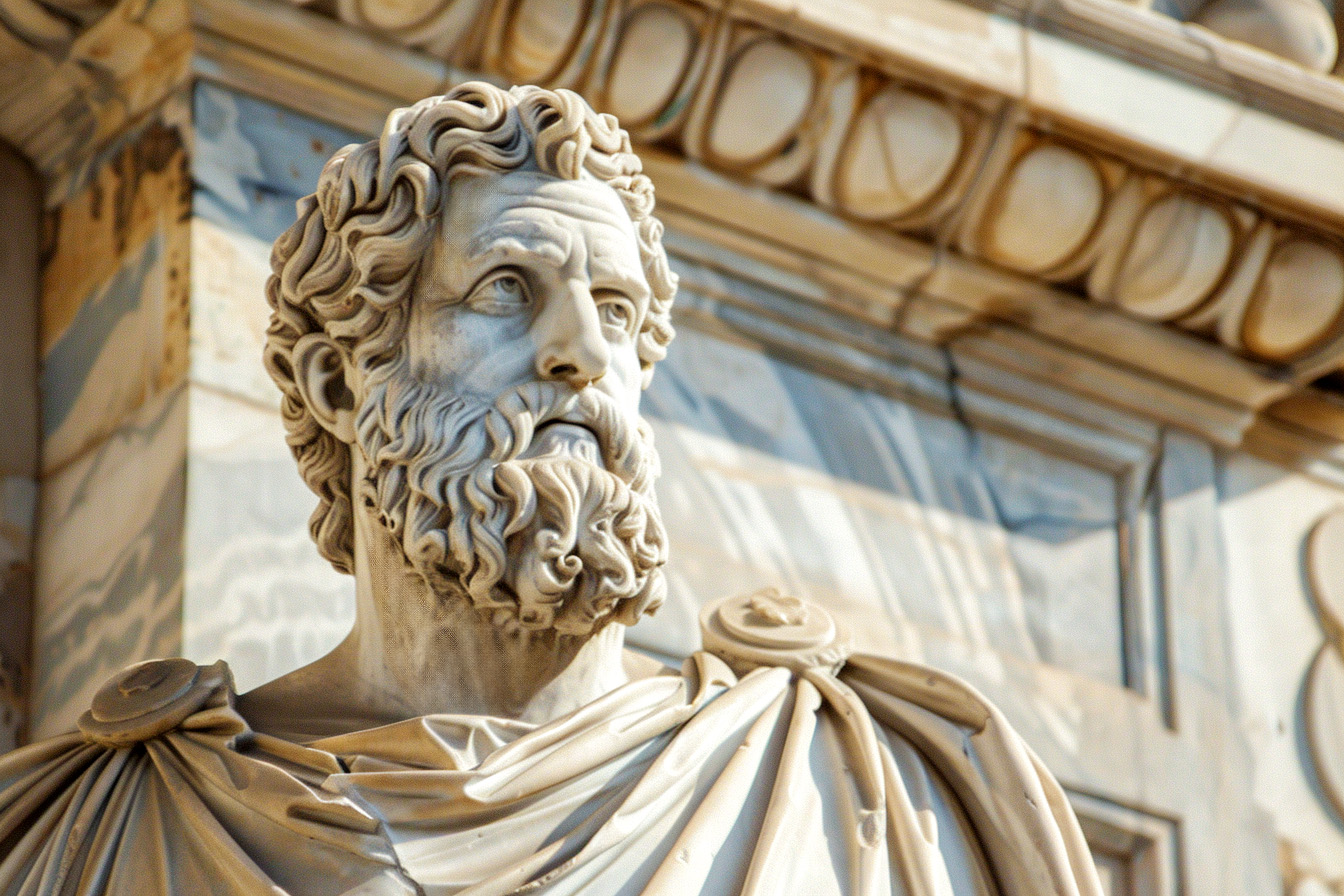

10 Stoic Secrets to Trading Success: Stoicism

Maintaining a steady mindset can be the difference between success and failure in the volatile world of trading. Stoicism, an ancient Greek philosophy, offers timeless principles that can be applied to modern-day trading. By incorporating these Stoic secrets into your trading practice, you can develop resilience, improve decision-making, and achieve long-term market success. Let’s look […]

10 Stoic Secrets to Trading Success: Stoicism Read More »