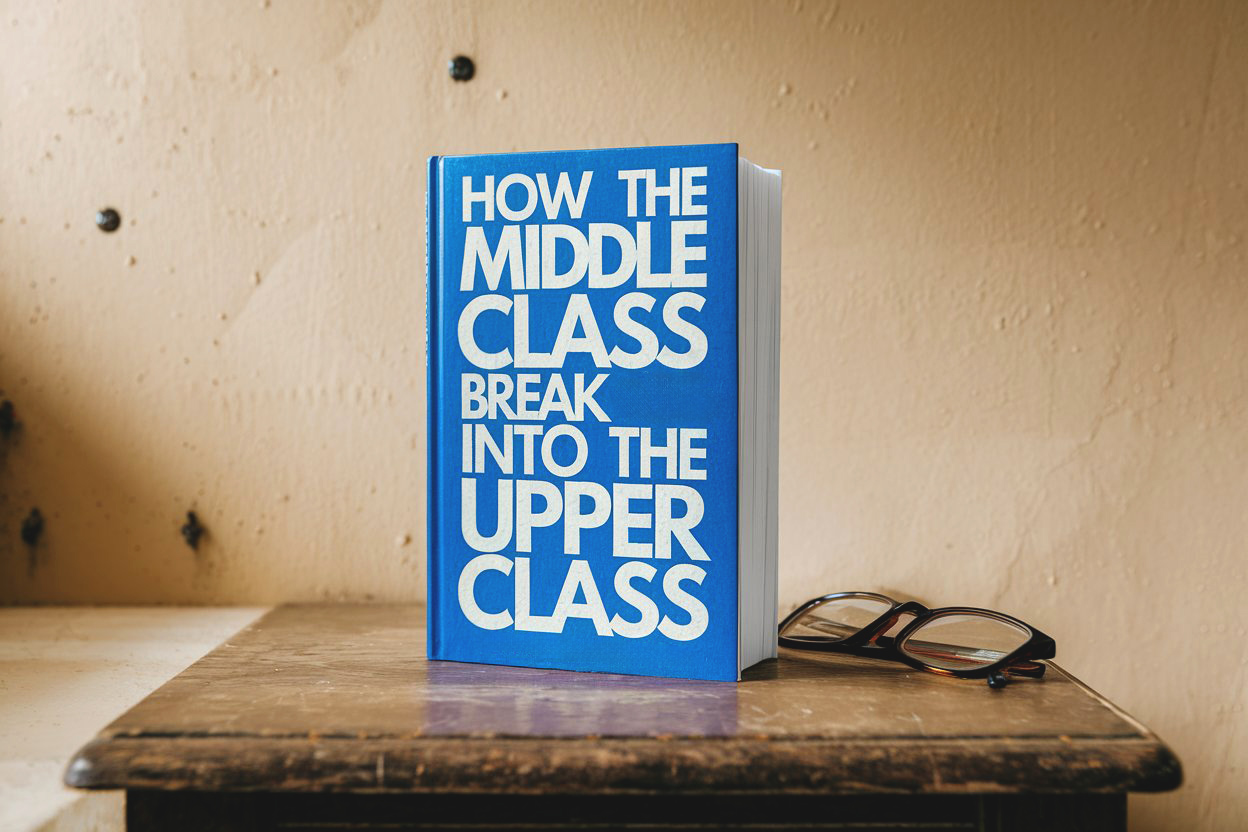

Smart Money Books: 10 Wealth Guides to Achieve Financial Intelligence

Knowledge is power in the quest for financial success. The right books can provide invaluable insights, strategies, and mindsets to help you build wealth and achieve financial intelligence. This article explores ten influential books that offer diverse perspectives on money management, investing, and financial literacy. These works provide unique teachings that can guide you toward […]

Smart Money Books: 10 Wealth Guides to Achieve Financial Intelligence Read More »