1. The Forgotten Financial Manual That Shaped a Billionaire’s Mindset

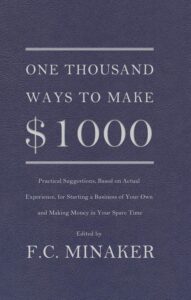

In the depths of the Great Depression, a practical guide to entrepreneurship was published that would go on to shape one of the greatest financial minds in history. “One Thousand Ways to Make $1000” by F.C. Minaker, released in 1936, found its way into the hands of a young Warren Buffett at the Benson Public Library in Omaha.

Buffett discovered this book when he was just 7 years old, and it left such an impression that he “virtually memorized” it, according to a 1988 Fortune profile. The book’s practical approach to business and entrepreneurship resonated deeply with the mathematically inclined young Buffett as a kid, setting him on a path that would eventually lead to billions.

This Depression-era manual wasn’t a theoretical treatise on economics or investing theory. Instead, it offered concrete examples of how ordinary Americans had built businesses and made money through practical ingenuity during tough economic times.

The book covered a broad spectrum of topics, including investing, marketing, merchandising, sales, customer relations, and raising charity money. For a numbers-oriented child with an entrepreneurial spirit, it was the perfect blueprint for understanding how business works at its most fundamental level.

2. How a Depression-Era Book Changed Warren Buffett’s Life at Age 11

The impact of Minaker’s book on young Buffett cannot be overstated. After reading “One Thousand Ways to Make $1000,” Buffett boldly declared that he would become a millionaire by age 35. This wasn’t just a childish fantasy—it became a driving goal that shaped his early decisions and set the foundation for his legendary investment career.

The book transformed Buffett from a child who enjoyed numbers into a focused young entrepreneur with a clear vision of his financial future; Buffett immediately began implementing the book’s lesson inspired by what he learned. He started selling packs of chewing gum door-to-door in his neighborhood, eventually moving on to the more profitable venture of selling Coca-Cola bottles, which earned him a nickel for every six bottles sold.

These weren’t just childhood hobbies—they were his first attempts at applying business principles he’d absorbed from Minaker’s book. His paper routes, golf ball sales, and other early ventures trace back to this formative influence, showing how deeply the book’s entrepreneurial spirit had taken root.

3. Inside F.C. Minaker’s Entrepreneurial Playbook from 1936

Minaker’s approach was remarkably straightforward for a book that would influence such a financial titan. Written in a conversational style similar to Dale Carnegie’s “How to Win Friends and Influence People,” the book was filled with inventive ideas for making money through excellent salesmanship, hard work, and resourcefulness. Rather than complex financial theories, it focused on practical methods that ordinary people could implement immediately.

The book offered an impressive array of business ideas, some of which naturally seem quaint by today’s standards. These included goat dairying, manufacturing motor-driven chairs, and renting billiard tables to local establishments. Even candy production and sales that may have inspired Buffett to purchase See’s Candies in his later career.

But beneath these specific suggestions lay timeless business principles. Minaker emphasized starting small, reinvesting profits, providing customer value, and steadily building toward bigger opportunities. Does that sound familiar?

The manual was particularly notable for being published during the Great Depression when unemployment reached nearly 20%. Its optimistic tone and practical advice offered hope that entrepreneurial spirit could overcome even the direst economic circumstances.

4. The Simple Money-Making Lessons That Resonated with Young Warren

Among the many concepts in Minaker’s book, several made a lasting impression on Buffett and later became hallmarks of his investment philosophy. Perhaps most significantly, the book introduced Buffett to the power of compounding—a concept that fascinated him and became a cornerstone of his investment approach.

The power of letting money grow exponentially over time became a driving principle that shaped his entire career. This appreciation for the long-term growth of money would later manifest in Buffett’s legendary patience as an investor.

Another key principle that Buffett absorbed was understanding what you invest in. Almost every entrepreneur profiled in Minaker’s book launched a business based on something they already had expertise in rather than simply chasing hot markets.

This parallels Buffett’s famous investment strategy of staying within his “circle of competence.” Even as a child reading these stories, Buffett internalized the importance of investing in businesses and ideas you thoroughly understand—a principle that would later help him avoid numerous investment fads and bubbles throughout his career.

5. Why “One Thousand Ways to Make $1000” Still Matters Today

While some of Minaker’s book’s specific business ideas are now obsolete, its fundamental principles remain remarkably relevant. The underlying business concepts—from marketing and investing to sales and customer relations—are as applicable today as they were nearly 90 years ago.

In an age of digital entrepreneurship and side hustles, the book’s core message about finding opportunities and taking the initiative resonates perhaps even more strongly than it did during the Depression.

The book’s emphasis on starting small and growing steadily makes it particularly valuable. Minaker insisted that people don’t make money because they keep “waiting for business to get better” instead of taking action with their resources.

This mindset of beginning with modest means and steadily building wealth through disciplined reinvestment mirrors today’s financial wisdom about consistent investing and compound growth. For modern entrepreneurs facing economic uncertainty, Minaker’s Depression-era advice about resourcefulness and persistent effort offers timeless guidance.

6. How Practical Examples in Minaker’s Book Sparked Buffett’s First Ventures

The book’s influence on Buffett went beyond theoretical interest—it directly inspired his earliest business ventures. One of Buffett’s most successful early enterprises began at age 17 when he and his friend Don Danley purchased a used pinball machine for $25 in 1946. They placed it in a barber shop, splitting the profits with the owner.

This business proved so successful that within a week, they had earned enough to buy another machine, eventually expanding to multiple locations.

This pinball machine business was so profitable that Buffett later called it “the best business I was ever in,” joking that he “peaked very early in my business career.” After just one year, the teenage entrepreneurs sold the business for over $1,200—an impressive return on their initial $25 investment.

Other early ventures included selling used golf balls, delivering newspapers, and various small enterprises that helped Buffett develop his business acumen and build investment capital. His efforts reflected the book’s emphasis on finding opportunities within reach and steadily building on small successes.

7. The Timeless Principles of Wealth Building Hidden in an Obscure Text

At its core, Minaker’s book emphasized wealth-building principles that have stood the test of time and become central to Buffett’s approach. The power of compounding was perhaps the most significant—the concept that money, when reinvested over time, grows exponentially rather than linearly.

This principle became so fundamental to Buffett’s thinking that it influenced his investment strategy and entire approach to building wealth. Another key principle was the importance of starting early. Buffett has famously described compounding as “building a little snowball and rolling it down a very long hill”—the earlier you start, the more time your investments have to grow.

Minaker’s book encouraged readers not to wait for perfect conditions but to begin immediately with their available resources. This message resonated with young Buffett, who didn’t wait for adulthood to start his business ventures. The book’s emphasis on patience, disciplined reinvestment, and focus on fundamentals rather than get-rich-quick schemes all became hallmarks of Buffett’s approach to building his fortune.

8. From Paper Routes to Billion-Dollar Investments: Tracing Buffett’s Journey Back to Its Source

The entrepreneurial spark ignited by Minaker’s book set Buffett on a remarkable trajectory. Buffett steadily built his financial knowledge and capital from his early ventures selling chewing gum and Coca-Cola and running a paper route; by age 14, he had invested his earnings in 40 acres of farmland, which he rented out for profit.

He achieved his goal of becoming a millionaire two years after the deadline he set from reading Minaker’s book. Warren Buffett became a millionaire at the age of 32 in 1962. His Buffett Partnership, which he ran, was valued at over $7 million, and his shares were worth over $1 million at the time. Each step along the way reflected principles he had absorbed from “One Thousand Ways to Make $1000.”

By age 35, his partnerships had grown to $26 million. By 39, his net worth was $25 million. At 43, it had reached $34 million. [1] The trajectory continued upward, eventually making Buffett one of the world’s wealthiest individuals.

Throughout this remarkable journey, the foundational principles he learned from Minaker’s book—the power of compounding, reinvestment, understanding your investments, and patient growth—remained consistent guideposts.

9. What Modern Entrepreneurs Can Learn from This Depression-Era Classic

Today’s aspiring entrepreneurs and investors can draw valuable lessons from the book that shaped Warren Buffett. Perhaps most importantly, Minaker’s work emphasizes that successful wealth-building doesn’t require complex strategies or privileged access—it requires disciplined application of fundamental principles.

The book’s underlying message about creativity, excellent salesmanship, hard work, and resourcefulness remains as relevant for modern entrepreneurs as it was during the Great Depression. For those seeking to build wealth today, the book offers a reminder to start with available opportunities rather than waiting for perfect conditions.

It emphasizes understanding what you’re investing in rather than chasing current trends or temporary fads. Perhaps most significantly, it highlights the power of compound growth over time—reminding us that consistent reinvestment of modest gains can eventually produce remarkable results.

While the specific business opportunities of today differ dramatically from those of 1936, the underlying principles of entrepreneurship and wealth-building that inspired a young Warren Buffett continue to offer a valuable blueprint for financial success.

Conclusion

“One Thousand Ways to Make $1000” may seem like an unlikely candidate for a life-changing book. Its Depression-era advice and practical business suggestions could easily have faded into obscurity. Instead, this humble manual has indirectly shaped the modern financial landscape through its profound influence on Warren Buffett.

The lessons a young boy absorbed from its pages—about compounding, understanding investments, starting small, and patiently building wealth—evolved into principles that would guide hundreds of billions of dollars in investments, create a trillion-dollar company, and create one of history’s greatest fortunes for Warren Buffett.

The book’s lasting significance lies not in its specific business ideas but in its timeless wisdom about approaching money and opportunity. For anyone seeking financial success today, how this forgotten manual shaped Warren Buffett’s mindset offers a powerful reminder that outstanding achievements often begin with simple principles applied consistently over time.

Though you may never have heard of F.C. Minaker’s book before, its impact continues reverberating through Buffett’s investment philosophy and the countless lives it has touched through Warren Buffett’s business and skills in capital allocation. Sometimes, the most profound wisdom comes from the most unexpected sources—and sometimes, the right book at the right time can change not just a life but the world.