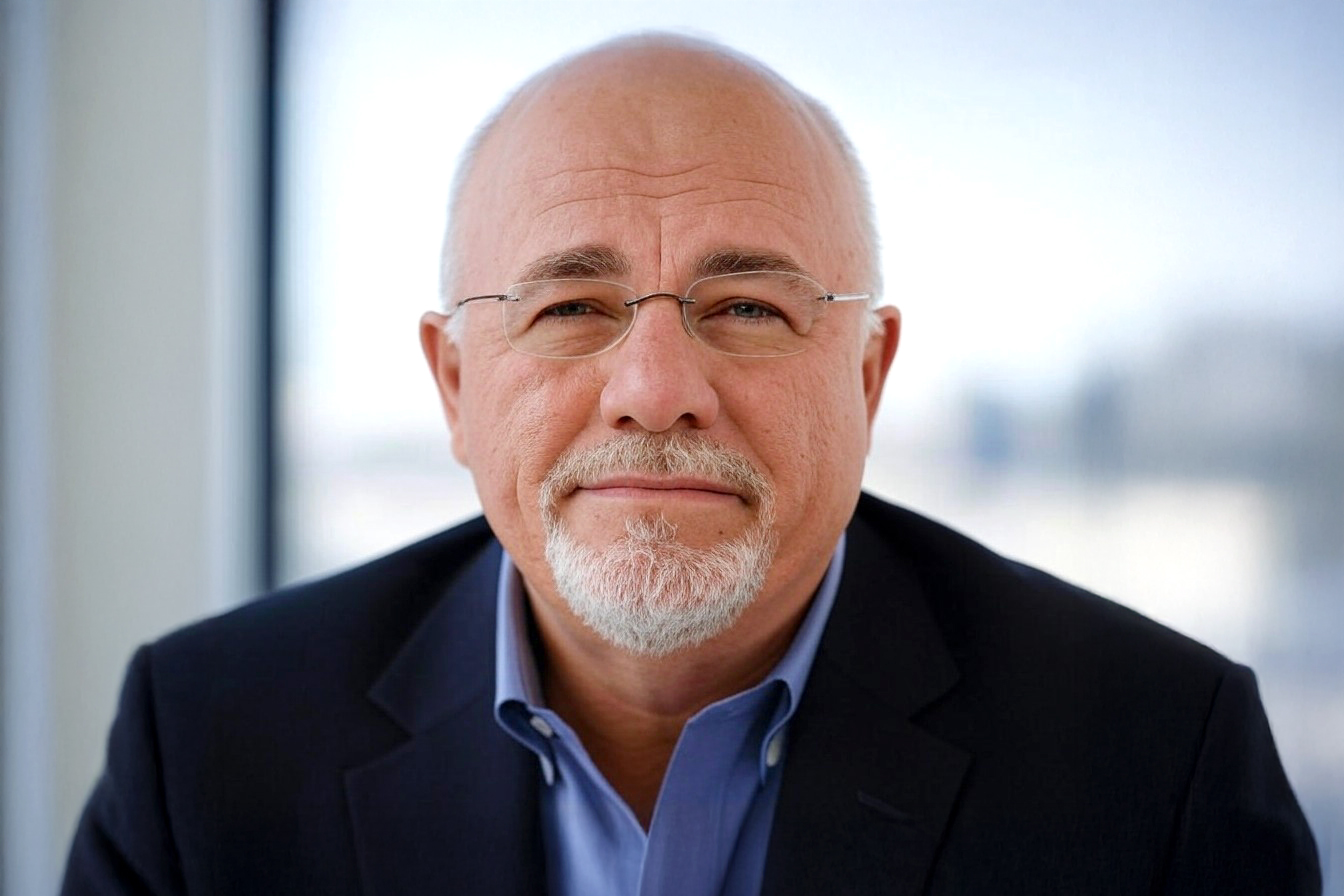

In a world obsessed with acquiring more, financial guru Dave Ramsey has built his career on a counterintuitive message: your spending habits might be what’s keeping you financially stuck.

While many Americans dream of financial freedom, their daily consumption choices often undermine their long-term wealth-building potential. This disconnect between aspirations and actions creates a financial treadmill where financial progress remains elusive despite working harder and earning more.

Through his radio show, books, and courses, Ramsey has identified specific consumption patterns that keep middle-class families trapped in a cycle of earning and spending that prevents meaningful wealth accumulation. By understanding these patterns and implementing Ramsey’s alternative approach, you can break free from the consumption traps that may be holding you back from your financial goals.

Let’s explore how your consumption keeps you in the middle class, according to Dave Ramsey.

1. The Trap of Lifestyle Inflation: Earning More but Saving Less

According to Dave Ramsey, lifestyle inflation is one of the most common financial pitfalls that keeps people trapped in the middle class. This phenomenon occurs when spending increases directly proportional to income—you get a raise, so you upgrade your car, move to a bigger house, or start eating at fancier restaurants.

The result? Despite earning more money, your wealth doesn’t grow. Ramsey often discusses why people fall into this trap. This mindset leads to a perpetual cycle where increased income never translates to increased wealth.

The middle class is particularly vulnerable to lifestyle inflation because modest income increases justify modest lifestyle upgrades. That new promotion might be the perfect excuse to trade in your three-year-old car for this year’s model. But these small decisions compound over time, leaving you with better stuff but no better financial position.

What makes lifestyle inflation so dangerous is how normal it feels. In our consumer-driven culture, spending more as you earn more is accepted and expected. Breaking this cycle requires consciously maintaining your current lifestyle even as your income grows, directing the surplus toward wealth-building instead.

2. How Debt-Fueled Consumption Drains Your Wealth-Building Potential

Dave Ramsey says that debt is the greatest threat to your financial future. His stance on borrowing money, particularly for consumer purchases, is unequivocal: “Debt is not a tool; it is a method to make banks wealthy, not you.”

When you finance consumption through credit cards, car loans, or store financing, you’re not just paying for the item—you’re paying extra in interest, often turning affordable purchases into financial burdens. This practice diverts money that could be growing through investments into payments that only make the lender richer.

Ramsey points out that this debt cycle is insidious because it becomes normalized. “Debt has been sold to us for so long that we feel like we can’t survive without it,” he explains. This mindset keeps middle-class families making payments instead of making investments.

The math is compelling. When you’re paying interest rates of 20% or more on credit cards while your investments might earn 8%-12% annually, you’re moving backward financially with every purchase. Ramsey advocates a cash-only approach to consumption, arguing that you can’t afford it if you can’t pay for something outright (except perhaps a home).

3. Status Symbols: The Hidden Cost of Keeping Up Appearances

Pursuing status symbols represents one of the most psychologically powerful forms of consumption, keeping people financially stagnant. Dave Ramsey is particularly critical of this aspect of consumer behavior.

“We’re buying things we don’t need with money we don’t have to impress people we don’t like,” Ramsey frequently states. This observation highlights how social comparison drives many purchasing decisions that ultimately impede wealth building.

Luxury cars, designer clothing, and the latest electronic gadgets often serve as visual signals of success. However, Ramsey points out the irony that many truly wealthy individuals avoid flashy displays of wealth. Instead, they direct their resources toward assets that appreciate rather than depreciate.

What makes status-driven consumption particularly harmful is its never-ending nature. There’s always a newer model, a more exclusive brand, or a bigger house. This pursuit creates a financial treadmill where you run faster without moving forward financially.

Ramsey encourages his followers to find satisfaction in financial progress rather than material possessions. He advocates measuring success by your net worth rather than what’s parked in your driveway.

4. The New vs. Used Dilemma: Why Depreciation Matters

“A new car loses 60% of its value in the first five years. That means your $40,000 car is going to be a $16,000 car in five years. If you lose $24,000 every five years, don’t be scratching your head and wondering why you can’t build wealth. It’s because you’re driving it—down the sewer.” – Dave Ramsey.

One of Dave Ramsey’s most consistent advice concerns depreciation, particularly with vehicles. Ramsey often points out that new cars lose 60% of their value in the first four years. This rapid decline in value represents one of the most significant wealth transfers from the middle class to businesses.

When you buy a new car, you’re paying a premium for that new-car smell and the privilege of being the first owner. That premium, however, evaporates almost immediately. Ramsey advises buying reliable used cars that have already experienced their steepest depreciation.

This principle extends beyond automobiles to furniture, appliances, electronics, and more. By purchasing gently used items, you let someone else absorb the depreciation hit while retaining most of the product’s useful life.

Ramsey’s advice is practical. His approach to car ownership is encapsulated in his “Drive Free and Retire Rich” strategy, which involves saving money, investing, and using those investments to purchase cars without going into debt. By this, he means that avoiding car payments by buying affordable used vehicles with cash frees up hundreds of dollars monthly that can be invested for your future instead.

5. Breaking the Consumption Cycle: Ramsey’s Approach to Financial Freedom

Escaping the middle-class consumption trap requires a systematic approach, so Ramsey developed his famous “Baby Steps” program. This step-by-step plan provides a clear path from consumption-driven finances to wealth building.

“You must gain control over your money, or the lack of it will forever control you,” Ramsey states. His approach begins with establishing an emergency fund and becoming debt-free before focusing on wealth building through consistent investing.

Breaking the consumption cycle often means temporarily living below your means—sometimes significantly—to gain long-term financial traction. This might mean delaying gratification, a concept that runs counter to modern consumer culture but is essential for economic progress.

Ramsey emphasizes that financial freedom isn’t about deprivation but prioritization. By eliminating debt payments and redirecting that cash flow toward investments, you eventually reach a point where your money works harder than you do, creating true financial independence.

6. Redirecting Your Resources: Prioritizing Investment Over Spending

The fundamental shift Dave Ramsey advocates is redirecting money from consumption to investment. “Wealth building is a marathon, not a sprint,” he often says, emphasizing the importance of consistent investing over extended periods.

The results can be transformative when middle-class families redirect the money they would typically spend on payments, upgrades, and status symbols toward investments; Ramsey recommends simple, long-term investment strategies, normally advocating for growth-stock mutual funds held over decades.

The power of compounding gains makes this redirection particularly impactful. Even modest amounts invested regularly can grow substantially while the exact amounts spent on consumption disappear.

For those concerned about missing out on life’s pleasures, Ramsey offers perspective: “If you will live like no one else, later you can live like no one else.” This mantra encapsulates his philosophy that temporary sacrifices in consumption enable future financial freedom that most middle-class consumers never experience.

7. Building Real Wealth: Living Below Your Means by Design

Living below your means isn’t just about cutting expenses—it’s about intentionally designing a lifestyle that prioritizes financial progress over consumption. “Act your wage,” Ramsey advises, encouraging people to align their lifestyle with their actual income rather than their desired income.

This approach differs dramatically from the typical middle-class pattern of getting over-extended to afford a lifestyle. Instead of viewing frugality as deprivation, Ramsey frames it as a strategic choice that enables greater freedom and options in the future.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make so you can give back and have money to invest,” Ramsey explains. This perspective shift transforms budgeting from a restrictive practice to an empowering one.

According to Ramsey, self-made millionaires didn’t become wealthy by appearing rich. Many drive older cars, live in modest homes, and avoid lavish displays of consumption. This counterintuitive approach—living below your means while your means grow—accelerates wealth building in ways that middle-class consumption patterns can’t match.

8. The Middle-Class Mindset: Identifying Financial Habits That Hold You Back

The middle-class relationship with money often revolves around consumption rather than creation. “Your largest wealth-building tool is your income,” Ramsey states, yet many middle-class families use their income primarily to finance lifestyle rather than build assets.

This mindset manifests in patterns like buying based on monthly payments rather than total cost, prioritizing immediate gratification over long-term security, and measuring success through possessions rather than net worth. These thought patterns keep financial freedom perpetually out of reach.

Ramsey challenges his listeners and readers to adopt wealth-building thought patterns instead. This includes viewing debt as a liability rather than a tool, considering the opportunity cost of each purchase, and finding satisfaction in financial progress rather than buying new things.

“You must walk to the beat of a different drummer—the same beat that the wealthy hear. If the beat sounds normal, evacuate the dance floor immediately! The goal is not to be normal because, as my radio listeners know, normal is broke,” Ramsey advises. This different rhythm involves patience, intentionality, and a willingness to make choices that might seem strange to consumption-oriented peers.

Conclusion

Dave Ramsey’s message about consumption and wealth building is ultimately one of empowerment. Anyone can begin moving toward true financial peace by identifying and changing the consumption patterns that keep most Americans financially stagnant.

Breaking free from middle-class consumption traps isn’t about deprivation but prioritization. It means choosing financial freedom over fleeting pleasures, security over status symbols, and long-term wealth over immediate gratification.

Ramsey says, “The paid-off home mortgage has replaced the BMW as the status symbol of choice.” This shift in values from consumption to financial peace represents the heart of his philosophy and offers a path forward for those ready to move beyond middle-class financial limitations.