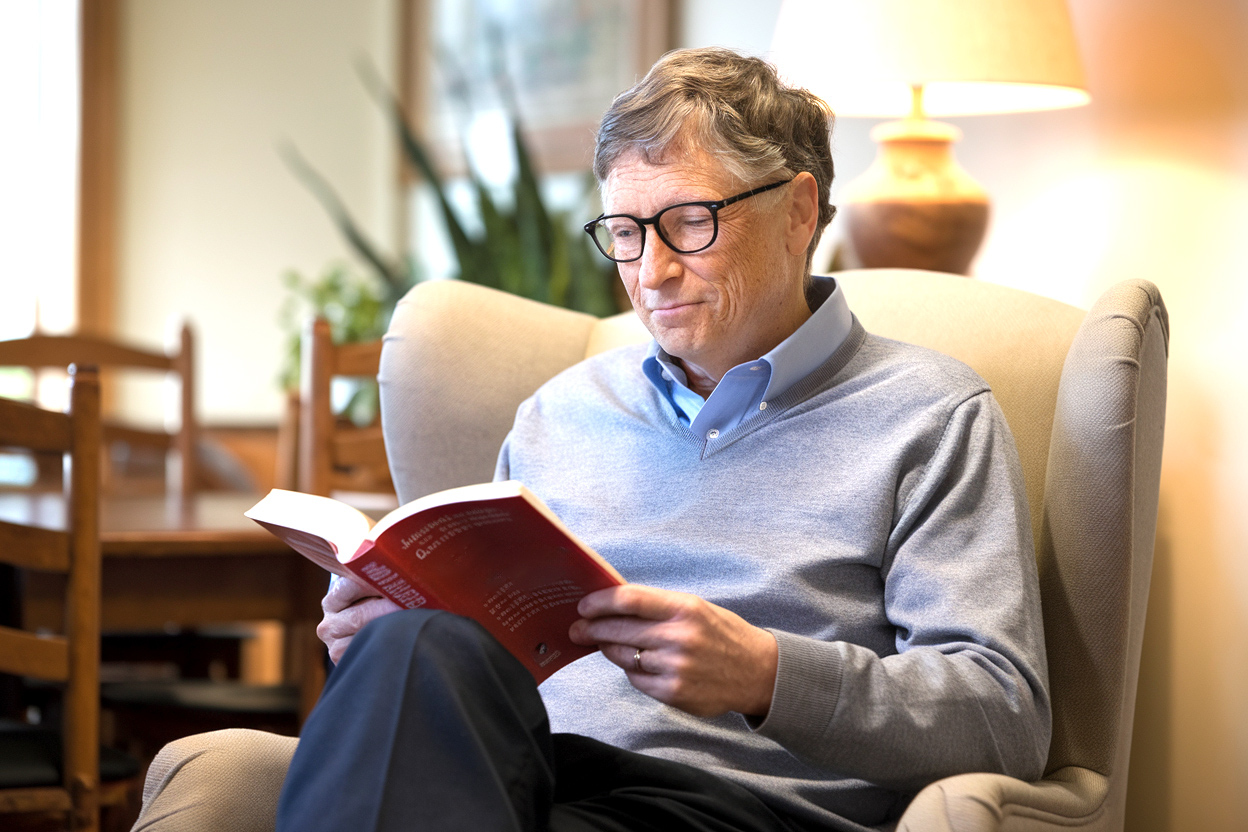

Reading books can profoundly reshape our perspectives, especially regarding wealth and financial independence. The following ten books have been instrumental in transforming middle-class mindsets and guiding readers toward millionaire status. Each offers unique insights and strategies to help individuals reframe their approach to money, success, and personal growth.

Here are the ten books that change middle-class thinking and build millionaire mindsets:

1. “The Millionaire Mind” by Thomas J. Stanley

Thomas J. Stanley delves into the psychology of millionaires, uncovering the attitudes and beliefs that pave the way to financial success. Contrary to popular myths, many affluent individuals prioritize financial discipline over extravagant spending. This revelation challenges the common perception that wealth is synonymous with lavish lifestyles and excessive consumption.

Stanley’s research emphasizes that selecting a profession aligning with one’s abilities and passions significantly contributes to financial prosperity. This insight underscores the importance of career satisfaction in achieving long-term economic success. Moreover, millionaires often exhibit courage by taking calculated risks and value integrity and strong social skills, essential in building wealth.

2. “The Middle-Class Millionaire” by Russ Alan Prince and Lewis Schiff

Russ Alan Prince and Lewis Schiff explore the journey of individuals who have transitioned from middle-class status to millionaires. Their findings reveal that hard work and continuous education are pivotal in this transformation. This emphasis on personal development highlights the importance of lifelong learning in achieving financial success.

These “middle-class millionaires” often demonstrate resilience, learning from failures and persisting despite setbacks. This ability to bounce back from adversity is a crucial trait that separates successful individuals from those who remain stagnant. Their spending habits reflect personal success and influence broader market trends and societal norms.

3. “The Top 10 Distinctions Between Millionaires and the Middle Class” by Keith Cameron Smith

Keith Cameron Smith identifies key differences in mindset and habits between the wealthy and the middle class. One notable distinction is that millionaires think long-term, setting clear visions for their desired futures, while the middle class often focuses on short-term goals. This long-term perspective allows wealthy individuals to make decisions that may not yield immediate results but lead to substantial gains over time.

Additionally, millionaires discuss ideas and opportunities, whereas the middle class may concentrate more on material possessions and other people. This shift in focus from immediate gratification to long-term planning is crucial for wealth accumulation. By prioritizing intellectual growth and opportunity recognition, millionaires position themselves for continued success.

4. “The Automatic Millionaire” by David Bach

David Bach presents a straightforward approach to wealth-building: automation. He advocates for setting up automatic systems for saving and investing, ensuring consistent contributions without relying on daily willpower. This method simplifies financial planning and helps individuals stay on track toward their financial goals.

By automating finances, readers can steadily build wealth over time with minimal effort. Bach’s approach addresses one of the most common obstacles to wealth accumulation: the tendency to procrastinate or make impulsive financial decisions. Automation removes these barriers, allowing for consistent progress toward financial goals.

5. “Rich Dad Poor Dad” by Robert Kiyosaki

In this seminal work, Robert Kiyosaki contrasts the financial philosophies of his “rich dad” and “poor dad.” The “poor dad” emphasizes traditional employment and job security, while the “rich dad” focuses on financial education, investing, and making money work for you instead of you working for money. This dichotomy challenges readers to reconsider their approach to earning income and pursuing wealth accumulation.

Kiyosaki introduces concepts such as understanding the difference between assets and liabilities, highlighting the importance of acquiring income-generating assets. This book encourages readers to seek financial independence through informed investment choices and entrepreneurial endeavors. Kiyosaki empowers readers to make strategic financial decisions by redefining what constitutes true wealth.

6. “Think and Grow Rich” by Napoleon Hill

Napoleon Hill’s classic work delves into success and wealth accumulation principles. Based on interviews with successful individuals, Hill identifies key factors such as desire, faith, and persistence as essential to achieving financial goals. This emphasis on mindset and personal attributes underscores the importance of psychological preparation in pursuing wealth.

He introduces the “mastermind alliance” concept, emphasizing the power of collaboration with like-minded individuals. Hill’s insights encourage readers to cultivate a success-oriented mindset, which is fundamental in transitioning from a middle-class mentality to that of a millionaire. By focusing on personal development and strategic relationships, readers can create an environment conducive to financial success

7. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Thomas J. Stanley and William D. Danko reveal that many millionaires live modestly, accumulating wealth through frugality, hard work, and prudent investing. They challenge the stereotype of the affluent living lavish lifestyles, showing that many prioritize financial independence over conspicuous consumption. This insight helps readers understand that wealth accumulation often results from disciplined financial habits rather than high-income careers.

The authors highlight key practices among the wealthy, such as budgeting, living below one’s means, and making informed financial decisions. This book provides a blueprint for readers to build wealth without altering their middle-class values. By adopting these practices, individuals can accumulate significant wealth by maintaining a modest lifestyle.

8. “Secrets of the Millionaire Mind” by T. Harv Eker

T. Harv Eker explores the internal beliefs and attitudes that influence financial success. He posits that individuals possess a “financial blueprint” shaped by early experiences and subconscious beliefs about money. This concept helps readers understand how their upbringing and environment may have influenced their financial behaviors and outcomes.

Eker provides strategies to identify and revise limiting beliefs, promoting habits that foster wealth accumulation. By reshaping one’s mindset, readers can overcome psychological barriers and adopt behaviors conducive to financial prosperity. This focus on mental reprogramming offers a unique approach to wealth creation, addressing the root causes of economic struggles

9. “The Millionaire Fastlane” by MJ DeMarco

MJ DeMarco challenges conventional wealth-building advice, advocating for entrepreneurship to achieve financial independence rapidly. He introduces the concept of the “Fastlane,” a strategy focused on creating scalable businesses that generate significant income. This approach contrasts with traditional methods of wealth accumulation, which often rely on long-term saving and investing.

DeMarco emphasizes the importance of control, scalability, and effectively leveraging time. He encourages readers to identify market needs and develop innovative solutions, positioning themselves for accelerated wealth creation. By focusing on entrepreneurship and value creation, readers can potentially achieve financial success more quickly than through conventional means.

10. “Everyday Millionaires” by Chris Hogan

Based on an extensive study of over 10,000 millionaires, Chris Hogan dispels myths surrounding wealth accumulation. He reveals that most millionaires are self-made, achieving their status through consistent saving, investing, and living within their means. This research-based approach provides readers with concrete evidence that millionaire status is attainable for ordinary individuals.

Hogan highlights practices such as avoiding debt, setting clear financial goals, and maintaining disciplined investment habits. This book shows that ordinary individuals can attain extraordinary wealth through deliberate and informed financial choices. By following these principles, readers can develop a realistic and achievable path to economic success.

Conclusion

Collectively, these books offer diverse perspectives and strategies for transforming middle-class thinking into a millionaire mindset. They emphasize the importance of financial education, disciplined habits, strategic planning, and a proactive approach to wealth-building. By internalizing and applying the principles outlined in these works, readers can embark on a path toward financial independence and success.