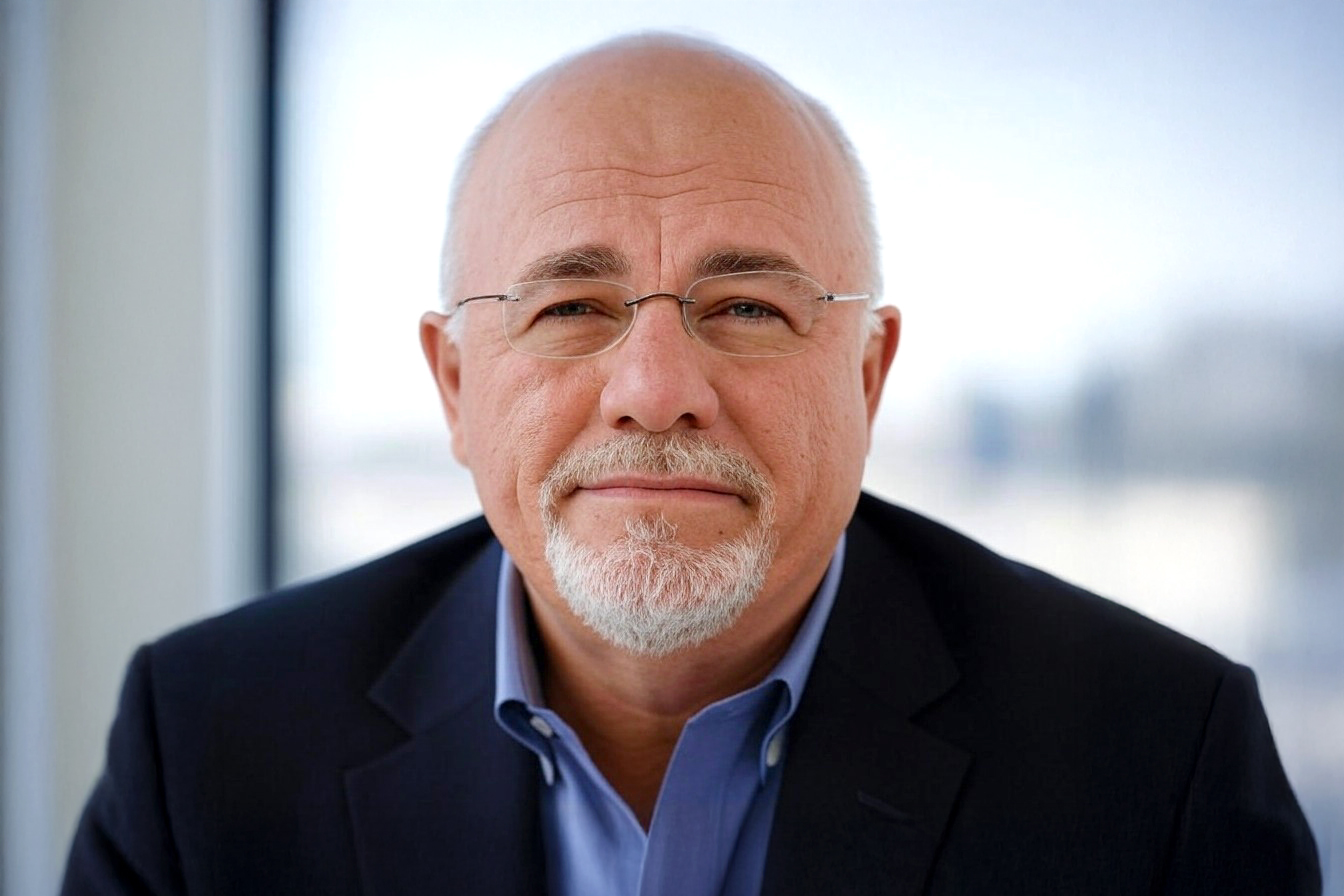

Dave Ramsey’s financial advice has helped millions of people manage their money and build wealth. His straightforward approach focuses on behavioral change and practical steps to achieving financial freedom.

If you’re looking to manage your money like Dave Ramsey, here are 10 key rules to follow:

1. Create and Stick to a Budget

“A budget is telling your money where to go instead of wondering where it went.” – Dave Ramsey.

The foundation of Dave Ramsey’s financial philosophy is creating and adhering to a budget. He advocates for a zero-based budgeting method, where every dollar of your income is assigned a purpose before the month begins. This approach ensures that you control your spending and that your money works towards your financial goals.

To create a Ramsey-style budget, list all your income sources for the month. Then, allocate every dollar to specific categories such as housing, food, transportation, savings, and debt repayment. Ramsey recommends using tools like his EveryDollar app to make budgeting more straightforward and accessible.

The key to successful budgeting is consistency. Review your budget regularly and adjust as needed, but always ensure that you live within your means and allocate funds toward your financial priorities.

2. Build an Emergency Fund

“Ever notice that when you are broke, everything is an emergency?” – Dave Ramsey.

Ramsey emphasizes the importance of having an emergency fund to protect against unexpected events. He recommends a two-step approach to building this financial safety net.

First, save $1,000 for a starter emergency fund as quickly as possible. This initial amount is meant to cover minor emergencies while you’re focusing on paying off debt. As of 2025, Ramsey still recommends $1,000 as a starting point, though some financial experts suggest adjusting this amount for inflation.

Once you’ve paid off all non-mortgage debt, Ramsey advises expanding your emergency fund to cover 3-6 months of expenses. This larger fund provides a more robust financial cushion against major life events such as job loss or significant medical costs.

An emergency fund reduces stress and prevents you from relying on credit cards or loans when unexpected costs arise. It’s a crucial step in achieving long-term financial stability.

3. Get Out of Debt Using the Snowball Method

“Knock out a small debt first, so you get a quick win. Momentum is key.” – Dave Ramsey.

Ramsey’s approach to debt repayment is known as the debt snowball method. This strategy involves listing your debts from smallest to largest, regardless of interest rates. You make minimum payments on all debts except the smallest, which you attack with any extra money you can find in your budget.

Once the smallest debt is paid off, you roll that payment into the next smallest debt, creating a “snowball” effect as you pay off each debt in turn. This method is designed to provide quick wins and build momentum, keeping you motivated throughout the debt repayment process.

While some financial experts argue that paying off high-interest debt first (the debt avalanche method) saves more money in the long run, Ramsey believes the psychological boost from the snowball method leads to greater odds of success for most people.

4. Live Below Your Means

“Act your wage.” – Dave Ramsey

One of Ramsey’s core principles is living below your means. This involves spending less than you earn and avoiding lifestyle inflation as your income increases. By consistently living on less than you make, you create a margin in your budget for saving, investing, and achieving your financial goals.

Practical ways to live below your means include:

- Avoiding unnecessary purchases and focusing on needs rather than wants

- Finding ways to reduce your major expenses like housing and transportation

- Cooking at home instead of eating out

- Shopping for deals and using coupons

- Avoiding status symbols and keeping up with the Joneses

Living below your means requires discipline, but it’s a crucial habit for building long-term wealth and financial security.

5. Invest for the Future

“If you invest $464 in a good mutual fund every month from age thirty to age seventy, you’ll end up with more than $5 million.” – Dave Ramsey.

Ramsey strongly advocates long-term investing as a means of building wealth. He recommends investing 15% of your household income in retirement once you’ve paid off all non-mortgage debt and built a full emergency fund.

Ramsey’s investment philosophy includes:

- Focusing on mutual funds, particularly growth stock mutual funds

- Avoiding single stocks due to their higher risk

- Maximizing tax-advantaged retirement accounts like 401(k)s and Roth IRAs

- Starting to invest as early as possible to take advantage of compounding

While some financial advisors may recommend a more diversified approach, Ramsey’s emphasis on consistent, long-term investing in simple, growth-oriented mutual funds has resonated with many of his followers.

6. Avoid Using Credit Cards

“Debt is dumb. Cash is king.” – Dave Ramsey.

Ramsey strongly opposes credit cards, believing they lead to overspending and unnecessary debt. He advocates using cash or debit cards for all purchases, arguing that people spend less when they feel the psychological impact of handing over physical cash.

To implement this rule:

- Cut up your credit cards and close the accounts

- Use the envelope system for budgeting, where you put cash for each budget category in separate envelopes

- Learn to say no to purchases you can’t afford in cash

While this approach may seem extreme to some, especially those who use credit cards responsibly for rewards, Ramsey believes the risks of credit card debt outweigh any potential benefits.

7. Save for Major Purchases

“Don’t buy things you can’t afford, with money you don’t have, to impress people you don’t like.” – Dave Ramsey

Instead of financing large purchases, Ramsey encourages saving up and paying cash. This applies to everything from cars to vacations to home appliances. By saving in advance, you avoid interest charges and develop patience and discipline in your spending habits.

To save for major purchases:

- Set specific savings goals for each item

- Create separate savings accounts for different goals

- Look for ways to increase your income or decrease expenses to accelerate savings

- Consider delaying purchases until you can afford to pay cash

This approach may mean driving an older car or postponing a vacation, but it leads to greater freedom from debt and peace of mind in the long run.

8. Educate Yourself About Money

“Winning at money is 80 percent behavior and 20 percent head knowledge.” – Dave Ramsey.

Ramsey emphasizes the importance of ongoing financial education. He believes understanding how money works is crucial to making wise financial decisions. However, he also stresses that knowledge alone isn’t enough – you must change your behavior to succeed financially.

To educate yourself about money:

- Read personal finance books, including Ramsey’s titles

- Attend financial education classes or workshops

- Listen to financial podcasts or radio shows

- Follow reputable financial experts on social media

- Practice applying what you learn to your finances

You’ll be better equipped to navigate financial challenges and opportunities by continually improving your financial knowledge and skills.

9. Give Generously

“Good things that cannot be calculated or quantified are set in motion in your life and finances when you give.” – Dave Ramsey.

Charitable giving is an integral part of Ramsey’s financial philosophy. He believes that generosity not only helps others but also improves your own financial and personal well-being. Ramsey encourages giving even while working on your financial goals, starting with small amounts and increasing as your financial situation improves.

To incorporate giving into your financial plan:

- Include charitable donations in your monthly budget

- Research organizations that align with your values

- Consider non-monetary ways to give, such as volunteering your time or skills

- Teach your children about the importance of generosity

By making giving a priority, you cultivate gratitude and perspective, which can positively impact all areas of your life, including your finances.

10. Work Hard and Stay Focused

“Work is doing it. Discipline is doing it every day. Diligence is doing it well every day.” – Dave Ramsey.

Ramsey’s final rule emphasizes the importance of hard work and perseverance in achieving financial success. He believes there are no shortcuts to building wealth and that consistent effort over time is key.

To apply this rule:

- Develop a strong work ethic in your career or business

- Stay committed to your financial goals, even when progress seems slow

- Avoid get-rich-quick schemes or excessive risk-taking

- Celebrate small victories along the way to stay motivated

- Surround yourself with like-minded people who support your financial goals

By maintaining focus and discipline, you’ll be better equipped to overcome financial challenges and achieve long-term success.

Conclusion

Following Dave Ramsey’s 10-money rules requires commitment and often significant lifestyle changes. However, these principles have provided many people with a clear path to financial freedom from debt and peace of mind.

Whether you follow Ramsey’s advice to the letter or adapt it to your situation, the underlying principles of budgeting, avoiding debt, saving, investing, and giving can help you build a strong financial foundation for the future.