Creating wealth isn’t about finding secret formulas or making lucky guesses. It’s about recognizing and understanding patterns that have stood the test of time. These patterns appear consistently across markets, economies, and human behavior.

By studying and internalizing these patterns, you can better understand how wealth is built and maintained. The following patterns represent foundational principles that successful wealth-builders have leveraged throughout history.

While no single pattern guarantees success, their combined understanding provides a robust framework for making informed financial decisions. If you really want to create wealth, study and follow these ten patterns:

1. The Compound Growth Pattern: How Small Returns Become Life-Changing Wealth

Albert Einstein supposedly described compound interest as the world’s eighth wonder, noting that those who understand it earn it while those who don’t pay it. The magic of compounding lies in its exponential nature – a concept that becomes more powerful the earlier you begin.

When you reinvest your returns, each cycle builds upon the last, creating an accelerating growth curve. This principle applies to both financial and non-financial aspects of wealth building. A single dollar invested at a modest return rate can grow into substantial wealth over decades through compounding.

This pattern extends beyond financial returns – it applies to knowledge, relationships, and business growth. Each new skill you learn combines with previous knowledge to create unique insights. Every professional connection can lead to exponential networking opportunities. In business, each satisfied customer can become a source of referrals, creating compound growth in your customer base.

2. The Market Cycle Pattern: Dancing with Bulls and Bears

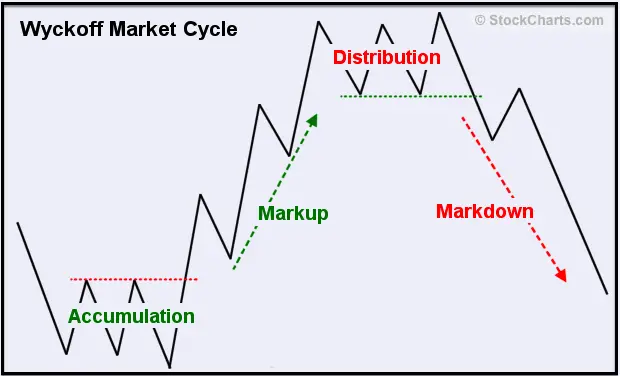

Markets move in cycles of expansion and contraction, following recognizable patterns of accumulation, markup, distribution, and markdown phases. These cycles occur across all timeframes and markets, from stocks to real estate to commodities.

Understanding these rhythms helps maintain perspective during market extremes. During euphoric peaks, markets can seem unstoppable, leading to overconfidence and excessive risk-taking. At devastating lows, recovery can seem impossible, causing many to abandon sound long-term strategies.

The key isn’t to perfectly time these cycles but to recognize where we might be within them. This awareness helps you maintain emotional equilibrium and make more rational decisions. By understanding market cycles, you can better position your investments to weather different market conditions while taking advantage of opportunities during various phases.

3. The Diversification Pattern: Building Your All-Weather Portfolio

Diversification represents nature’s way of managing risk. Just as ecosystems thrive through biodiversity, investment portfolios become more resilient through variety. This pattern involves spreading investments across asset classes that respond differently to economic conditions.

When some assets struggle, others may thrive, creating a natural stabilizing effect. The goal isn’t maximizing returns but optimizing them within your risk tolerance. Proper diversification goes beyond owning different stocks—it includes varying asset classes, geographic regions, and investment strategies.

This pattern also applies to income sources and business strategies. Having multiple streams of income provides stability and opportunities for growth. In business, diversifying your customer base, product lines, or service offerings can protect against market changes while creating new growth opportunities.

4. The Behavioral Finance Pattern: Mastering Your Investment Psychology

Human psychology follows predictable patterns in financial markets, and understanding these patterns can help you make better investment decisions. Loss aversion makes you feel the pain of losses roughly twice as intensely as the pleasure of equivalent gains, often leading to premature selling during market downturns.

Confirmation bias leads you to seek information supporting your beliefs while dismissing contradicting evidence. This can result in holding onto losing investments too long or avoiding promising opportunities that don’t fit your preconceptions.

Recognizing these patterns in your behavior is the first step toward making more objective decisions. The most successful investors develop systems to counter these natural biases. This might include creating investment checklists, maintaining decision journals, or working with trusted advisors who can provide objective feedback.

5. The Risk Management Pattern: Playing Defense to Win

Successful wealth building requires understanding that protecting capital is as important as growing it. This pattern focuses on identifying and managing different types of risk – market, credit, liquidity, and operational risks.

The key is finding asymmetric opportunities where potential rewards significantly outweigh possible losses. This approach ensures survival during tough times while positioning for growth during favorable conditions. Risk management isn’t about avoiding risk entirely -but taking calculated risks with favorable odds.

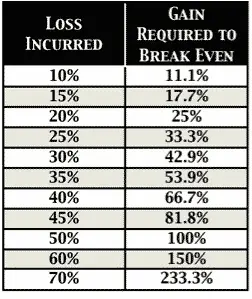

Professional investors often analyze what could go wrong rather than focus on potential returns. They understand that a 50% loss requires a 100% gain to break even. This defensive mindset helps preserve capital during market downturns and provides the necessary ammunition to take advantage of opportunities.

6. The Value Investing Pattern: Finding Hidden Gems in Plain Sight

Value investing involves identifying assets trading below their intrinsic worth. This approach, championed by Benjamin Graham and Warren Buffett, involves looking beyond market noise to find fundamental value. It requires patience, thorough analysis, and the discipline to act when opportunities arise.

The pattern repeats because markets regularly overreact to short-term news, creating opportunities for long-term investors. Value investors look for strong businesses with temporary problems, assets that are out of favor with the market, or situations where fear has driven prices below reasonable levels.

This pattern works because human nature causes markets to swing between extremes of fear and greed. By focusing on fundamental value rather than market sentiment, you can profit from these emotional swings while maintaining a margin of safety.

7. The Dollar-Cost Averaging Pattern: Slow and Steady Wins the Race

Consistent, regular investing helps overcome the challenge of market timing. By investing fixed amounts at regular intervals, you naturally buy more shares when prices are low and fewer when prices are high. This removes the emotional burden of trying to pick perfect entry points.

This pattern works particularly well in workplace retirement accounts or systematic investment plans. It turns market volatility into an advantage rather than a source of stress. The key is maintaining the discipline to continue investing during market downturns when emotional instincts might suggest otherwise.

The power of this pattern lies in its simplicity and effectiveness over time. It combines the benefits of compound growth with a systematic approach that reduces the impact of market volatility on your long-term results.

8. The Income Generation Pattern: Building Your Money Machine

Sustainable wealth often comes from building multiple streams of income. This pattern involves creating systems that generate regular cash flow through dividends, interest, rental income, or business operations. The focus is on assets that produce income rather than solely relying on price appreciation.

Initially, it’s crucial to reinvest this income, allowing it to compound and eventually create a self-sustaining cycle of wealth generation. As your income streams grow, they can provide financial flexibility and reduce dependence on any single source of income.

The most effective income-generating assets often require a significant upfront investment of time or capital but can provide consistent returns for years or decades. This might include building a business, developing a real estate portfolio, or creating intellectual property.

9. The Entrepreneurial & Innovation Pattern: Riding the Waves of Change

Technological and market innovations create waves of opportunity. Understanding adoption curves and innovation cycles helps identify emerging trends early. This pattern involves recognizing how new technologies or business models can disrupt existing systems and create wealth-building opportunities.

The key is balancing the potential of innovation with the risks of unproven ideas. Successful entrepreneurs and investors often position themselves at the intersection of established trends and emerging opportunities. They understand that timing is crucial – too early can be as costly as too late.

Innovation patterns tend to follow predictable cycles of development, adoption, maturity, and eventual disruption. By understanding these cycles, you can better identify opportunities while avoiding the pitfalls of over-hyped trends.

10. The Global Economic Pattern: Thinking Like a Global Investor

Global economic patterns emerge from demographics, technology, and policy changes. Understanding these macro trends helps position your investments to benefit from long-term shifts in the worldwide economy.

This includes recognizing demographic transitions, technological revolutions, and the continuous evolution of global markets. Major economic shifts often create risks and opportunities across different regions and sectors. Thinking globally while acting locally can provide significant advantages in an interconnected world.

Successful investors pay attention to cyclical and secular trends in the global economy. They understand how changes in one region can create ripple effects worldwide and position their investments accordingly.

Conclusion

These patterns provide a comprehensive framework for understanding how wealth is created and maintained over time. Each pattern reinforces the others, creating a holistic wealth-building approach beyond simple investment strategies.

The key to success lies not in flawlessly executing any single pattern but in understanding how they work together and applying them consistently over time. By studying these patterns and adapting them to your circumstances, you can develop a more systematic and successful approach to building lasting wealth.

Start by focusing on the patterns that resonate most strongly with your situation, then gradually incorporate others as your understanding grows. Wealth building is a journey rather than a destination; these patterns can guide you.

Success comes not from finding shortcuts but from understanding and working with these fundamental patterns. They represent the accumulated wisdom of generations of successful investors and entrepreneurs and offer a proven path toward building and maintaining long-term wealth.