Income disparities across the United States have long been a topic of interest for economists, policymakers, and the general public. In 2025, understanding the factors that influence average income by state becomes increasingly essential.

This comprehensive analysis will explore the various aspects contributing to income differences, regional trends, and the potential future landscape of state-level incomes.

Median Income Per State Definition

- Definition: Median income represents the middle value in a list of all incomes sorted from lowest to highest. Half of the individuals or households earn less than this amount, and half earn more.

- How It’s Affected: Extreme values do not influence median income (outliers). It better represents what a “typical” individual or household earns in a state.

- Usefulness: Median income is often used to assess economic well-being because it reflects the midpoint of income distribution and avoids distortion caused by outliers.

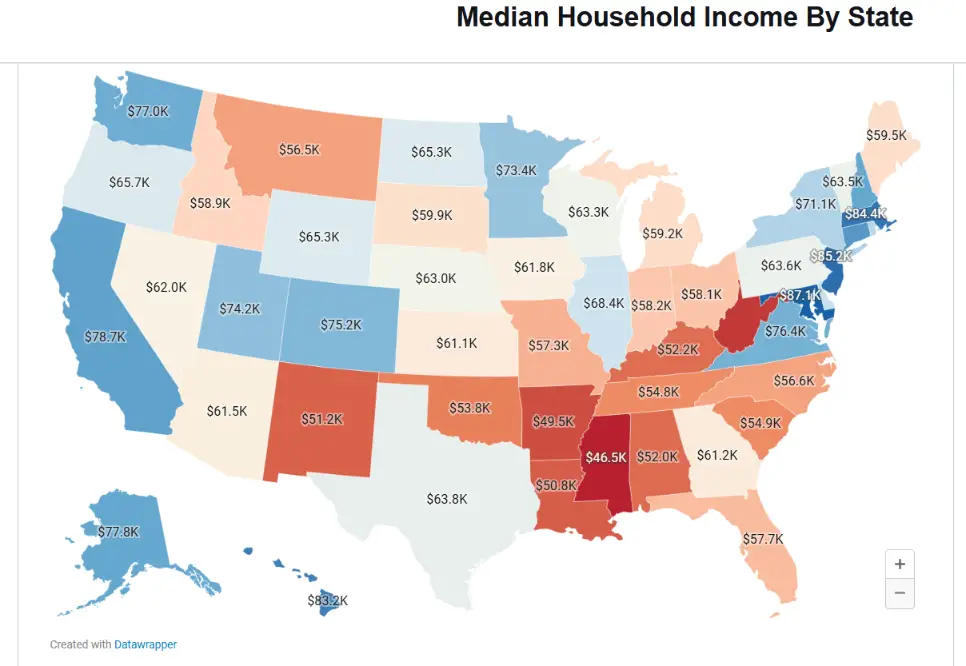

The Median Income by State in 2025:

1. Maryland: $87,063

2. New Jersey: $85,245

3. Massachusetts: $84,385

4. Hawaii: $83,173

5. Connecticut: $79,855

6. California: $78,672

7. New Hampshire: $77,923

8. Alaska: $77,790

9. Washington: $77,006

10. Virginia: $76,398

11. Colorado: $75,231

12. Utah: $74,197

13. Minnesota: $73,382

14. New York: $71,117

15. Rhode Island: $70,305

16. Delaware: $69,110

17. Illinois: $68,428

18. Oregon: $65,667

19. North Dakota: $65,315

20. Wyoming: $65,304

21. Texas: $63,826

22. Pennsylvania: $63,627

23. Vermont: $63,477

24. Wisconsin: $63,293

25. Nebraska: $63,015

26. Nevada: $62,043

27. Iowa: $61,836

28. Arizona: $61,529

29. Georgia: $61,224

30. Kansas: $61,091

31. South Dakota: $59,896

32. Maine: $59,489

33. Michigan: $59,234

34. Idaho: $58,915

35. Indiana: $58,235

36. Ohio: $58,116

37. Florida: $57,703

38. Missouri: $57,290

39. North Carolina: $56,642

40. Montana: $56,539

41. South Carolina: $54,864

42. Tennessee: $54,833

43. Oklahoma: $53,840

44. Kentucky: $52,238

45. Alabama: $52,035

46. New Mexico: $51,243

47. Louisiana: $50,800

48. Arkansas: $49,475

49. West Virginia: $48,037

50. Mississippi: $46,511 [1]

1. Top States for Median Household Income

In 2025, certain states will continue to lead the pack regarding median household income. Strong economies, diverse industries, and high living costs characterize these high-income states. The spatial econometric models reveal that household income in one area is positively correlated with income levels in nearby regions, indicating that a state’s economic health can be influenced by the financial success of its surrounding areas.

States with robust technology, finance, and government sectors often top the list. For example, states like Maryland, New Jersey, and Massachusetts have historically ranked high due to their proximity to major economic centers and concentration of high-paying industries. The presence of these industries attracts highly skilled workers, further driving up average incomes.

Education levels play a crucial role in determining income. States with a higher percentage of residents holding advanced degrees tend to have higher average incomes. This is because educational attainment is closely linked to earning potential and job opportunities in high-paying sectors.

2. Lowest-Income States

At the other end of the spectrum, some states consistently rank lower regarding median household income. These states often face unique economic challenges that contribute to lower average incomes. Rural states with less diverse economies or those heavily reliant on declining industries may struggle to keep pace with national income averages.

In states like Mississippi, which has historically had lower income levels, the relative standing of different demographic groups can vary significantly. Factors contributing to lower incomes in these states may include limited access to higher education, fewer job opportunities in high-paying sectors, and lower living costs that can translate to lower wages.

However, it’s important to note that lower nominal incomes don’t always equate to a lower standard of living, as cost-of-living differences can significantly impact purchasing power.

3. Regional Income Trends

Income patterns across different U.S. regions provide valuable insights into broader economic trends. Historically, there have been notable differences in median and mean family income evolution across the four Census regions: Northeast, Midwest, South, and West.

These regional disparities can be attributed to various factors, including industry concentrations, migration patterns, and policy differences.

In recent years, all regions have experienced increasing income inequality, with average incomes growing faster than median incomes. This trend suggests that high-income earners are seeing their incomes rise more rapidly than middle- and low-income earners.

However, the pace of this change has varied across regions, with some areas experiencing more pronounced inequality growth than others.

Understanding these regional trends is crucial for policymakers and businesses alike, as they can inform decisions on economic development strategies, investment priorities, and policies to reduce income disparities.

4. Factors Influencing State Income Levels

Several key factors contribute to the variations in income levels across states. These include demographics, education, human capital, employment status, and job characteristics. Each of these elements shapes a state’s economic landscape and, consequently, its average income levels.

Industry presence is a significant determinant of state income levels. States with a high concentration of industries like technology, finance, and professional services tend to have higher average incomes. Conversely, states heavily reliant on industries with lower wage structures may see lower average incomes.

Education levels are consistently associated with income disparities. States with higher educational attainment rates typically see higher average incomes, as education often leads to better job opportunities and earning potential.

Cost of living differences across states can also impact nominal income figures. High-cost areas often have higher nominal incomes to compensate for increased living expenses, while lower-cost regions may have lower nominal incomes but potentially similar purchasing power.

The urban-rural divide within states can significantly influence average incomes. Urban areas often have higher concentrations of high-paying jobs and industries, which can drive up the state’s overall average income. Rural areas, on the other hand, may have fewer such opportunities, potentially lowering the state average.

State policies, including minimum wage laws, tax structures, and economic development initiatives, can also shape income levels. These policies can affect business environments, job creation, and worker compensation, all impacting average incomes.

5. Income Inequality Across States

Income inequality remains a pressing issue in 2025, with significant variations within and between states. Recent trends have shown that state incomes have become less similar (i.e., diverged) within the top 20 percent of the income distribution since 1969.

The top percentile alone accounts for more than half of aggregate divergence across states, with the top five percentiles combining for 93 percent. This growing inequality has important implications for economic mobility and quality of life across different states.

High levels of inequality can lead to social tension, reduced economic opportunities for lower-income individuals, and challenges in providing public services that benefit all residents.

6. Impact of Income Levels on State Economies

The average income levels in a state have far-reaching effects on its overall economic health and development. States with higher average incomes often benefit from increased consumer spending power, which can drive economic growth and job creation. These states may also see higher tax revenues, potentially allowing for more significant public service and infrastructure investment.

Higher incomes can give families and individuals more options for health insurance, medical care, and healthy lifestyle choices. Conversely, lower-income areas may face challenges accessing quality healthcare, education, and other essential services. This can create a cycle where economic disadvantages lead to poorer health outcomes, impacting economic productivity.

The relationship between income levels and economic development is complex and often self-reinforcing. States with higher incomes may attract more businesses and skilled workers, further boosting their financial prospects. However, this can also lead to increased living costs, potentially pricing out lower-income residents and exacerbating income inequality.

7. Future Projections and Trends

Looking ahead to 2025 and beyond, several trends will likely shape the landscape of state-level incomes. Technological advancements and the continued growth of the knowledge economy may further benefit states with strong tech and innovation sectors.

Historically, much income convergence across states was driven by labor migration from poorer to wealthier states. However, increasingly strict land use regulations in affluent areas have disrupted this pattern.

These regulations have boosted housing costs in more prosperous states, making migration less attractive for low-skill, low-wage workers while remaining appealing for high-skilled workers. This trend may continue to influence state-level income disparities in the coming years.

Demographic shifts, including an aging population and changing migration patterns, will likely impact state incomes. States that can attract and retain younger, skilled workers may see improvements in their average income levels, while those experiencing population aging or outmigration may face challenges.

Policy changes at the state and federal levels will play a crucial role in shaping future income trends. Initiatives to improve education, workforce development, and economic diversification could help address income disparities and boost overall state incomes.

Conclusion

As we look towards 2025, the landscape of average incomes across U.S. states remains complex and dynamic. While some states continue to lead in median household income, others face ongoing challenges in closing the gap. The interplay of industry presence, education levels, cost of living, and demographic trends will continue to shape these disparities.