The American middle class faces unprecedented challenges in maintaining its economic status. Recent economic shifts, technological advancements, and global uncertainties have created a perfect storm that threatens the financial stability of millions.

A combination of stagnant wages, rising costs, and structural changes in the job market have made the traditional path to middle-class security increasingly precarious. As we look ahead to the next five years, several critical factors could push previously stable middle-class families into financial hardship.

Understanding these threats isn’t just a mental exercise—it’s essential for developing strategies to protect your financial future. Let’s examine the five most significant risks to middle-class prosperity and explore how to safeguard against them.

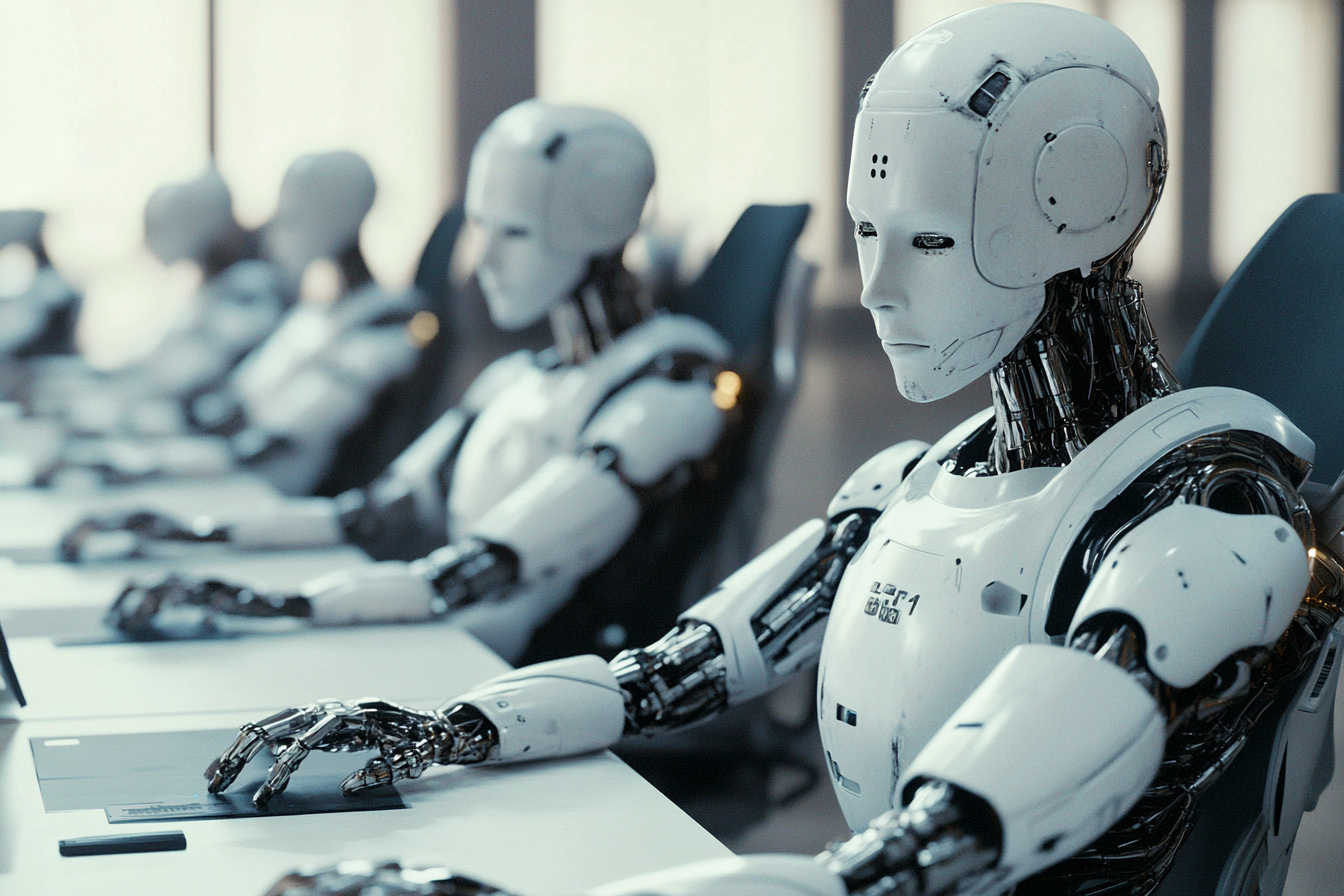

1. The AI Revolution: How Automation Could Eliminate Your Job

According to recent McKinsey research, depending on the pace of adoption, between 75 million and 375 million workers globally may need to switch occupational categories by 2030 due to automation and artificial intelligence.

This technological shift poses a particular threat to middle-class professionals who once thought their jobs were secure. Legal assistants, for instance, are seeing their document review tasks handled by AI systems that can process thousands of pages in hours.

Major accounting firms are increasingly adopting AI and automation technologies to handle routine tasks like data entry and basic bookkeeping, which may impact entry-level accounting positions.

The key is to focus on skills that AI can’t easily replicate—creative problem-solving, emotional intelligence, and complex decision-making. Professional development shouldn’t wait: enroll in courses focusing on AI implementation, such as prompt engineering, data analysis, or human-centered skills complementing automated systems.

Losing a six-figure middle-class job can quickly push people from a comfortable lifestyle to the brink of poverty if they can’t find a replacement job within a reasonable amount of time. To avoid this potential fate, it’s crucial to upgrade job skills continuously and have an emergency fund.

2. The Silent Wealth Killer: When Your Paycheck Can’t Keep Up with Inflation

The gap between wage growth and inflation has become a critical concern for middle-class families. While average wages in the US have increased by roughly 4-5% annually in recent years, inflation peaked at 9.1% in June 2022 and has since moderated but still often exceeded wage growth, creating a gap in purchasing power.

A family earning $75,000 annually might find their real purchasing power reduced to around $72,000-$73,500 in a high-inflation year, depending on the specific inflation rate and wage increases.

Rising costs hit essential items hardest. Grocery prices have surged, with basic items like eggs and dairy products seeing double-digit percentage increases since 2020. Energy costs fluctuate dramatically, affecting both home utilities and transportation expenses.

The problem for the middle class is that even though the rate of inflation has slowed, prices have not come back down. The current high cost of groceries and rising rent are causing record credit card debt and burning through savings at a fast pace. This results in people needing to move to lower-cost rent areas and be more frugal in their food purchases, which pushes them into poverty.

Creating additional income streams through side gigs, freelance work, or passive income investments has become essential for maintaining middle-class status.

3. The Housing Crisis: Getting Priced Out of the American Dream

The current housing market presents unprecedented challenges for middle-class homeownership. A ResiClub analysis of the Case-Shiller National Home Price Index revealed that US home prices have soared by 47.1% since 2020.

According to a CoreLogic report, investor purchases of single-family homes peaked at nearly 30% of all US home sales in January 2024, but this share declined to 23.4% by June 2024. This capital allocation into the housing market has helped drive up prices.

A concrete example: A home that cost $300,000 in 2020 might now sell for $ today, especially if it is in desired locations like Florida, Idaho, Texas, or Nashville, Tennessee.

Current mortgage interest rates, which have risen significantly since 2021, can translate to a monthly payment increase of several hundred dollars on a typical home loan. However, the exact amount varies based on the loan size and specific rate change.

For example, a two percentage point increase in mortgage rates on a $300,000 loan could increase monthly payments by around $400-$500. Rental markets have also seen increases due to rising insurance and maintenance costs.

According to Realtor.com data, as of September 2024, the median rent growth in the top 50 metros has moderated to about 3.5% year-over-year. However, some urban areas may still be experiencing higher increases.

Middle-class families are increasingly exploring alternative options, such as relocating to smaller markets or considering multi-generational housing arrangements. The rising cost of homes, higher interest rates, and more expensive home insurance are pushing middle-class families down the socioeconomic ladder.

4. Drowning in Debt: The Hidden Danger of Easy Credit and Empty Savings

As of 2024, the average American household carries about $59,580 in non-mortgage debt, including credit cards, auto loans, and student loans. With credit card interest rates averaging around 20.75% as of October 2024, a $5,000 balance could grow to approximately $6,800 in two years with only minimum payments.

Student loan debt continues to be a significant burden, with the average federal student loan balance at about $37,338 per borrower as of 2024. However, it’s important to note that debt levels can vary significantly based on income, location, and individual circumstances.

The combination of high debt and low savings creates a perfect storm. One medical emergency or job loss can trigger a financial cascade. Establishing an emergency fund covering six months of expenses must become a priority, even if it means temporarily reducing retirement contributions or lifestyle expenses.

The middle class must do everything possible to avoid the debt trap. The snowball of high-interest credit cards can quickly push them into tough economic times as the interest becomes impossible to keep up with.

5. Market Mayhem: Why Global Economic Instability Could Push You into Poverty

Global economic disruptions, from supply chain crises to geopolitical conflicts, create ripple effects that threaten middle-class stability. The recent pandemic demonstrated how quickly economic shocks can eliminate jobs and deplete savings.

Industries previously considered stable, like hospitality and transportation, saw widespread layoffs and business closures.

The solution lies in diversification – not just of investments but of income sources and skills. Middle-class families need multiple financial backup plans. This includes maintaining marketable skills in different sectors, building diverse investment portfolios, and creating multiple income streams.

Conclusion

The threats to middle-class stability are real but not insurmountable. Success in navigating these challenges requires proactive planning and adaptation.

Focusing on continuous skill development, maintaining financial flexibility, and building solid savings habits can help protect against economic downturns. Exploring alternative housing options, managing debt aggressively, and diversifying income sources provide additional security.

The next five years will likely bring significant economic changes, but informed preparation can help middle-class families maintain their financial position.

By understanding these potential threats and taking decisive action now, we can build resilience against future economic challenges. The key lies not in avoiding risk entirely but in building solid financial foundations that weather various economic storms.