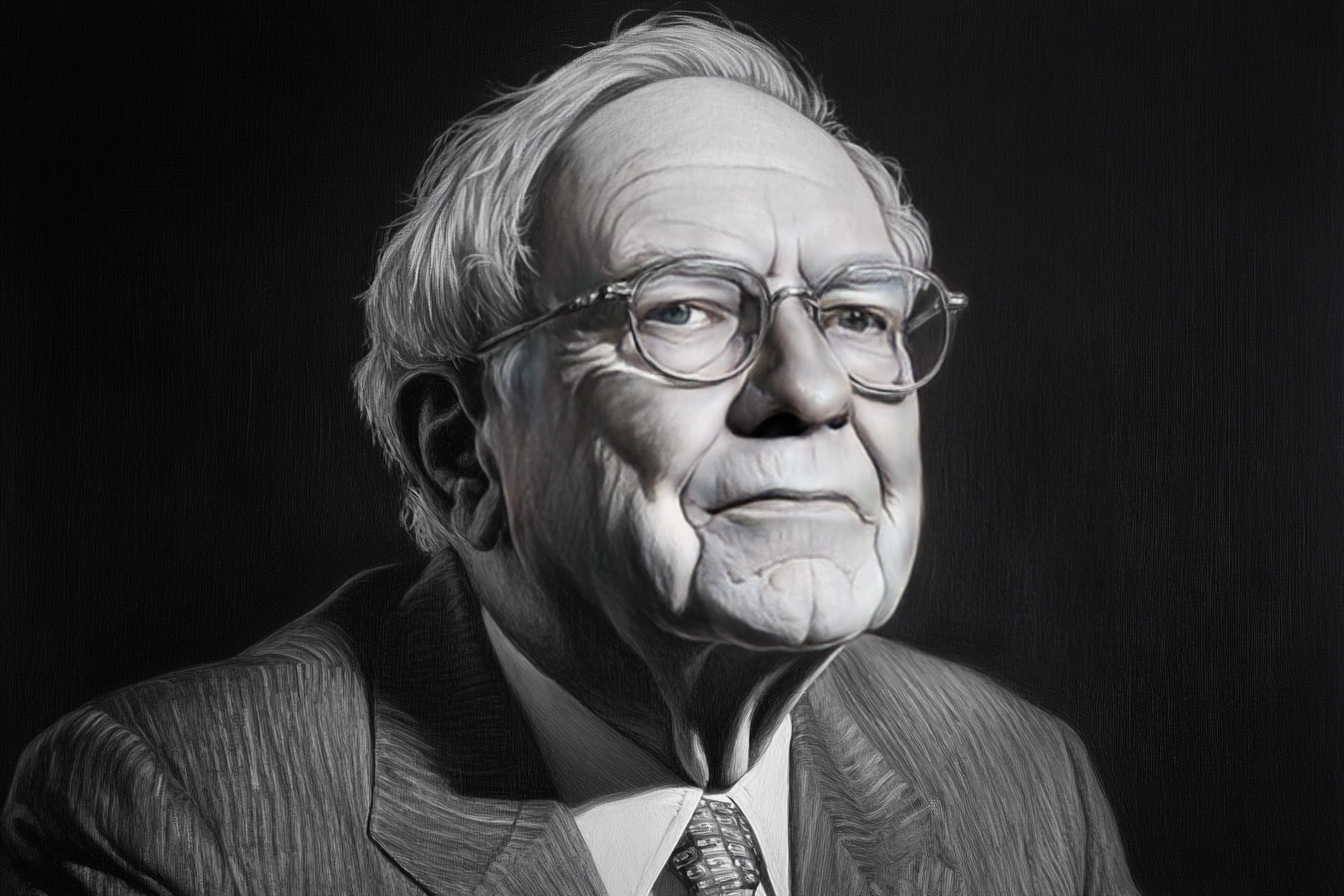

Warren Buffett, one of the world’s most successful investors, has long been a source of wisdom for those seeking financial success. His approach to wealth creation goes beyond mere investment strategies, focusing on fundamental mindset shifts that can transform one’s economic future.

In this article, we’ll explore five critical mindset changes Buffett teaches that can help turn poor people into wealthy people.

1. Invest in Your Greatest Asset: Yourself

“The most important investment you can make is in yourself.” – Warren Buffett.

The journey to wealth often begins with recognizing your most valuable asset: yourself. This philosophy underscores the critical importance of continuous self-improvement and personal growth.

Investing in yourself can take many forms. It might mean pursuing further education through formal degrees or specialized certifications in your field.

It could involve developing new skills that increase your marketability and earning potential. For some, it might mean focusing on physical and mental health to ensure you operate at peak performance.

To start investing in yourself, identify areas where you can grow. This might involve taking online courses, attending workshops, or seeking mentorship. The key is approaching personal development as an ongoing process, always looking for opportunities to enhance your knowledge and capabilities.

2. Think Long-Term: The Power of Patient Investing

“Only buy something that you’d be pleased to hold if the market shut down for ten years.” – Warren Buffett.

One of Buffett’s most notable characteristics as an investor is his long-term perspective. This approach starkly contrasts the get-rich-quick mentality that often leads to financial ruin.

Long-term thinking in investing means looking beyond short-term market fluctuations and focusing on the intrinsic value of investments. It’s about identifying quality assets that have the potential to grow steadily over time rather than chasing the latest market trends or trying to time the market for quick profits.

Consider Buffett’s investment in Coca-Cola. He first purchased shares in 1988 and has held them since, seeing tremendous growth over the decades despite various market ups and downs. This patience and long-term vision have been critical to his success.

For the average investor, adopting this mindset might mean investing in low-cost index funds that track the overall market and hold them for many years.

It could also involve researching and investing in companies with solid fundamentals and potential for long-term growth rather than trying to profit from short-term market movements.

To cultivate this mindset, start by developing a long-term financial plan. Set clear goals for the future and make investment decisions that align with these objectives. Resist the urge to react to every market movement and instead focus on the long-term potential of your investments.

3. Master Your Money: The Art of Financial Discipline

“Do not save what is left after spending; instead, spend what is left after saving.” – Warren Buffett.

Financial discipline is a cornerstone of wealth building, and Buffett’s wisdom shines in this area. This simple yet profound statement encapsulates the essence of financial discipline.

Mastering your money involves developing good financial habits, prioritizing saving, and investing over unnecessary spending. It’s about living below your means, even as your income grows, to ensure you always put money aside for the future.

This discipline manifests in various ways. It might mean creating and sticking to a budget that allocates a significant portion of your income to savings and investments before considering discretionary spending.

It could involve automating your savings so that a set amount is transferred to your investment accounts each month before you have a chance to spend it.

The power of this approach lies in the compounding gains that accumulate over time. By consistently saving and investing, even small amounts can grow significantly. For instance, someone investing $200 monthly at age 25 could have over a million dollars by retirement age, assuming average stock market returns.

To develop financial discipline, start by tracking your spending and identifying areas where you can cut back. Create a budget that prioritizes saving and investing, and stick to it. Consider using tools and apps to help you automate your savings and keep track of your financial goals.

4. Choose Your Circle Wisely: The Influence of Association

“It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours, and you’ll drift in that direction.” – Warren Buffett.

The people we surround ourselves with can profoundly impact our mindset, habits, and, ultimately, our success. This principle applies strongly to financial success.

Surrounding yourself with financially savvy, motivated individuals can expose you to new ideas, opportunities, and positive financial habits. Conversely, spending time with people who are financially irresponsible or have a negative attitude toward money can hinder your progress.

Consider a young entrepreneur’s experience joining a local business networking group. She gained valuable insights and advice through this association and found mentors and potential business partners. These relationships played a crucial role in your business and personal wealth growth.

To apply this principle, seek out opportunities to connect with successful individuals in your field or those who have achieved the financial goals you aspire to.

This might involve joining professional associations, attending networking events, or seeking mentorship opportunities. Be intentional about building relationships with people who inspire and challenge you to improve.

5. Embrace the Journey: The Virtue of Patience in Wealth Building

“No matter the talent or efforts, some things take time. You can’t produce a baby in one month by getting nine women pregnant.” – Warren Buffett.

Building substantial wealth is rarely a quick process. It requires patience, persistence, and a willingness to stay the course despite setbacks. This mindset is crucial for long-term financial success.

It helps you avoid the pitfalls of get-rich-quick schemes and keeps you focused on consistent, sustainable growth. It also enables you to weather the inevitable ups and downs of the market without making rash decisions based on short-term fluctuations.

For example, consider an investor who began putting money into a diversified portfolio in the early 2000s. Despite facing significant market downturns like the 2008 financial crisis, by staying patient and consistently investing over the long term, they would have seen substantial growth in their portfolio by 2024.

Focus on your long-term goals rather than short-term market movements to cultivate patience in your wealth-building journey. Develop and stick to a solid financial plan, even when progress feels slow. Celebrate small milestones along the way to stay motivated, and use setbacks as learning opportunities rather than reasons to give up.

Conclusion

Adopting these five mindset shifts – investing in yourself, thinking long-term, mastering financial discipline, choosing your circle wisely, and embracing patience – can significantly impact your financial trajectory.

These principles, distilled from Warren Buffett’s wisdom, offer a roadmap for transforming your finances and overall approach to life and success.

As you implement these mindset shifts, remember that change doesn’t happen overnight. It’s a gradual process that requires consistent effort and dedication.

Start small, focusing on one area at a time, and gradually incorporate these principles into your daily life. With time and persistence, you’ll find yourself making decisions and developing habits that align with the mindset of the wealthy.

The journey from poverty to riches is as much about mental transformation as financial strategies. By adopting these mindset shifts and applying them consistently, you’re not just changing your financial habits – you’re reshaping your entire approach to wealth and success.

Buffett’s life and career demonstrate that the right mindset, patience, and perseverance can lead to extraordinary financial achievements.