1. Understanding Moving Averages: A Trader’s Psychological Compass

Moving averages are fundamental tools in technical analysis, serving as a psychological compass for traders navigating the complex world of financial markets. At their core, moving averages calculate the average price of an asset over a specified period, creating a smoothed line that helps identify trends and potential turning points.

The appeal of moving averages lies in their simplicity and visual clarity. They provide traders with a quick, intuitive grasp of market direction, satisfying the human need for order and pattern in seemingly chaotic price movements. This psychological anchor offers stability and direction in the often turbulent volatility on charts.

2. The Emotional Landscape of Trading: How Moving Averages Help Navigate

Trading is an emotional rollercoaster, with fear and greed often driving decisions more than logic. Moving averages act as a stabilizing force in this emotional landscape. Providing objective, quantified, data-driven price action insights on overall direction, they help traders shift from the immediate emotional response to price fluctuations.

When prices dip below a rising moving average, it can show the fear of a market crash, suggesting a potential opportunity to lock in long-side profits. Conversely, prices soaring above a falling moving average can signal momentum and a likely entry signal on the long side, hinting at a possible reversal. This emotional buffering effect of moving averages promotes more rational, less impulsive trading decisions.

3. Trend Identification and Confirmation: Satisfying Our Pattern-Seeking Minds

Humans are inherently pattern-seeking creatures, and the financial markets are a prime arena for this tendency. Moving averages cater to this psychological need by helping identify and confirm trends. When prices consistently stay above a rising moving average, it confirms an uptrend, satisfying our desire for confirming directional movement.

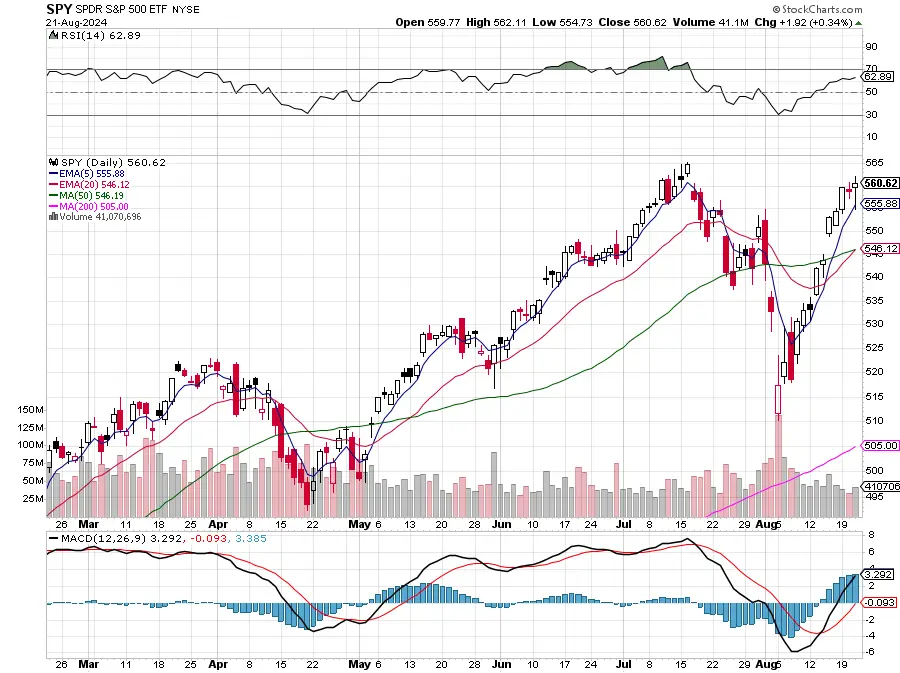

For instance, a trader might use a 50-day moving average to confirm a trend. If prices remain above this line as they slope upward, it reinforces the belief in an ongoing uptrend, aligning with our psychological preference for continuation and momentum.

4. Support and Resistance: The Self-Fulfilling Prophecy of Moving Averages

Moving averages often act as dynamic support and resistance levels, a phenomenon rooted in collective psychology. As many traders use similar moving averages (like the popular 50-day and 200-day), these levels become widely observed.

This widespread observation creates a self-fulfilling prophecy. Traders expect prices to bounce off these levels and place orders accordingly. This collective action often causes prices to react at these levels, further reinforcing their significance. This feedback loop demonstrates how shared beliefs in the market can shape reality, an essential aspect of market psychology.

5. Noise Reduction: How Moving Averages Promote Disciplined Decision-Making

One of the most psychologically beneficial aspects of moving averages is their ability to reduce market noise. Smoothing out short-term price fluctuations helps traders focus on the bigger picture, promoting more disciplined decision-making.

This noise reduction is a psychological filter, preventing overreaction to every minor price movement. It encourages a calmer, more strategic approach to trading, aligning with the disciplined mindset crucial for long-term market success.

6. The Allure of Crossover Signals: Clear Triggers for Action

Moving average crossovers, such as the bullish cross (short-term MA crossing above long-term MA) and bearish cross (short-term MA crossing below long-term MA), are especially attractive to traders. These clear, definitive signals satisfy our psychological need for decisive action points in the often ambiguous trading world.

The simplicity and objectivity of these signals make them psychologically appealing. However, this appeal can also lead to herd behavior, as many traders react to the same signals simultaneously, potentially amplifying market moves.

7. Time Frame Flexibility: Adapting Moving Averages to Individual Psychology

The flexibility to adjust moving averages to different time frames caters to diverse trading styles and risk tolerances. A day trader might use a 5-day and 20-day moving average, while a long-term investor could prefer a 50-day and 200-day combination.

This adaptability gives traders control over their strategy, aligning the tool with their personal trading psychology. It allows each trader to find a comfortable balance between responsiveness and trend confirmation, which is crucial for maintaining psychological equilibrium in trading.

8. The Lagging Nature of Moving Averages: Managing Expectations and Bias

Understanding that moving averages are lagging indicators is crucial for managing trading psychology. This awareness helps traders avoid the pitfall of expecting moving averages to predict future price movements.

Recognizing this limitation encourages a more nuanced approach to using moving averages. It prompts traders to combine them with other technical tools or fundamental analysis, fostering a more comprehensive and psychologically balanced trading strategy.

The key to using moving averages as technical tools for profitability is to create a favorable risk/reward ratio by capturing trends and swings and cutting losses short.

9. Combining Moving Averages: Strategies to Enhance a Psychological Edge

Many traders use combinations of moving averages to gain a psychological edge. For example, the triple moving average strategy uses short-, medium-, and long-term averages to provide multiple confirmation points.

While these combinations can offer psychological reassurance through multiple data points, they also risk leading to analysis paralysis. The key is finding a balance that provides confidence without overwhelming decision-making.

10. Common Pitfalls: Overcoming Psychological Traps in Moving Average Trading

Even with their benefits, moving averages can lead to psychological traps. Over-reliance on these indicators can create a false sense of certainty. Confirmation bias might cause traders to focus only on moving average signals confirming their beliefs.

To avoid these pitfalls, it’s crucial to maintain a balanced perspective. Moving averages as part of a broader analytical framework and system with more factors, rather than as standalone decision-makers, can help mitigate these psychological risks.

11. The Role of Backtesting: Building Confidence in Moving Average Strategies

Backtesting moving average strategies plays a vital role in building trader confidence. By analyzing how signals for a trading plan would have performed in past market conditions, traders can gain insights and refine their approach.

However, being aware of the psychological pitfall of overoptimization is essential. The past doesn’t always predict the future, and a strategy that worked perfectly in backtesting may fail in live markets. Maintaining a realistic perspective on backtesting results is crucial for healthy trading psychology.

Backtesting doesn’t ensure success but increases the probability of finding what works. However, if signals don’t work in backtesting, they will almost certainly not work in the markets.

12. Beyond the Indicators: Integrating Moving Averages with Holistic Market Analysis

While moving averages are powerful tools, they shouldn’t be used in isolation. Integrating them with fundamental analysis and broader market context provides a more comprehensive trading approach.

This holistic view helps prevent the psychological trap of indicator fixation. By considering multiple factors, traders can develop a more nuanced, psychologically balanced approach to market analysis and decision-making.

Conclusion

Moving average strategies can be powerful tools for traders when understood and applied with awareness of their psychological implications.

They provide a framework for decision-making that aligns with natural human tendencies for pattern recognition and trend-following. However, their true power lies in integrating them into a broader trading strategy and mindset.

Traders can use these tools more effectively by understanding both the technical and psychological dynamics of moving averages. They can leverage the emotional stability, trend confirmation, and clear signals that moving averages provide while avoiding common psychological pitfalls.

Successful trading with moving averages ultimately requires combining technical knowledge and psychological insight. It involves using these indicators as guides rather than gospel and always maintaining a critical, holistic view of the markets.

With this balanced approach, moving averages can become a valuable psychological compass in the complex trading world.