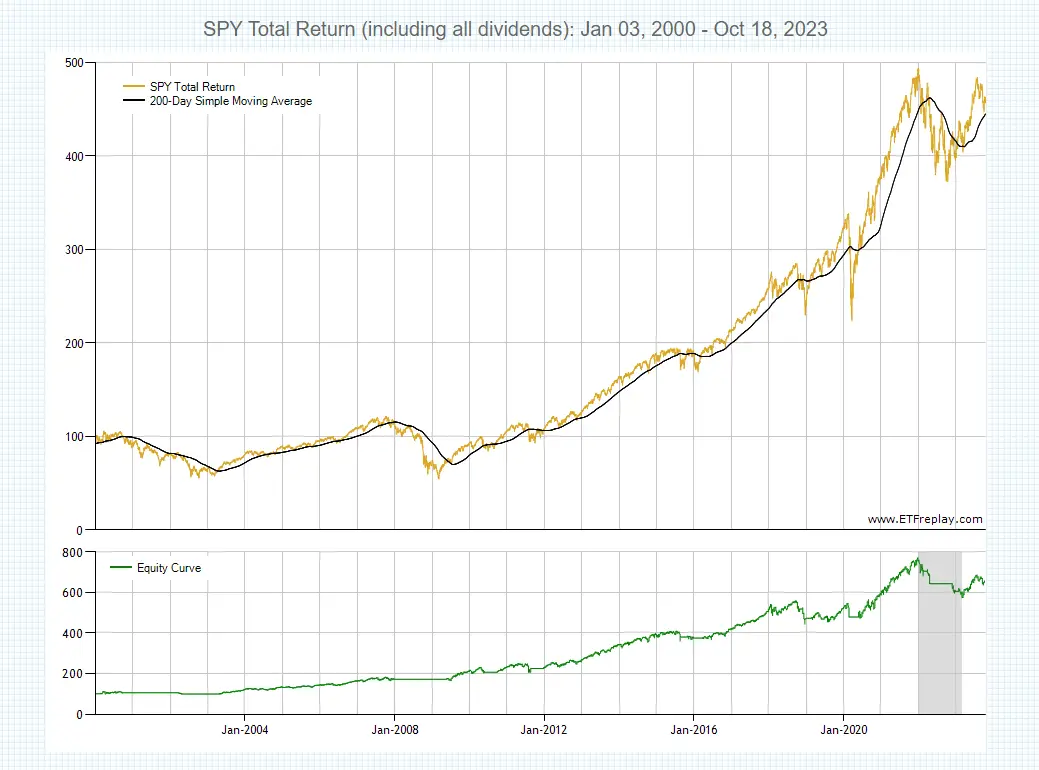

Are you looking to outperform traditional buy-and-hold strategies? Buy and hold has been the go-to strategy for many investors over recent decades. However, it’s not without its downsides, such as enduring bear markets and crashes. In today’s market, many investors seek more dynamic approaches to maximize returns while minimizing risk. This article will walk you through a three-step method focused on the SPY ETF and the 200-day moving average, aiming to give you the best of both worlds: the gains of a bull market and the safety nets for bearish downturns. While this strategy has historically outperformed buying and holding the SPY ETF, conducting your due diligence is crucial. You must understand why it worked in the past and the potential for risks and rewards going forward before you put any real capital at risk. Keep reading to discover how to beat the market in three easy steps.

Here’s a simple strategy to beat buy and hold by focusing on the SPY ETF and the 200-day moving average:

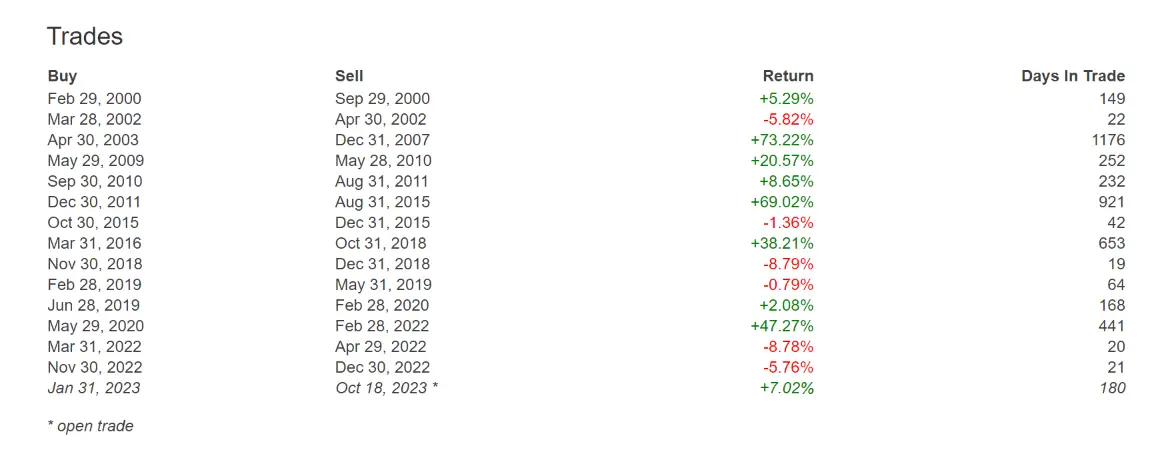

- Buy at the end of the month when SPY breaks back over the 200-day moving average.

- Hold as long as SPY closes over the 200-day moving average on the last day of the month.

- Sell if SPY closes under the 200-day moving average on the last day of the month.

Signal Parameters

- If you’re long on the SPY ETF and the price is going to close over the 200-day simple moving average on the last day of the month, stay long.

- If you’re long on the SPY ETF and the price is going to close under the 200-day simple moving average on the last day of the month, sell your position and go to cash.

- If you’re in a cash position and the price is going to close over the 200-day simple moving average on the last day of the month, buy the SPY ETF and go long.

- If you’re in a cash position and the price is going to close under the 200-day simple moving average on the last day of the month, stay in cash.

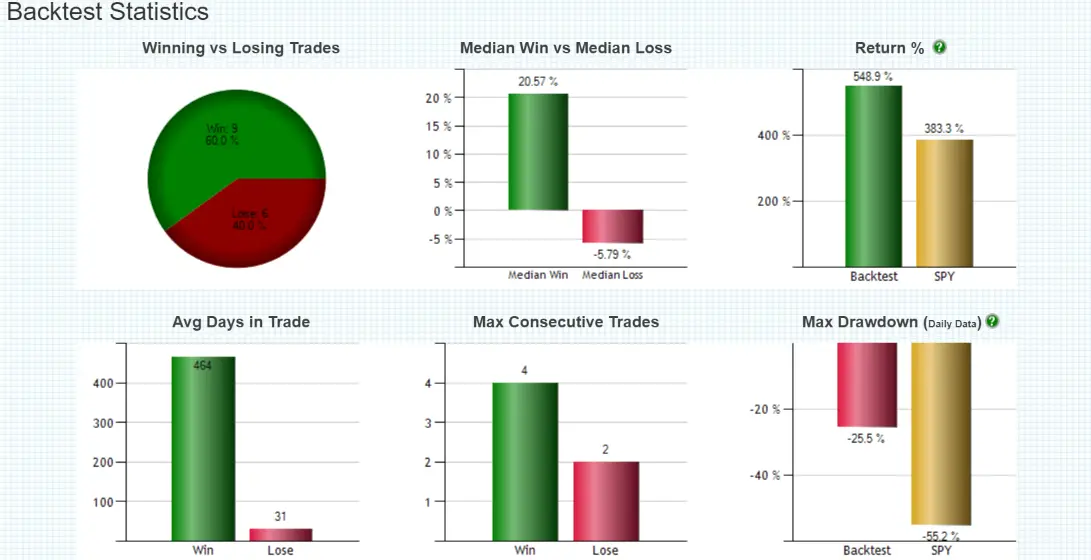

The strategy has beaten the returns of just buying and holding the S&P 500 index since 2000 with a strategy performance of 548.9% versus the buy-and-hold return of 383.3%, and it also reduced capital drawdown by half.

Step 1: Buy at the Right Time

Pros

- Capitalizing on Momentum: Buying when the SPY ETF breaks over the 200-day moving average allows you to ride the upward trend, potentially increasing your returns.

- Timely Entry: This strategy helps you enter the market at a point where there’s a higher likelihood of a sustained uptrend, as indicated by the 200-day moving average cross.

Cons

- False Positives: The market can be volatile, and a break over the 200-day moving average doesn’t always guarantee a continued upward trend.

- Missed Opportunities: You might miss out on other profitable buying opportunities by waiting for this specific signal.

Step 2: Hold with Caution

Pros

- Risk Mitigation: Holding only when the SPY is above the 200-day moving average can help you avoid the worst drawdowns during bear markets.

- Simplicity: The strategy is easy to follow, requiring a check only at the end of the month. This can avoid all intra-month volatility with a focus on how the month closes.

Cons

- Capital Stagnation: If the SPY hovers around the 200-day moving average, your capital might not be effectively utilized.

- Long-Term Timing: Frequent buying and selling each month in a choppy market can lead to frustration waiting a month for your next signal

Step 3: Know When to Exit

Pros

- Capital Preservation: Selling when the SPY is below the 200-day moving average helps protect your capital during market downturns, crashes, and long-term bear markets.

- Emotional Discipline: A clear exit strategy can help avoid emotional decision-making.

Cons

- Early Exit: You might sell off your position just before the market rebounds, missing out on potential gains.

- Tax Implications: Selling positions can trigger capital gains tax in a taxable account, which needs to be considered in your overall strategy. This can be avoided by using an IRA or 401(K) account. You may need to use an S&P 500 index fund instead of the SPY for a 401(K) account.

Why This Strategy Beat Buy & Hold for the Past 23 Years

This strategy has outperformed the traditional buy-and-hold approach over the past 23 years primarily because it aims to capture the best parts of bull markets while avoiding the worst of bearish periods. By focusing on the 200-day moving average, the strategy has historically reduced drawdowns and capitalized on upward trends.

Past Performance Doesn’t Guarantee Future Performance

While this strategy has shown promise over the past 23 years, it’s crucial to remember that past performance does not indicate future results. Market conditions change, and what worked in the past may not necessarily work in the future. Always research and consider your risk tolerance before adopting any investment strategy.

Key Takeaways

- Leverage Market Trends: Utilize the SPY ETF’s upward momentum by entering when it surpasses its 200-day moving average.

- Risk Minimization: Safeguard your investment by maintaining your position only when the SPY ETF remains above the 200-day moving average at each month’s end.

- Asset Protection: Shield your capital by exiting the market if the SPY ETF dips below the 200-day moving average at month-end.

- Historical Success: Over two decades, the strategy has outpaced traditional investment methods.

- No Guarantees: Previous wins don’t assure future performance; always exercise due diligence before adopting a trading or investing strategy to ensure you fully understand the potential risks and rewards.

Conclusion

By strategically timing your market entry, sustaining your position during favorable conditions, and wisely retreating during downturns, this approach offers a balanced method for SPY ETF investment. While it has historically outperformed conventional long-term investment tactics, it’s essential to remember that past wins don’t assure future success. Always proceed with caution and conduct your own thorough analysis of any strategy.

This strategy is simple but effective, requiring only one action at the end of each month. It aims to maximize returns during bull markets and protect capital during bear markets, offering a balanced approach to investing in the SPY ETF.

This article is for informational purposes only and not investment advice; please look for investment advice from a certified investment advisor.

Notes:

All returns are Total Return, which includes dividends and distributions, and assume the entry and exit are executed at the closing price.

Some academic studies have demonstrated that over very long periods, using a long-term moving average for entries and exits may aid in reducing risk. ETFreplay provides this tool as a convenience to begin to track how well these long-term academic studies apply to markets now accessible via ETFs.

ETFreplay provides this tool for information purposes only, and in no way does it reflect investment advice.