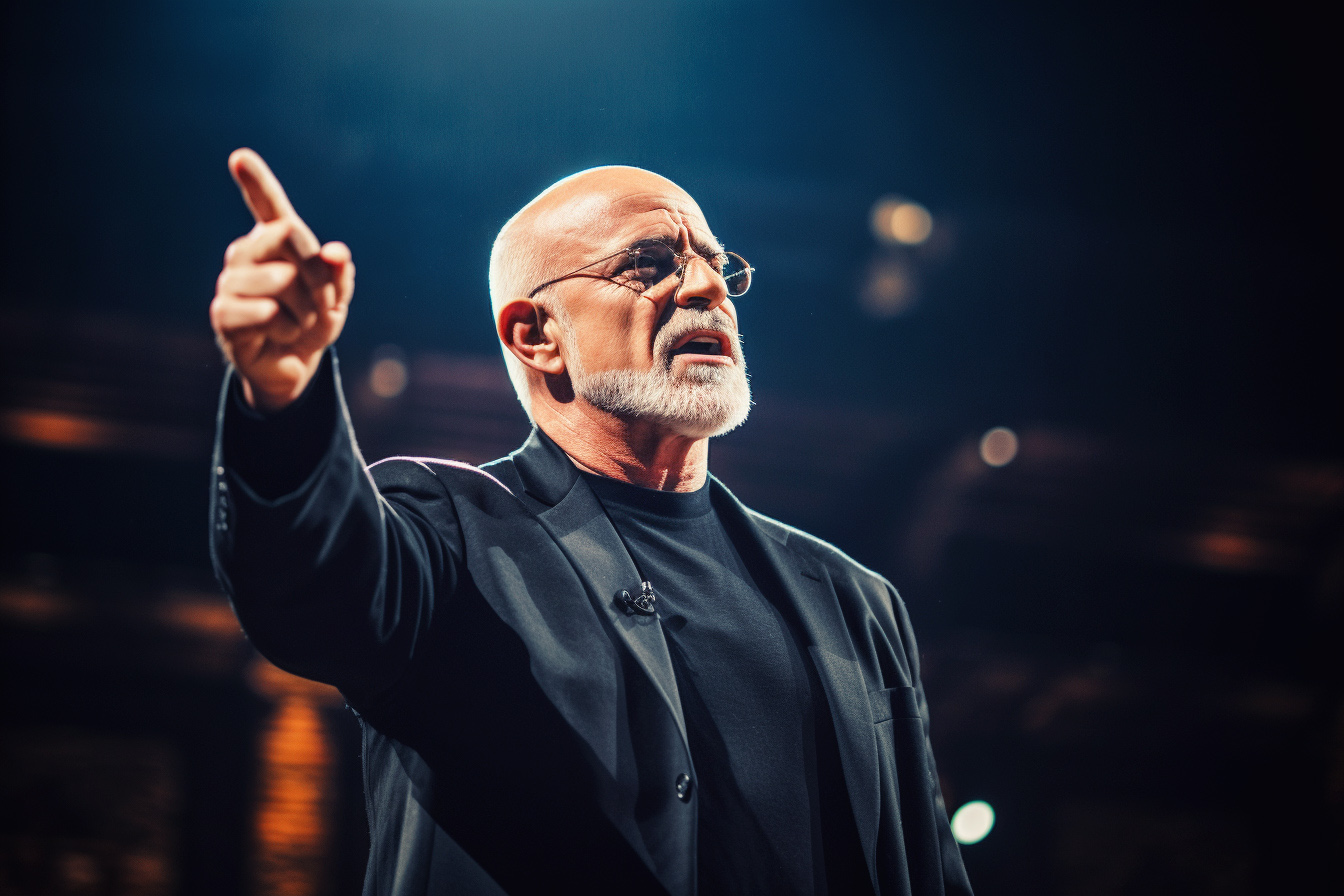

Personal finance expert Dave Ramsey has helped millions achieve financial peace and freedom from debt. But he says many fall for money myths, keeping them in debt. Debt and economic lies trap millions in the bondage of owing money. According to Ramsey, falling into debt is easy, but escaping is challenging. In his books, podcasts, and speeches, Ramsey exposes the biggest financial lies keeping people stuck in the vicious debt cycle.

This article will debunk the top ten financial lies Ramsey calls out so you can break free from debt and discover financial peace. I will unpack money myths related to debt that keep people trapped in the rat race and the treadmill of overspending.

Gain insight from Ramsey’s wisdom so you can take control of your finances, get out of debt, and start living – and giving – in ways you never thought possible. Don’t let these ten financial lies keep you in the debt trap. Read on to uncover the truth that sets people financially free.

Here are the ten financial lies that kept people in debt, according to Dave Ramsey:

- Debt is normal

- I have plenty of time to plan for my financial future

- You don’t make enough money to live debt-free

- The sacrifices aren’t worth it

- Having a budget limits your freedom

- You need to keep up appearances

- I want it, and I want it now

- Not using debt is a scary lifestyle change

- Debt isn’t a big deal

- You don’t need your spouse on the same page[1]

1. Debt is Normal

Ramsey says the notion debt is average or beneficial is false. You don’t need debt to live well. Debt steals your present and future. Choosing to avoid debt helps you start living your dreams now.

Our culture promotes debt as a necessity—even a path to prosperity. But Ramsey teaches that owing money rarely leads to wealth. It weighs you down with monthly payments, interest charges, and restrictions on your freedom. Don’t believe debt is essential for the good life. With focus and discipline, you can build security and abundance without obligation.

2. I Have Plenty of Time to Plan for My Financial Future

According to Ramsey, delaying responsible money habits keeps you stuck in debt now while stealing from your future. You can’t build wealth for tomorrow when you keep overpaying for your past through debt.

It’s easy to say you’ll start budgeting or pay off debt someday. But procrastination means you lose hard-earned money to interest longer. Ramsey urges stopping the waiting game and taking action today. Implement financial best practices like budgeting, saving, and eliminating debt as soon as possible.

3. You Don’t Make Enough Money to Live Debt-Free

Ramsey insists your income doesn’t determine whether you can pay off debt. Making strategic lifestyle sacrifices and finding ways to increase earnings responsibly can help anyone rapidly eliminate debt.

Don’t use a lack of money as an excuse to stay in debt. Where there is focus and intensity, there is a way, Ramsey teaches. If you make debt freedom your uncompromising priority, you can discover extra income streams and trim excess spending to conquer debt for good. Your obstacle is behavior, not math.

4. The Sacrifices Aren’t Worth It

According to Ramsey, temporary sacrifice brings lasting financial peace and freedom. Living with less now is worth it. Once you defeat debt, you can live more fully.

Don’t let fleeting pleasure or comfort stop you from permanent peace. With discipline and commitment, you can make rapid progress. When you finally slay the debt dragon, having your money back under your control will feel amazing. A few years of focused sacrifice can secure your financial future for life.

5. Having a Budget Limits Your Freedom

Ramsey says a budget gives you freedom by putting you in control of your money. When you have a plan for every dollar, you stop wondering where your money went each month.

People feel like they got a raise when they start budgeting and stop thoughtlessly burning through cash. A budget lets you direct dollars toward what matters most. Don’t avoid budgeting and remain a slave to impulsive spending. Embrace the power of planning.

6. You Need to Keep Up Appearances

According to Ramsey, comparing yourself to others and trying to keep up appearances keeps you in debt. Just because neighbors or friends seem to live lavishly doesn’t mean they manage money wisely.

Ramsey cautions against spending beyond your means to impress others. Their new cars and home upgrades may hide serious debt issues and financial insecurity. Don’t fall into the trap of competing with other people’s spending. Focus on living the proper lifestyle for you and your family, not keeping up appearances.

7. I Want It, and I Want It Now

Ramsey teaches that buying things you can’t afford with debt only weighs you down long-term. You’ll pay far more overall through interest and finance charges than if you saved up and paid cash.

According to Ramsey, the “I want it now” mindset leads to financial bondage. “Now” fades, but the debt and regret remain. Instead, cultivate patience and make purchases only when you have money. Delayed gratification leads to greater fulfillment and financial health.

8. Not Using Debt is a Scary Lifestyle Change

Ramsey says it’s entirely doable to live well without debt. Debit cards, cash, budgeting, and saving enable you to skip debt and enjoy life.

Debt often feels comfortable at first. But it eventually erodes your freedom and choices. Don’t be afraid to try a new way of living debt-free. The idea of change may seem daunting at first. But on the other side, you’ll find peace and abundance you never imagined.

9. Debt Isn’t a Big Deal

According to Ramsey, minimum debt payments stretch out interest costs over the years. What seems insignificant monthly becomes outrageous over time.

Ramsey warns that debt steals your future financial potential in tiny bites that eventually amount to debt feasting on your income through your monthly payment debt load. Every debt payment robs you of potential savings and investment gains. Recognize debt as a five-alarm fire emergency threatening your peace of mind.

10. You Don’t Need Your Spouse on the Same Page

Ramsey teaches that marriage makes debt “our” shared problem. Trying to eliminate debt separately prolongs the process.

Develop unified financial goals and work hand-in-hand to pay off debt rapidly. With teamwork, you gain the strength to conquer debt and any other challenge. Together, couples can achieve more than they could alone.

Key Takeaways

- Debt is not essential for a good life. Avoid falling for the myth that borrowing money is normal or wise.

- Don’t delay prudent money management. Implement financial best practices now to stop overpaying for your past.

- Income level does not determine your ability to become debt-free. Adjust spending and increase earnings to conquer debt.

- Temporary sacrifices bring lasting rewards. Cut back now so you can live more fully later.

- Budgeting leads to freedom by taking charge of your money flow. A spending plan helps you gain control.

- Don’t try to impress others with lavish spending. Appearances are often deceptive. Manage money based on your values.

- “I want it now” is a dangerous mindset. Save up instead of borrowing to avoid debt.

- Living debt-free is entirely doable. Don’t fear the debt-free lifestyle change. It leads to peace.

- Debt steals from your future in small bites that add up exponentially. Treat debt as an emergency.

- Marriage makes debt a shared foe. Teamwork is critical to overcoming deficits for good.

Conclusion

Question money myths are trapping you in debt. Implement positive financial practices to take control of your situation. With focus and discipline, you can defeat debt, find financial peace, and build wealth over time. Let wisdom, not falsehoods, guide your money journey.

Don’t buy into financial falsehoods keeping you stuck in debt. Ramsey provides the philosophy, process, focus, and math to help anyone gain freedom from debt. Will you answer the call to live and give like never before? Say goodbye to debt and hello to financial peace.