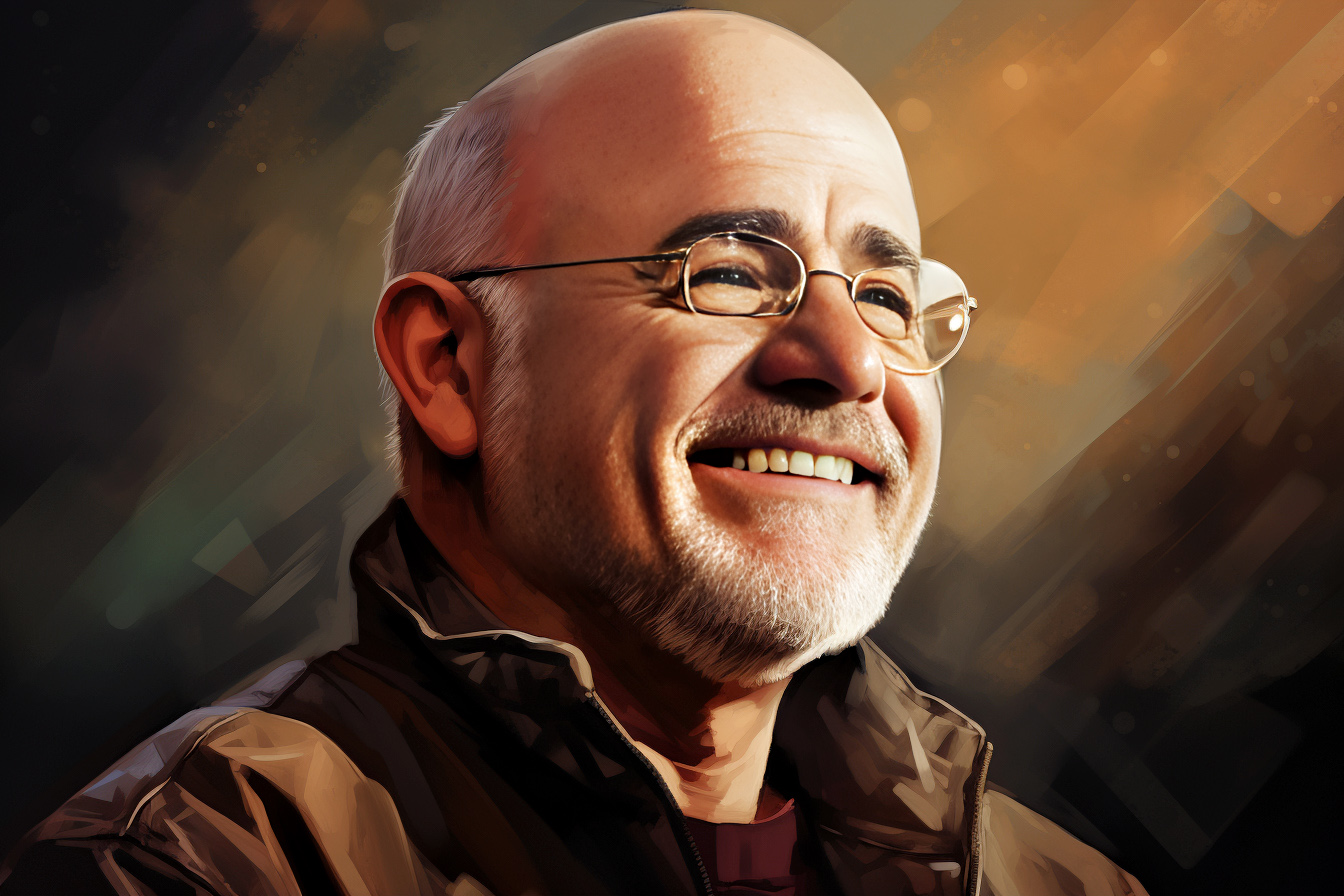

Frugality guru Dave Ramsey is famous for his simple money tips that help people crush debt, budget appropriately, and build wealth. Ramsey’s advice often focuses on developing intelligent, frugal living habits that allow people to dramatically cut expenses and save money.

This article highlights 8 of Dave Ramsey’s top recommended frugal living strategies. Implementing just a few of these can lead to thousands in annual savings.

Introduction

Dave Ramsey is a famous personal finance advisor and author known for his simple money tips and a sincere focus on eliminating all consumer debt. Ramsey has coached millions to pay off debt, budget wisely, and build wealth through his books, radio shows, podcasts, and more.

A central theme in Ramsey’s advice is embracing frugal living habits. He provides easy, actionable tips that help families watch their spending, save money regularly, and get out of debt fast. The following eight habits represent some of his favorite go-to frugal recommendations.

The Envelope System for Budgeting

The envelope system is one of Dave Ramsey’s top budgeting methods. Here’s how it works: you allocate a set amount of cash for specific spending categories like groceries, dining out, entertainment, etc. You put the money for each category in an envelope labeled for that expense.

You take money directly from that envelope when you spend in a category. Once the cash is gone from an envelope, no more spending can occur in that category until the next budget cycle. This prevents overspending and helps you stick to predetermined budgets for each expense area.

For example, Amanda budgets $400 per month for groceries. She puts $100 cash in the grocery envelope each week. When the $100 is gone, no more grocery spending can happen until next week’s $100 is added. This system prevents buying extra unneeded items.

Cutting Up Your Credit Cards

Dave Ramsey famously urges people to cut up their credit cards and stop using debt altogether. While extreme, this tactic works very effectively. Ramsey says credit cards encourage overspending and raising interest charges, fees, and debt.

By getting rid of credit cards and living only on cash, you are forced to live within your means and be more thoughtful about purchases. Impulse spending decreases dramatically when you pay with finite cash versus “invisible” credit.

For example, Trent had five maxed-out credit cards and $12,000 in debt. On Ramsey’s advice, he cut up his cards and switched to cash-only living. Within eight months, Trent paid off all his cards and saved $3,000 in fees and interest.

Buying Used Instead of New

One of Dave Ramsey’s favorite frugal hacks is purchasing used rather than new items. This applies to everything from cars and furniture to clothes, books, sports equipment, electronics, etc. Quality used items are often nearly as good as new, at a fraction of the cost.

Ramsey especially preaches buying used cars versus new ones, as the depreciation on new vehicles as soon as you drive off the lot is massive. Even buying used cars that are just 2-3 years old can mean savings in the thousands over brand new.

For example, when Emily’s old car died, she ignored Ramsey’s advice and bought a new $32k SUV. Just a year later, when finances got tight, she had to sell it for $22k, losing $10k instantly.

Limit Dining Out

Dining out less is one of the easiest ways to slash expenses and save money fast. Restaurant meals typically cost 300-400% more than cooking at home. Cutting back on dining out 1-2 times weekly can lead to huge savings.

Ramsey advises being ruthlessly strategic about restaurant spending. For example, eat out for special occasions only, or cap yourself at once per week. Brown bag lunches and avoiding daily Starbucks stops can save you $100+ each month.

Jade ate out 4-5 times weekly and ignored her growing credit card debt. On Ramsey’s advice, she limited restaurants to twice a month max. She immediately saved $350 monthly and paid off two credit cards in five months.

Choosing Generic Over Name Brand

One of Dave Ramsey’s favorite frugal swaps is opting for generic store items over name brands. Food staples, over-the-counter medicine, cleaning products, and, more often, have generic versions that are 50% cheaper or more than the name brands.

In most cases, the quality and effectiveness are comparable. For example, 500 mg acetaminophen pain reliever is the same whether the bottle says Tylenol or CVS Health. A box of crispy rice cereal will taste the same as a Malt-O-Meal bag or Kellogg’s.

Marcus was skeptical but tried Ramsey’s advice and switched to leading generics for 90 days. He was shocked that most seemed identical, yet he saved $58 on groceries that month alone.

Avoid Impulse Purchases

Ramsey constantly advises listeners of his show to avoid impulse purchases. His famous tip is to wait at least 24 hours (preferably longer) before any sizable purchase. This helps ensure it’s a real need, not just an emotional want.

This pause also gives you time to find better deals and not just jump at the first price you see. You can save hundreds by taking time to verify you’re getting the best price and not buying on a whim.

For example, when Erica saw a new $800 patio set she loved, she almost bought it on the spot. But she waited two days per Ramsey’s tip and found the same set priced at $550 with free shipping elsewhere.

Negotiating Bills and Big Purchases

“If you don’t ask, you don’t save!” That’s one of Dave Ramsey’s mantras when negotiating lower prices. He advises you always to negotiate medical bills, large purchases like appliances or furniture, and monthly services like cable, phone plans, or gym memberships.

Even a 5-15% discount on significant expenses or monthly services can lead to thousands in savings each year. Ramsey says even just threatening to cancel service will often lead companies to offer you discounts to stay.

For example, calling his internet provider for a better rate got Kevin a new half-price promo for a year. When she negotiated her hospital bill, Jen saved over $800 on the initial amount.

Using Community Resources

Dave Ramsey is a huge fan of utilizing free and low-cost resources in most communities. This includes public libraries, parks, museums, recreational centers, government programs, and support groups.

These resources allow you to enjoy free or cheap entertainment, education, healthcare, and services. This replaces expensive alternatives like movie theaters, colleges, private lessons, therapists, hotels, and consultants.

For instance, instead of hiring a moving company, Jeff used his community tool library to borrow a truck and moving equipment for just a $50 deposit. Emily takes free computer classes at the library instead of paying over $1000 for courses at the community college.

Conclusion

Implementing Dave Ramsey’s top frugal living strategies can help anyone dramatically cut expenses and save thousands. Daily changes like limiting dining out, brown bagging lunch, choosing generics, and avoiding impulse purchases quickly add up. More big steps like budgeting with envelopes, ditching credit cards, negotiating bills, and using community resources take it further.

Adopting just a few of Ramsey’s favorite frugal hacks can transform your finances. To see the true potential, look at Miranda’s story. She put 5 of Ramsey’s tips into practice – she started packing lunches, switched to generics, cut up her cards, bought used, and negotiated bills. In less than eight months, Miranda was debt-free, had a 6-month emergency fund, and saved $750 a month she used to spend. Frugality goes a long way!