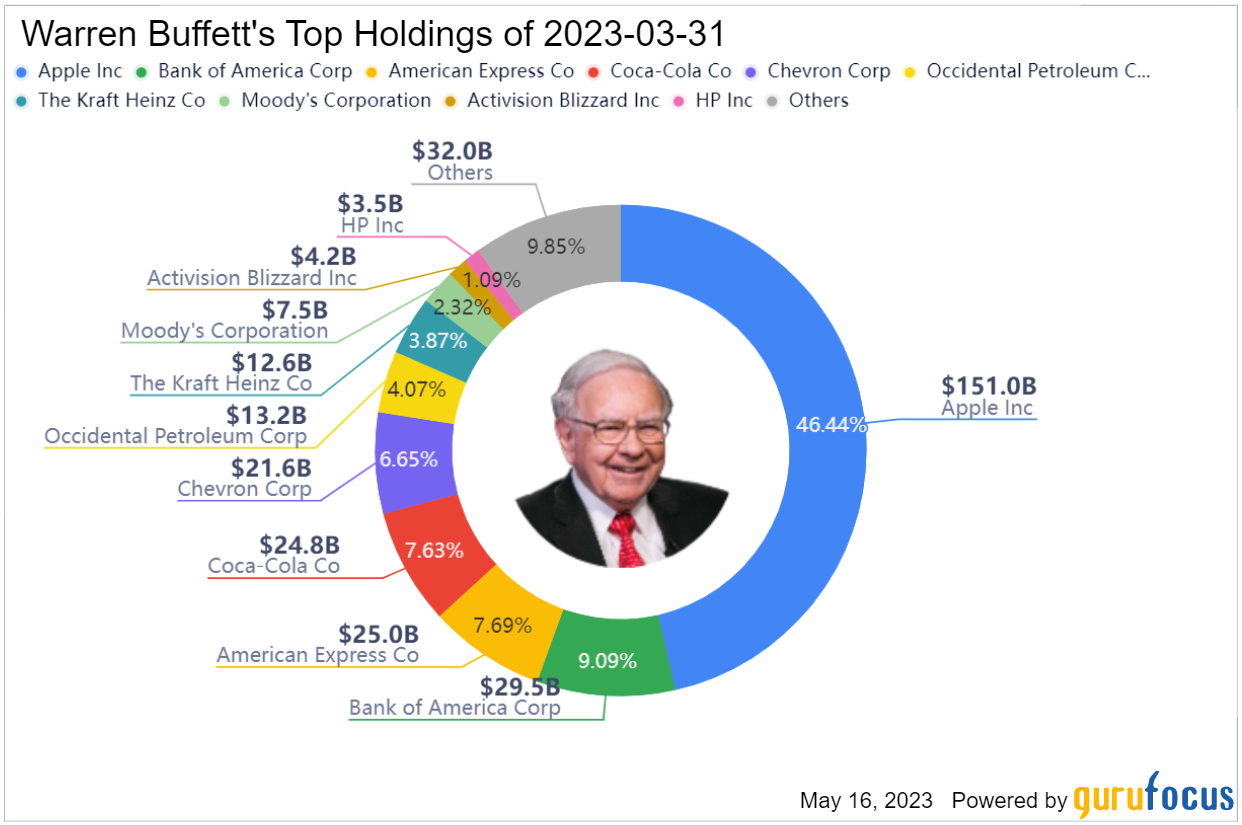

Image via GuruFocus.com

The current Warren Buffett portfolio’s latest Berkshire Hathaway 13F report is dated May 15, 2023 (Q1). This report reflects the stocks of public companies Buffett holds inside his company-owned portfolio for Berkshire Hathaway as of March 31, 2023, at the end of the 1st quarter. Warren Buffett is the Chairman, CEO, and biggest shareholder of Berkshire Hathaway Inc. BRK.A (class A common stock), BRK.B (class B common stock).[1]

The following stocks are the Berkshire Hathaway portfolio holdings; Warren Buffett owns only his ~16% stake in Berkshire Hathaway worth more than $113 billion, and shareholdings in two banks: JP Morgan and Wells Fargo.

Current Berkshire Hathaway portfolio value: $325,108,757,000[2]

Total number of stocks owned: 48

Top 5 stocks by portfolio value size: Apple (AAPL), Bank of America(BAC), Chevron (CVX), Coca-Cola (KO), and American Express(AXP).

Current Warren Buffett Portfolio 2023 (Q1)

| Company | Ticker | Market value as of 31 March 2023 | Number of shares | % of the total portfolio |

| APPLE INC (COM) | AAPL | 150,975,908,000 | 915,560,382 | 46.44% |

| BANK OF AMERICA CORP (COM) | BAC | 29,539,568,000 | 1,032,852,006 | 9.09% |

| AMERICAN EXPRESS CO (COM) | AXP | 25,008,185,000 | 151,610,700 | 7.69% |

| COCA COLA CO (COM) | KO | 24,812,002,000 | 400,000,000 | 7.63% |

| CHEVRON CORP (COM) | CVX | 21,603,624,000 | 132,407,595 | 6.65% |

| OCCIDENTAL PETROLEUM (COM) | OXY | 13,216,875,000 | 211,707,119 | 4.07% |

| KRAFT HEINZ CO (COM) | KHC | 12,592,298,000 | 325,634,818 | 3.87% |

| MOODYS CORP (COM) | MCO | 7,549,445,000 | 24,669,778 | 2.32% |

| ACTIVISION BLIZZARD INC (COM) | ATVI | 4,231,550,000 | 49,439,781 | 1.30% |

| HP INC. (COM) | HPQ | 3,549,965,000 | 120,952,818 | 1.09% |

| DAVITA HEALTHCARE PARTNERS I (COM) | DVA | 2,927,712,000 | 36,095,570 | 0.90% |

| VERISIGN INC (COM) | VRSN | 2,708,323,000 | 12,815,613 | 0.83% |

| CITIGROUP INC. (COM) | C | 2,590,429,000 | 55,244,797 | 0.80% |

| KROGER CO. (COM) | KR | 2,468,500,000 | 50,000,000 | 0.76% |

| PARAMOUNT GLOBAL (COM CL B) | PARA | 2,091,139,000 | 93,730,975 | 0.64% |

| VISA INC (COM CL A) | V | 1,870,745,000 | 8,297,460 | 0.58% |

| GENERAL MTRS CO (COM) | GM | 1,467,200,000 | 40,000,000 | 0.45% |

| MASTERCARD INC (CL A) | MA | 1,448,788,000 | 3,986,648 | 0.45% |

| AON PLC (COM) | AON | 1,366,782,000 | 4,335,000 | 0.42% |

| CHARTER COMMUNICATIONS INC N (CL A) | CHTR | 1,369,268,000 | 3,828,941 | 0.42% |

| LIBERTY MEDIA CORP DELAWARE (COM C SIRIUSXM) | LSXMK | 1,209,400,000 | 43,208,291 | 0.37% |

| AMAZON COM INC (COM) | AMZN | 1,089,813,000 | 10,551,000 | 0.34% |

| CELANESE CORP. (COM) | CE | 960,302,000 | 8,819,016 | 0.30% |

| CAPITAL ONE FINANCIAL (COM) | COF | 954,099,000 | 9,922,000 | 0.29% |

| SNOWFLAKE INC (COM) | SNOW | 945,084,000 | 6,125,376 | 0.29% |

| MCKESSON CORP. | MCK | 815,306,000 | 2,289,864 | 0.25% |

| ALLY FINANCIAL INC. (COM) | ALLY | 739,211,000 | 29,000,000 | 0.23% |

| T-MOBILE US INC (COM) | TMUS | 759,251,000 | 5,242,000 | 0.23% |

| GLOBE LIFE INC (COM) | GL | 699,037,000 | 6,353,727 | 0.22% |

| MARKEL CORP. (COM) | MKL | 602,505,000 | 471,661 | 0.19% |

| LIBERTY MEDIA CORP FORMULA ONE (COM SER C) | FWONK | 577,871,000 | 7,722,451 | 0.18% |

| LIBERTY SIRIUS XM SERIES A | LSXMA | 567,633,000 | 20,207,680 | 0.17% |

| NU HOLDINGS LTD | NU | 509,885,000 | 107,118,784 | 0.16% |

| FLOOR & DECOR HOLDINGS (COM) | FND | 469,492,000 | 4,780,000 | 0.14% |

| LOUISIANA-PACIFIC CORP (COM) | LPX | 381,905,000 | 7,044,909 | 0.12% |

| STONECO LTD (COM CL A) | STNE | 102,035,000 | 10,695,448 | 0.03% |

| JOHNSON & JOHNSON (COM) | JNJ | 50,701,000 | 327,100 | 0.02% |

| MARSH & MCLENNAN | MMC | 67,438,000 | 404,911 | 0.02% |

| DIAGEO ADR (COM) | DEO | 41,264,000 | 227,750 | 0.01% |

| LIBERTY LATIN AMERICA LTD (COM CL A) | LILA | 21,862,000 | 2,630,792 | 0.01% |

| MONDELEZ INTL INC (CL A) | MDLZ | 40,298,000 | 578,000 | 0.01% |

| PROCTER & GAMBLE CO (COM) | PG | 46,897,000 | 315,400 | 0.01% |

| JEFFERIES FINANCIAL GROUP INC (COM CL C) | JEF | 13,761,000 | 433,558 | 0.00% |

| LIBERTY LATIN AMERICA LTD (COM CL C) | LILAK | 10,606,000 | 1,284,020 | 0.00% |

| SPDR S&P 500 ETF TRUST | SPY | 16,130,000 | 39,400 | 0.00% |

| UNITED PARCEL SERVICE INC (CL B) | UPS | 10,326,000 | 59,400 | 0.00% |

| VANGUARD S&P 500 ETF | VOO | 16,171,000 | 43,000 | 0.00% |

| VITESSE ENERGY INC (CL B) | VTS | 971,000 | 51,026 | 0.00% |

| Total market value ($) | 325,108,757,000 |

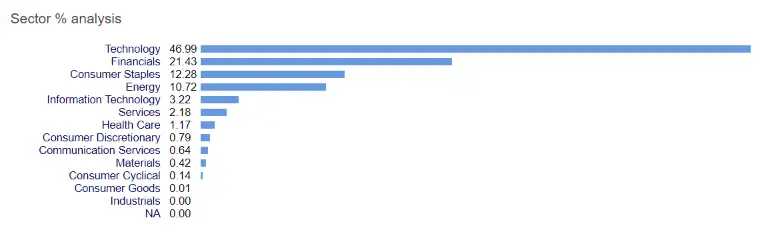

Current Warren Buffett Portfolio Allocation 2023

Berkshire Hathaway Cash Holdings

In addition to $325 billion in stocks, Berkshire Hathaway’s holdings consist of more than $127 billion in cash and cash equivalents, according to its first-quarter report.