As we approach spring 2023, the US housing market has not crashed nationally. Not even close. The most significant drops in home prices have been in the same metropolitan areas that also have had the biggest run-ups in price since 2020.

According to Newsweek, the cities with the biggest drops in home prices so far are:

- Austin, Texas

- San Francisco, California

- San Diego, California

- Phoenix, Arizona

- Denver, Colorado

- Seattle, Washington

- Tampa, Florida

While home prices in Austin are expected to decline by more than 15% next year, in San Francisco, San Diego, Phoenix, Denver, Seattle, and Tampa, prices will drop by over 10% during 2023.

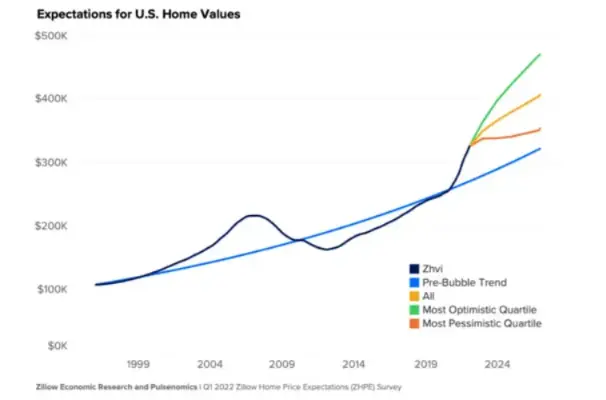

Home values slipped just 0.1% in January 2023, leaving the typical home value at $329,542, or 4.1% below the peak value set in July 2022, according to the Zillow Home Value Index. Home values are still 6.2% higher than one year earlier–a rapidly decelerating pace of annual growth, down from the nearly record-high 18.8% year-over-year growth measured in April. Zillow projects typical U.S. home values to rise 0.5% from January 2023 to January 2024 (seasonally adjusted).[1]

While there is some evidence to suggest that we are on the brink of the worst housing meltdown in recent American history, the current price stats show no significant changes. However, there are mounting indications that this is the start of another housing depression similar to the one we saw in 2008 based on the collapse of buyer interest and listed home prices being lowered in the past few months. This article will explore the disturbing details of the 2023 housing crash, what is causing it, and what it means for the future.

The 2020-2022 Housing Boom

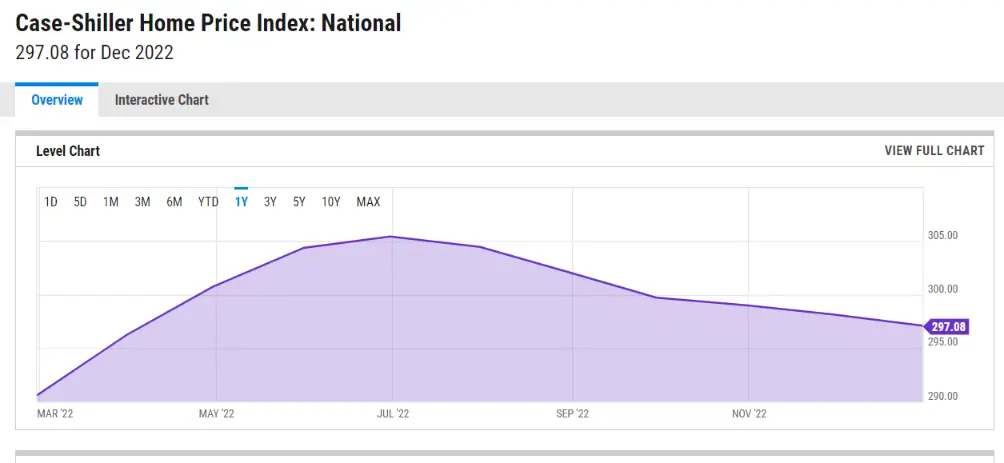

From March 2020 to June 2022, the median home price increased by 43%, as measured by the Case Shiller Index. This unbelievable rise was never thought to be possible. Real estate investors and homeowners cashed in on millions in this super growth era, owners pulled out record-high equity through HELOCs, and buyers grew desperate, watching as month after month prices just increased. At the peak of the housing market through 2021 and 2022, homebuyers were getting into bidding wars and even buying homes they had not seen in person. After 27 straight months of near-parabolic growth, the market finally quit increasing at a runaway pace in June 2022. The Federal Reserve’s rising interest rates and inflation’s economic impact on homebuyers helped stop the exponential rise in home values in 2022.

The 2023 Housing Crash

The trend in the housing market is finally starting to change. Prices for five straight months have declined, falling 3.6% from the peak. To many, this seems like a slight decline compared to what happened three years prior. For prices to fall to pre-pandemic levels, the Case Shiller must drop an additional 28%. While a 3.6% drop is barely noticeable to buyers, there is mounting evidence that this is the start of another housing market crash similar to the one we saw in 2008. The danger comes from the markets that went up the most and are detached so much from the fundamental value of home prices historically and new home replacement value. Million-dollar prices in big cities for starter homes are not sustainable in an economy with runaway inflation, high energy costs, and a cost of living crisis.

The Evidence for the 2023 Housing Crash

The evidence for the 2023 housing crash can be found in shocking new weekly data. For example, the most recent Case Shiller release revealed that prices have declined for six months. This may seem like no big deal, but if we trace the history, we can see that this decline rarely happens. In fact, since 1986, which is the earliest reading for the Case Shiller, the market has seldom dropped more than 3%. The only exceptions were 2008 and this small 3.05% drop in 1990.

Many experts speculate that we are in what they call the denial phase of the crash. You have a lot of people who are private sellers refusing to budge on prices and maintaining this illusion of a market. Home sellers have the cognitive bias of anchoring on past high prices instead of comparing them to the price they paid for a home. While it may be frustrating as a buyer, we know from previous crashes that private sellers are not the first mover home sellers in any real estate market. They are almost always the last to sell due to the cost of realtors and the cost of buying and moving to a new home. The group that moves prices first and the most in the housing markets is almost always the builders. Builders look at the cost they have in the land, licensing costs, cost of materials, labor, and market demand for a geographic location. They set their cost for a profit margin and not anchoring cognitive bias for what they paid. Builders want to create and move inventory for profit.

The Role of Builders in the 2023 Housing Crash

The builders are multi-billion dollar corporations that move thousands of units per month and have whole teams dedicated to setting prices. They understand the demand and supply better than anybody else and have a much higher incentive to move prices down to move inventory. We saw this past quarter that almost every single serious builder has lowered prices and included incentives like rate buy-downs to get people to buy. So, while the Case Shiller graph looks okay so far, it’s not indicative of what’s happening on the ground. The most recent earnings reports from builders reveal some severe market issues.

What it Means for the Future

While the effects of these actions will take some time to move into the existing home market, it’s undeniable that these developments in the new home space will have an effect. Imagine if you were purchasing an existing home and a new one down the street suddenly slashed its price by 20%, putting it on par with the existing one you were looking at. It will almost certainly sway your buying decision, as there’s always a premium between the current and new home inventory. New homes are always the ones that anchor prices to what they cost to purchase.

The evidence regarding a new home slowdown is pretty straightforward, it’s still not something that will suddenly erase all those post-2020 gains overnight. The truth about real estate crashes is that they take a long time to get rolling. The housing market is at a crossroads. For generations now, owning a home has been part of the American dream, and that dream is under threat by simple math.

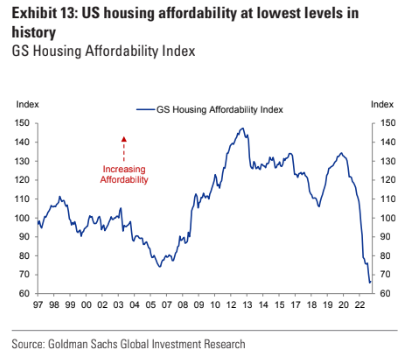

Affordability of Housing

To demonstrate this fact, we can look at the affordability of housing. Using data from the US Census Bureau, the Fed, and the US Department of Housing, we can see that the American who bought a median home in 2022 now pays over 52% of his gross before-tax income on the mortgage. We are now well above the relative prices of 2008, and if that was the worst real estate bubble this country has ever seen, we have to ask ourselves what is different about this one.

US housing affordability is at the lowest levels in history.

One of the three variables that need to give is prices, and looking at the affordability chart, it’s easy to see why so many are calling for a crash. Homeownership has become unaffordable, although unemployment is near record lows, and incomes have done very well over the past five years. Without demand from ordinary everyday Americans, it will be increasingly difficult for supply to stay low. Once the inventory situation unfolds, prices will decrease as demand has to meet supply at the right price level.

Conclusion

In conclusion, while the housing market has not yet crashed, mounting evidence suggests that we are on the brink of the worst housing meltdown in recent American history. The evidence can be found in shocking new data being updated every week. The builders are multi-billion dollar corporations that move thousands of units per month and have whole teams dedicated to setting prices. They understand the demand and supply better than anybody else and have a much higher incentive to move prices down to move inventory.

Undeniably, these developments in the new home space will affect the existing home market. The most recent earnings reports from builders reveal some serious market issues. Without demand from everyday Americans, it will be increasingly difficult for supply to stay low. Both new and existing home prices being lowered is the first signal of increasing supply over demand from buyers at those price levels. Once the inventory situation unfolds, we will see home sellers that need to move give up. The market is at a crossroads, and we could be entering a long, painful bear market that we will see play out in the coming year.