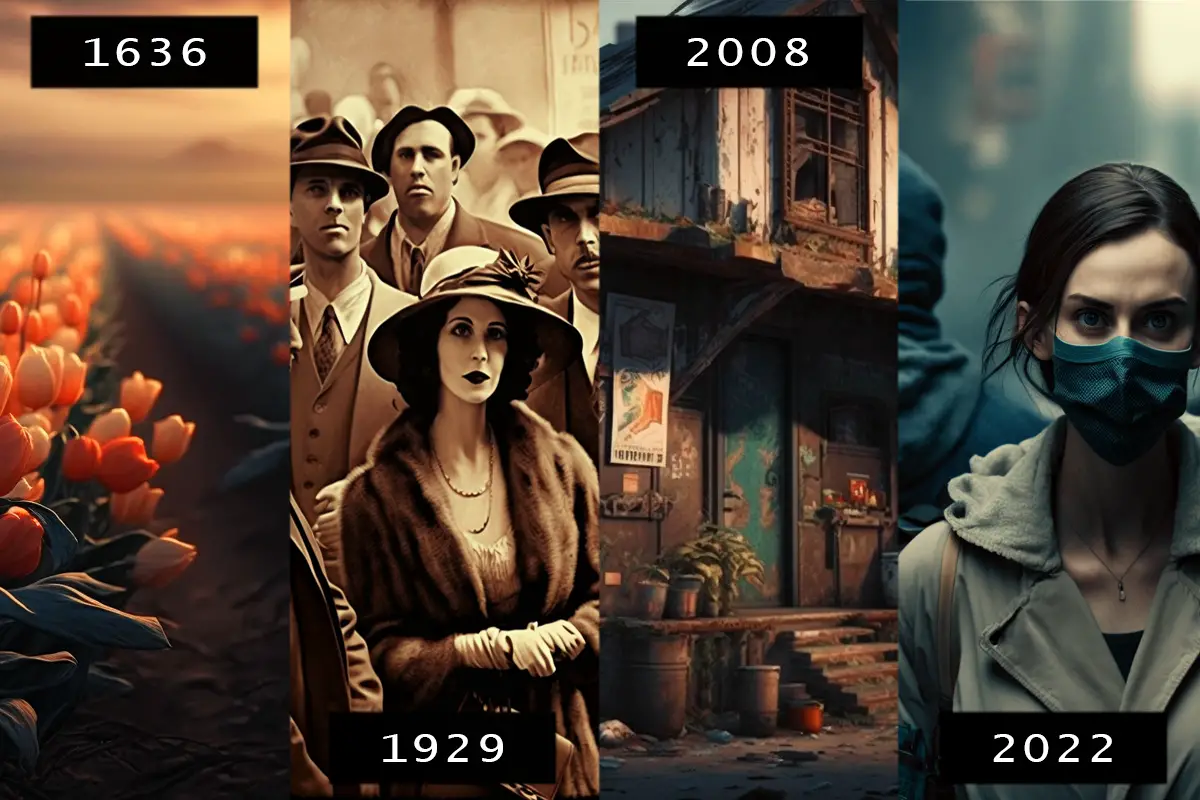

“It’s just part of the business cycle” has become a typical response to financial crises, stock market crashes, and recessions. However, it’s never just part of the free market when real people who lose their jobs, homes, and futures feel the repercussions of monetary policy, speculation, and bubbles. This article will use historical events as examples to explore how financial crises lead to recessions and who’s to blame. We will examine the tulip bubble of the 1600s and the stock market crash of 1929 and compare the global financial crisis of 2008 and the current state of the world’s economies.

The Tulip Bubble

In 1636 in Holland, tulips were highly valued as a status symbol, and their prices skyrocketed due to speculation in the tulip market. As more and more people became interested in buying tulips, prices rose excessively and exponentially. Tulip bulbs became a highly sought-after commodity. Some tulip bulbs were valued the same as a house at the peak.

However, the market was eventually flooded with tulips as more people started to cultivate them, causing a saturation in supply. With more tulips available, the prices began to drop rapidly, and many lost money as the bubble burst. High prices will create and bring out supply looking to capitalize on high prices. Irrational exuberance drives price bubbles to unsustainable price levels detached from any rational fundamental value.

The tulip bubble is often cited as an example of how speculation can create a bubble unsupported by underlying economic realities. The tulip market was not based on real economic growth or production but on the perceived value of tulips as a symbol of luxury and status and the hopes of getting rich by buying them at ridiculous prices. This led to an unsustainable market bubble that eventually collapsed, causing many people to suffer financial losses.

There were a lot of similarities between the tulip mania in Holland in the 1600s and the recent cryptocurrency and NFT bubble as people chased prices higher in things that had no real value outside what you could get someone else to pay for them. The recent bear market in crypto and the collapse in NFT prices had more to do with the previous bubble than anything else. A lot of the extra fiat currency unleashed into the market during the lockdowns in 2020 also found its way into the speculative crypto market bubble helping to raise prices.

Stock Market Crash of 1929

The stock market crash of 1929 in the United States is one of the most significant events in the history of finance. During the 1920s, the US was experiencing an economic boom, and many investors poured their money into the stock market. However, this investment was fueled mainly by low-margin requirements, easy credit, and speculation, with many investors buying stocks with margin loans.

Margin requirements rose from 10-20 percent to 40-50 percent by the middle of 1929. Investors could buy $100 worth of stock with only $10 in investment capital at the peak of margin loan leverage. It was common for many investors to get 1:3 or 1:4 leverage for the capital with some brokers creating a runaway speculative bubble and the danger of cascascading margin calls later.

As stock prices continued to rise, investors became more and more optimistic, believing that the upward trend would continue indefinitely. This led to a speculative frenzy, with more and more people investing in the market, driving prices even higher.

However, in October 1929, the market suddenly crashed, and stock prices plummeted. This caused a panic among investors, who tried to sell their stocks quickly, further driving down costs. On Black Monday, October 28, 1929, the Dow declined nearly 13 percent. On the following day, Black Tuesday, the market dropped almost 12 percent. In a few days, billions of dollars were lost, and many investors were wiped out. Margin calls due to leverage triggered and compounded the selling.

The crash had far-reaching effects, with many traders bankrupt and banks collapsing due to withdrawals. The entire U.S. economy was affected, and the Great Depression, a period of economic hardship and high unemployment, followed as investment capital was destroyed in the stock market.

The stock market crash of 1929 is often cited as an example of how easy credit and speculation can create a bubble unsupported by underlying economic realities. The crash highlighted the importance of financial regulation. It led to the establishment of the Securities and Exchange Commission (SEC) in 1934, designed to protect investors and prevent fraud in the stock market.

The Dot Com Bubble

The Dot Com Bubble was a period of wild speculative investment in the tech industry in the late 1990s and early 2000 that became ungrounded from the economic realities of the internet at the time. The internet was still relatively new, and many people believed that any company with an online presence was poised for incredible growth. Investors poured money into tech startups, even those without a proven business model or path to profitability. As a result, many of these companies had inflated valuations with no connection to fundamental realities or even future cash flow. The NASDAQ was trading at prices far above what the actual value of the dot-com companies at the time would ever be.

The bubble burst in 2000 when many of these companies failed to create profits, and investors realized they had invested in hype rather than substance. Many dot-com startups went bankrupt as their cash burn rate was high and could not raise more capital, and the stock prices of even the most successful tech companies plummeted. The dot-com bubble burst had far-reaching consequences, leading to a significant decline in the stock market and causing many people to lose their jobs as the whole economy contracted from the economic excess of the time.

One of the lessons learned from the dot-com bubble burst was the importance of focusing on profitability early in the cycle of a new business, along with sustainable growth in revenue and those profits. Businesses had to adapt and become more careful with their investment capital allocations. At the same time, investors became more cautious and skeptical of new companies that promised to change the world through the internet. Ultimately, the dot-com bubble burst was a painful but necessary correction in the tech industry that eventually led to a more stable and sustainable business environment where profitable dot-com companies like Google, Facebook, and Amazon would later emerge as market leaders.

Financial Crisis of 2008

However, history repeated the same boom and bust cycle as the 2008 financial crisis hit. Once again, greed, speculation, and irresponsible lending caused the crash in the stock market, the housing market, and the larger economy. Banks were lending money to people who wanted to buy homes they couldn’t afford, and the banks were packaging these bad loans into complex financial products that they sold to investors. The financial derivative system collapsed when people started defaulting on their home loans. The 2008 financial crisis was one of the worst economic disasters in history, and it had a devastating impact on people’s lives all around the world. It’s been over a decade since the crisis, and we still feel its effects.

Once again, easy credit and speculation were significant factors in the crisis. Banks loaned money to people who could not afford to repay it, leading to a housing bubble that eventually burst. Homes reached such high prices by 2008 due to easy home loans, much like we have seen today in the recent home price run-up from 2018 to 2022. The global financial crisis had far-reaching consequences, including the collapse of major financial institutions and a global recession that lasted for years.

In the wake of the global financial crisis, many people asked who was to blame. Some pointed fingers at Wall Street and the banks, while others blamed government regulators who failed to rein in the excesses of the financial system. The financial crisis resulted from many factors, including easy credit, low-interest rates, Central Banks’ bloated balance sheets, speculation, and a lack of regulatory oversight.

2023 and Beyond

The world faces new challenges in 2023, including inflation, a new housing bubble, looming financial crises, and the rise and fall of cryptocurrencies. It’s easy to feel overwhelmed and powerless in the face of these challenges. Still, it’s essential to remember that we can make a difference in our financial life by making informed decisions and staying out of speculative bubbles by having would investing strategies of trading systems with an edge. While it’s tempting to dismiss financial crises as just part of the business cycle, the reality is that easy monetary policies and speculative bubbles with no underlying fundamental value have real-world consequences that profoundly affect people’s lives.

The real cause of all recessions that nobody talks about? Greed at all levels in the economic system. So why do we keep repeating the same mistakes over and over again? The answer is simple: people that don’t learn from the past are doomed to repeat it. People want to make as much money as possible and are willing to take risks. The problem is that these risks often hurt the investors and regular people who had nothing to do with it.

Past events have taught us that financial crises are inevitable when people prioritize greed over sound financial practices. It’s up to us to learn from these mistakes and not expose ourselves to the risk of large losses during these speculative bubbles.