This article examines the Cantillon Effect’s relevance in the current economic environment. The Cantillon Effect is a monetary phenomenon where the initial recipients of new money see a disproportionate benefit while the latter face a diminished effect. This article will provide an in-depth analysis of the Cantillon Effect and its implications for the global economy, especially in light of the current situation over the past three years of easy money distributed into the world’s economies.

What is the Cantillon Effect?

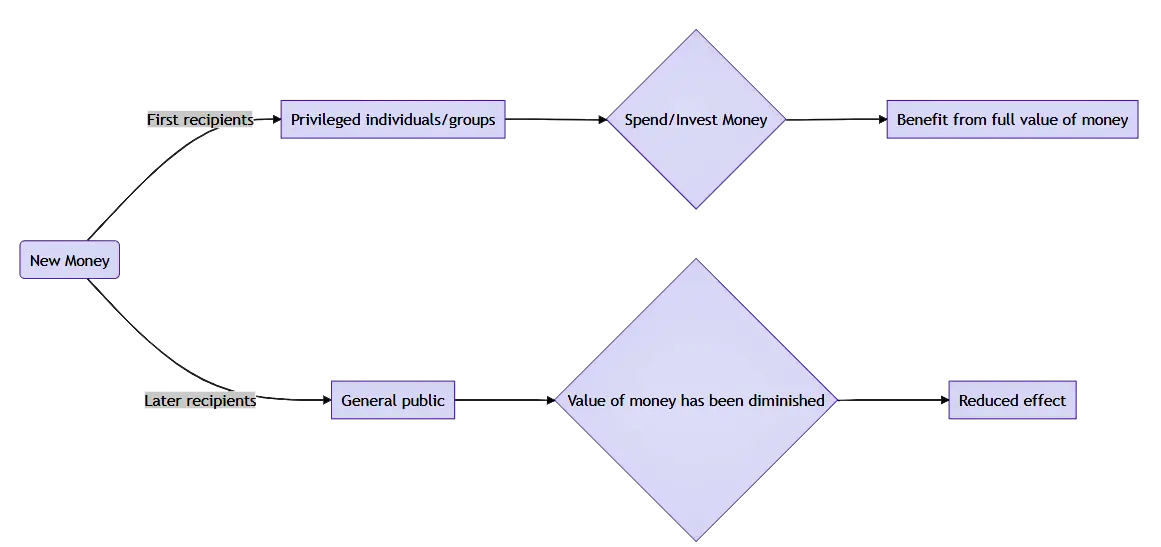

The Cantillon Effect is a term coined after the economist Richard Cantillon, who observed that the impact of monetary inflation is not evenly distributed. The product results from how new money is introduced into the economy. When new money is raised, it is first received by a few privileged individuals or groups, such as banks, government agencies, or wealthy business owners. These individuals then have the power to spend or invest the money before it impacts the economy, and as a result, they benefit from the total value of the capital.

On the other hand, when the newly created money eventually makes its way into the hands of the general public, its value has already been diminished due to the initial spending and investing by privileged individuals. As a result, the general population sees a reduced effect from the new money compared to the initial recipients. This is known as the Cantillon Effect, which has significant economic implications.

Implications of the Cantillon Effect

The Cantillon Effect has several implications for the global economy. One of the most significant implications is that it can lead to wealth inequality. The privileged individuals who receive the new money can increase their wealth before the general public can access it. This creates a significant wealth gap between select individuals and the rest of the population.

The Cantillon Effect also has implications for inflation. As the new money is spent and invested by the initial recipients, it can create inflationary pressures in the economy. This is because privileged individuals are likelier to pay with the new money early in the cycle of money distribution than other people more downstream in the economy. As a result, the economy can experience higher levels of inflation, which can harm the purchasing power for everyday goods and services of the general public.

The Cantillon Effect and the Current Economic Environment

The COVID-19 pandemic has caused significant disruptions to the global economy, and governments worldwide have introduced significant amounts of new money into the economy to combat the economic impact of the pandemic. However, this new money has primarily been directed toward the financial sector, businesses, and large corporations, which has exacerbated wealth inequality and diminished the value of the new money for the general public.

In response to the COVID-19 pandemic, the U.S. government implemented several policies to assist individuals and businesses financially.

Some of these policies included:

- Economic Impact Payments: The CARES Act provided direct payments of up to $1,200 to individuals and $2,400 to married couples, plus an additional $500 per child under age 17. This was intended to provide immediate financial relief to Americans during the pandemic.

- Paycheck Protection Program (PPP): The PPP was a loan program for small businesses to help keep their employees on the payroll during the pandemic. The loans were forgivable if the business used the funds to pay for eligible expenses such as payroll, rent, and utilities.

- Unemployment Insurance Expansion: The CARES Act expanded unemployment insurance benefits to provide an additional $600 per week in benefits to unemployed workers on top of their regular state benefits. This was intended to temporarily relieve workers who lost their jobs due to the pandemic.

- Coronavirus Relief Fund: The CARES Act established the Coronavirus Relief Fund, which provided $150 billion in funding to state, local, and tribal governments to support COVID-19 response efforts.

- Employee Retention Tax Credit: The CARES Act established a refundable tax credit for businesses that retained employees during the pandemic. The credit was worth up to 50% of eligible wages paid by the employer, up to a maximum credit of $5,000 per employee.

- Rental Assistance: The Emergency Rental Assistance Program provided $25 billion in funding to assist households unable to pay rent and utilities due to the pandemic.

- Small Business Debt Relief Program: The Small Business Debt Relief Program provided immediate relief to small businesses with existing SBA loans by covering all loan payments, including principal, interest, and fees, for six months.

These policies were designed to provide financial assistance to individuals and businesses impacted by the pandemic and to help support the U.S. economy during that difficult time.

The Federal Reserve has also implemented quantitative easing and purchasing corporate bonds in the United States, primarily benefiting large corporations and the wealthy [1]. Similarly, the Bank of England has implemented policies such as purchasing government bonds and quantitative easing in the United Kingdom, benefiting the financial sector and large corporations [2].

This has further exacerbated wealth inequality, as the privileged individuals who receive the new money can increase their wealth. At the same time, the general public faces a reduced effect from the new capital due to the Cantillon Effect.

Moreover, the current economic situation has highlighted the potential for the Cantillon Effect to create inflationary pressures. As privileged individuals spend and invest the new money, there is a risk of higher inflation, which can harm the general public’s purchasing power. For instance, the rapid increase in asset prices, such as stocks and real estate, has been attributed to the influx of new money into the financial sector, which can create inflationary pressures and harm the general public’s purchasing power [3].

Historical Examples of the Cantillon Effect

Historically, the Cantillon Effect has had significant economic implications, leading to wealth inequality, reduced purchasing power for the general population, and other economic distortions. Here are a few examples to illustrate this:

- During the Age of Discovery in the 16th century, the influx of precious metals from the Americas caused inflation and increased prices in Europe. The privileged individuals with access to the new money, such as monarchs and aristocrats, could benefit from the increased wealth. At the same time, the general population faced a higher cost of living and reduced purchasing power [1].

- During the industrial revolution in the 18th and 19th centuries, the introduction of new technologies and the growth of industry led to significant economic growth. However, the benefits of this growth were primarily concentrated among the privileged individuals who owned the means of production, while the working class faced low wages and poor working conditions [2].

- In the aftermath of World War II, the Bretton Woods system established the US dollar as the world’s reserve currency, which allowed the US to export inflation to other countries. The US benefited from increased economic growth and reduced unemployment, while other countries faced inflation and reduced purchasing power [3].

- In 2020, people in the U.S. that received the first unemployment insurance bonus and PPP loans enjoyed the maximum purchasing power from the freshly circulated dollars. Still, other people farther downstream in the economy from the new money saw their purchasing power, and the monetary value of their paychecks eroded as trillions in new dollars entered circulation.

- Also, as the Federal Reserve unleashed low-interest rates and low-interest loans into the real estate market for the past decade, homeowners enjoyed a rise in their home values. In contrast, new home buyers and renters saw increased rent prices and new home purchases.

Conclusion

The Cantillon Effect is a significant economic phenomenon with important implications for the global economy. It can lead to wealth inequality and inflationary pressures, and the current financial situation has exacerbated its products. Policymakers must consider the Cantillon Effect and the unintended consequences of their actions when introducing new money into the economy.