Exponential growth is when the growth rate becomes ever more rapid in proportion to the growing total number or size. Exponential growth is when the compounding of growth causes the growth rate to increase and go faster over time. Linear growth is constant and consistent within a bounded range; exponential growth constantly grows as gains lead to more gains.

Understanding Exponential Growth in Finance

Exponential growth is the phenomenon of consistent and continuously increasing growth. This fascinating concept has been observed in many aspects of finance, business, and economics, but what exactly does it mean? In this article, we’ll explore the fascinating world of exponential growth, where you’ll see its practical uses within financial landscapes.

What is Exponential Growth?

Exponential growth constitutes a mode of amplification where the pace of escalation is contingent upon the present magnitude. This signifies that the growth rate remains steadfast and unchanging over a particular interval and is a derivative of the current magnitude. The mathematical expression embodying exponential growth exemplifies this concept, depicting the correlation between the original magnitude, the rate of expansion, and the absolute magnitude over a designated duration.

The formula below succinctly encapsulates the essence of exponential growth, providing a concise and lucid means of comprehending this complex phenomenon. It accentuates exponential growth’s steadfast and persistent nature, where the escalation rate remains unchanged irrespective of the value’s dimension. This steadfastness is a fundamental attribute of exponential growth, rendering it valuable for analyzing and projecting growth patterns across various domains, including finance and economics.

Exponential growth can be represented by the following formula:

y = a * (1 + r)^t

where y is the final value, a is the initial value, r is the growth rate, and t is the number of periods.

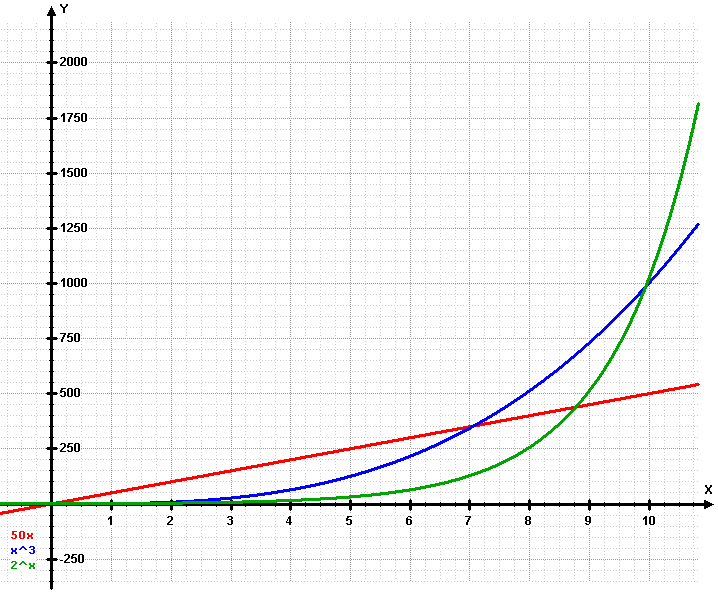

Below is an example of an exponential growth line on a chart in green compared to linear growth in blue.

Comparison between

f(x)=50x (linear) Red

f(x)=x^3 (power) Blue

f(x)=2^x (exponential) Green

Examples of Exponential Growth in Finance

Examples in finance and economics

- Compound Interest: Compound interest offers a powerful way to reap the rewards of exponential growth. This investment strategy can turn small sums into substantial gains over time as reinvested interest produces an ever-growing compounding effect, leading to unprecedented gains in the long term. The potential for such positive returns has made compound interest one of the most attractive and popular forms of investments today – giving investors leverage against risk while creating solid incentives for extended periods of commitment that lead to growth in capital.

- Stock Prices: Equity values can skyrocket with a company’s prolonged prosperity. As profits and income climb, the value of their stock grows proportionally. This exponential pattern shows immense potential for investment if you take advantage during times of financial success – they might provide rewards more significant than ever anticipated. If a publicly traded company compounds its growth in sales and profits, the stock generally follows by increasing its value until the new business success is priced in more accurately.

- Inflation: Inflation is a pervasive problem, causing the prices of goods and services to rise continually. This exponential growth seriously impacts consumer spending power, economic stability, and overall quality of life. To ensure financial prosperity in today’s world, we must understand inflationary processes and develop strategies for controlling them – something only achievable through understanding their intricate patterns. Current central bank monetary policy causes inflation to rise exponentially as it compounds annually on itself.

The Power of Exponential Growth

The potential for exponential growth is incredible; it can allow small investments to grow into sizeable sums over time. Even with a modest rate, such as 7% per annum, an investment will double in ten years due to its propensity for compounding. Its effect accumulates and creates impressive results, making investing through exponentials so lucrative. Those who understand these principles’ power can build significant capital gains over time if used responsibly and strategically. This principle first got me interested in investing in the stock market when I was a teenager, as I saw the potential to start young and let the power of compounding work for me.

Examples of the Power of Exponential Growth

- Compound Interest: The power of exponential growth can be seen in income investments like bonds through compound interest, where reinvested interest leads to exponential growth over time.

- Stock Prices: The exponential growth of a company’s earnings and revenue can lead to significant stock price growth, providing investors with substantial returns.

- Inflation: The exponential growth of prices, as seen in inflation, highlights the impact of exponential growth on the economy and the purchasing power of individuals.

- Population Growth: The exponential growth of populations can have significant impacts on resources, the environment, and the economy.

- Technological Advancement: The exponential growth of technology has led to significant advancements in medicine, communication, and transportation.

- Energy Production: The exponential growth of renewable energy sources such as solar and wind power is transforming the energy sector and reducing dependence on fossil fuels.

- Network Effects: The exponential growth of networks, as seen in social media and the internet, has transformed how we communicate and access information.

- Data Growth: The exponential growth of data, driven by advancements in technology and the rise of the internet, is transforming industries such as healthcare, finance, and retail.

- Economic Growth: As seen in developing countries, the exponential growth of economies can lead to significant improvements in living standards and economic prosperity.

- Investment Returns: The exponential growth of investments in real estate can lead to significant returns for investors over the long term.

The Limitations of Exponential Growth

Exponential growth may seem like a great deal, but it has certain restrictions. Characterized by rapid gains that diminish over time due to business market limitations and competition, exponential growth has finite potential – its days are inevitably numbered due to scalability for large corporations or investment systems. This pattern’s long-term sustainability should be considered when making financial decisions or investments; misjudging the limits could lead to disastrous consequences for any business venture if a market is not big enough or for investors if a market is not liquid enough to trade with size.

Examples of Limitations of Exponential Growth

- Sustainability: Exponential growth can only be sustained for a limited period, and eventually, the growth rate will slow down and level off.

- Resource Constraints: Exponential growth can be unsustainable in the long term due to limited resources, such as energy and raw materials, which can limit growth potential.

- Competition: Intense competition can limit the potential for exponential growth as companies compete for limited resources and market share.

- Environmental Impact: The exponential growth of industries and populations can significantly impact the environment, leading to pollution and other environmental issues.

- Economic Instability: Uncontrolled exponential growth, as seen in inflation, can lead to economic instability, affecting the purchasing power of individuals and the overall economy.

Conclusion

Understanding exponential growth can be valuable to business owners and individual investors. Proper implementation of this concept can enable significant returns on investments over time. However, it is crucial to be aware of exponential growth’s inherent limitations and risks so one can adequately strategize their approach and guard against losses due to unforeseen circumstances. With the right outlook and use of this concept, exponential growth can become an invaluable tool for plowing ahead in the finance and economics sectors. Risk management should always be a concern when high growth is the focus.