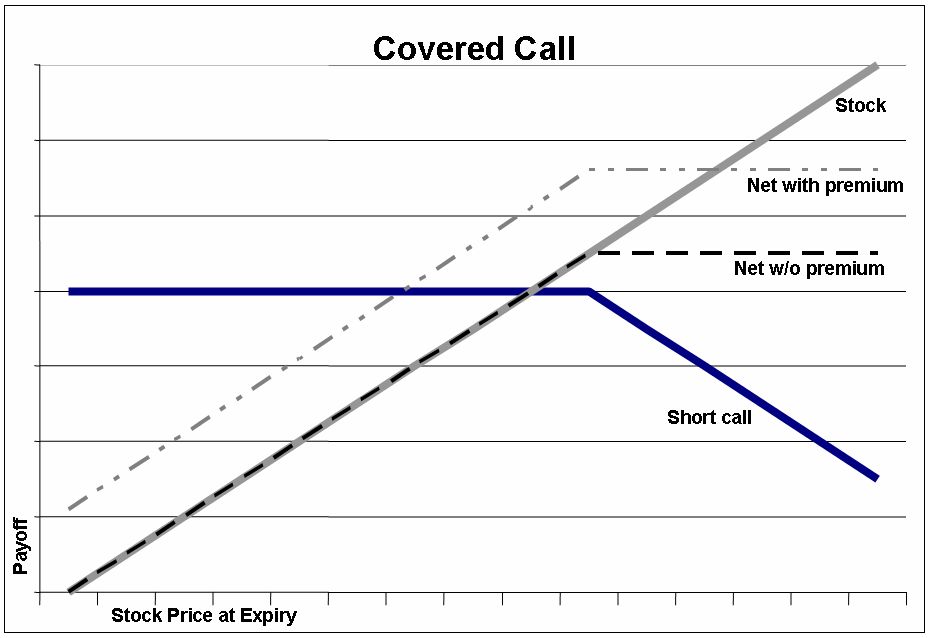

Covered calls are an income strategy for options traders and investors to earn money on stocks they plan to hold over the duration of a short-call option contract. This option play is created when an out-of-the-money call is sold on a current stock position. The trader collects the premium for the contract sold and will profit 100% from this option play if the call expires worthless. The risk of loss is on the downside of the stock price when it’s greater than the call option premium collected. The trader or investor can also profit from any stock price increase that occurs up to the call option strike price by expiration. If the stock price ends above the short-call option strike price the profit is the option premium and the stock is called away.

What is a good covered call strategy?

1. Choose a stock or ETF you’re bullish on:

- Is it a profitable business?

- Are their earnings and sales growing?

- Do they pay a dividend for additional income?

- Are they doing buybacks currently?

- Do you want to own the stock for one year?

2. Ensure there is adequate option interest in their option chain.

- Look for tight bid/ask spreads quoted in the option chain.

- Look for tight bid/ask spreads for the option trade execution with your broker.

- Check for available weekly, monthly, and quarterly option contracts.

- Look for liquidity for the options contract at the price and expiration you want to sell.

3. Choose the strike price and expiration date you want to sell your covered call option on.

- Check the Delta for your option contract with an options calculator.

- Delta 0.20 to 0.30 can be an optimum level for covered call selling as it both provides enough premium to make it worth the risk and the probability of the call option going in the money by expiration is less than 20% in most cases.

- Choose the expiration date that aligns with your planned stock holding period. Short-term traders may want to sell weekly options 1 to 2 weeks out.

- Longer-term investors planning to buy and hold may want to sell call options a month or two out for higher premiums and want the shares to be called away for the strike price. Investors can use covered call strikes as price targets to sell their holdings at, if they are not reached then the premium is just income.

4. Calculate the amount of option premium you will receive for selling the covered call option, this is your potential reward. Some active traders will want to set a stop loss of this amount on their stock and buy back the covered call if the stock price drops below the premium received. This is one strategy for risk management with covered call writing for those interested.

5. Map out your risk/reward ratio and probabilities for profitability for every covered call.

- Your reward is the call option premium plus the stock price movement to the strike price before the expiration. Maximum profits are the stock a penny under the strike at expiration and full call option premium collected just out of the money.

- The maximum risk is in the stock price going to zero before expiration minus the option premium received if no stop loss is in place. Possible but very low probability. Exchange-traded funds can lower individual stock risks through company diversification.

- Delta relates to the probability of the call option going in the money before expiration. At-the-money options have a .50 Delta with a 50% probability of expiring in the money in either direction. As an option goes in the money Delta expands and as an option gets farther away from being in the money it declines. A .20 Delta option has an approximate 20% chance of expiring in the money so one in five .20 Delta-covered call options could expire in the money and lead to the stock being called away.

6. You must have 100 shares of stock to sell one covered call option contract as they represent 100 share positions. A $5 call option represents a $500 value in call options sold on a 100-share underlying position.

7. A covered call option play can be managed by buying back the call option at any time and selling a new contract or exiting both the call options and shares if the market environment suddenly turns bearish.

8. The negative with a covered call option play is that it caps the upside gains of your stock positions in strong bull markets, some call it a stop-gain strategy because it lowers your potential reward. It can also have a bad risk-reward ratio in downtrends as the risk of the stock going lower can be far greater than the small call option premium collected.

9. However if executed correctly on the right stocks and ETFs in the correct market environment, covered calls can create consistent income over long periods of time on stocks that are being held already.

Are covered calls a good income strategy?

Covered calls are a good income strategy on stocks that investors plan to hold anyway for a long period of time. Covered calls give an investor a way to create cash flow on stock positions in addition to any dividends or capital gains. Covered calls can hedge some of the downside in the share price with the option premium collected and can also give room in price action to collect some capital gains in addition to the option premium collected if the stock price goes up before expiration but not enough to be in-the-money and have the stock called away.

How do covered calls make money?

Covered calls make money in option premiums and capital gains in sideways and up-trending stock market conditions. They make money by enabling stock investors to sell call options on the same stock over and over again when it’s not called away by reaching the strike price by expiration. Covered call writers can also decide to buy back the short call option with their capital gains in the stock when it’s in the money and keep their stock position for further covered call option plays. Covered calls will lose money in market crashes, bear markets, and downtrends when the stock price falls more than the call option premium collected.

Option traders should consider all the risks before implementing this strategy in their trading accounts.