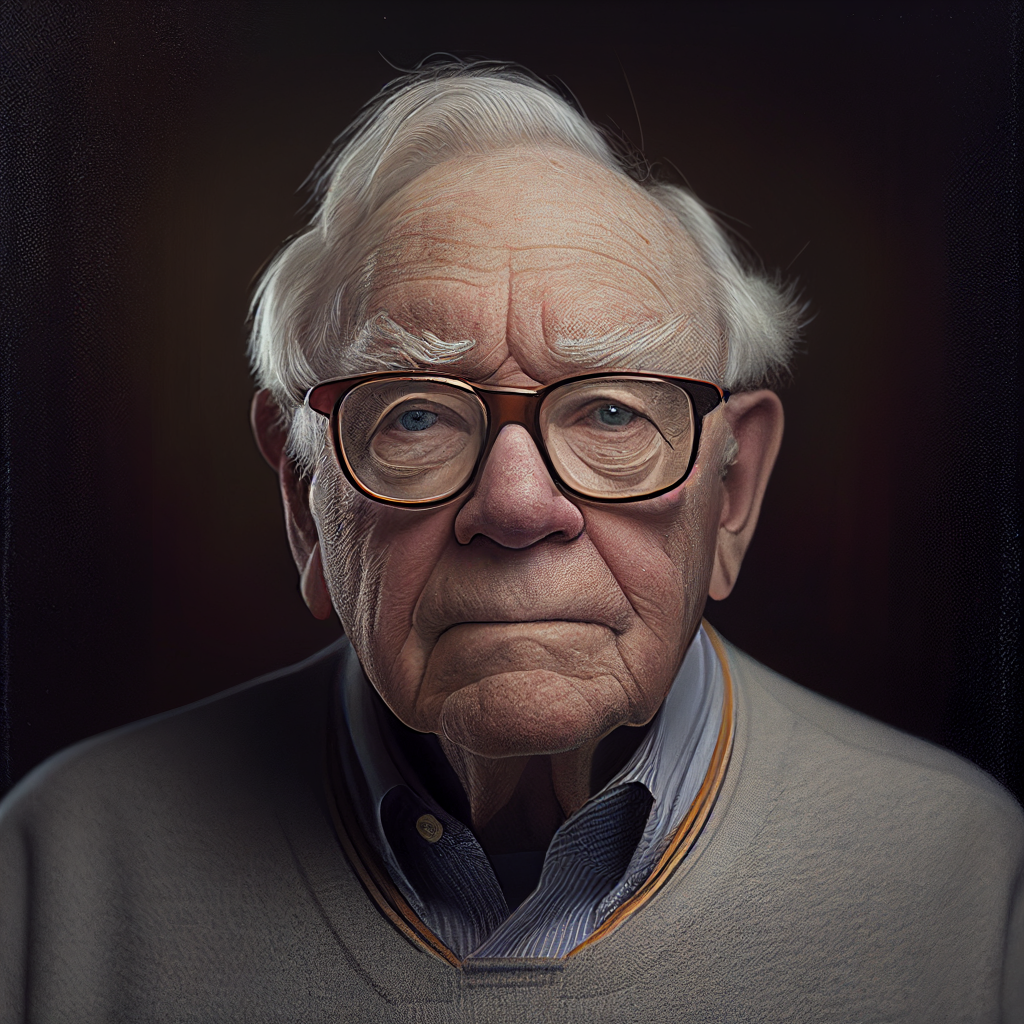

I believe too many people focus exclusively on Warren Buffett’s skill as a value investor and miss his other key strengths and ignore how exactly he became ranked as the richest man in the world many times. His story is far more fascinating than the common beliefs about him. Let’s explore some things about Warren Buffett and his career that most people don’t understand.

1. Warren Buffet first “retired” in his thirties.

Warren Buffett was a millionaire at thirty years old. That’s almost a $9.7 million net worth adjusted for inflation.

By January 1962, the Buffett Partnership had over $7 million in assets under management, with Buffett’s share worth over $1 million. Mr. Buffett closed his Partnership in 1969 after great returns citing that he was out of good investment ideas. He became a millionaire in his late twenties and “retired” in his late thirties.

In 1962, when Warren Buffett was just 30 years old, he was already a millionaire before he acquired Berkshire Hathaway or teamed up with Charlie Munger as his partner. [1]

2. Warren Buffett’s famed Berkshire Hathaway acquisition was his biggest mistake

“The— the dumbest stock I ever bought— was— drum roll here— Berkshire Hathaway. And— that may require a bit of explanation.” – Warren Buffett told Becky Quick on CNBC.

Buffett tells Becky in 2010 that his holding company (presumably with a different name) would be “worth twice as much as it is now” — another $200 billion — if he had bought a good insurance company instead of dumping so much money into the dying textile business. [2]

Warren Buffett started buying Berkshire Hathaway stock in 1962. After that, the stock would go up each time the company closed a mill. Buffett understood that Berkshire’s textile manufacturing business was a declining industry in the U.S. Berkshire’s fundamentals were not going to improve as it slowly went out of business but what he saw was an opportunity for a gain as its stock price was below its book value. Money could be made as it liquidated its assets.

Buffett explained his plan: “I’d buy the stock. I’d tender it to them and make a small profit.”

He continued, “So I started buying the stock. And in 1964, we had quite a bit of stock. And I went back and visited the management, Mr. (Seabury) Stanton. And he looked at me and he said, ‘Mr. Buffett. We’ve just sold some mills. We got some excess money. We’re gonna have a tender offer. And at what price will you tender your stock?’”

And I said, ‘11.50.’ And he said, ‘Do you promise me that you’ll tender it 11.50?’ And I said, ‘Mr. Stanton, you have my word that if you do it here in the near future, that I will sell my stock to— at 11.50.’ I went back to Omaha. And a few weeks later, I opened the mail—”

“And here it is, a tender offer from Berkshire Hathaway— that’s from 1964. And if you look carefully, you’ll see the price is—11 and three-eighths. He chiseled me for an eighth. And if that letter had come through with 11 and a half, I would have tendered my stock. But this made me mad. So I went out and started buying the stock, and I bought control of the company and fired Mr. Stanton.” – Warren Buffett

Buffett was so offended by an offer to purchase his shares because it was below a verbal agreement he had made that he instead chose in 1964 to buy more Berkshire stock. He gained control of the company their majority ownership and fired the guy who did not honor their oral agreement to buy Buffet’s shares at a higher price. This put Buffett in the strange situation of being the majority shareholder of a failing textile business he never really wanted in the first place. He let a quick trading opportunity turn into an investment.

He slowly changed Berkshire from a textile manufacturing company to an insurance and underwriting operation. He kept the original name and transformed it into a diversified holding company over the years. He used the cash flow generated from insurance premiums to purchase the cash-flowing businesses with growth and sustainability and to manage a corporate investment portfolio built with great growth companies he bought at reasonable prices. Berkshire Hathaway Inc. continued to acquire and grow until it became the sixth most valuable company in the world.

Buffett said, “Because Berkshire Hathaway was carrying this anchor, all these textile assets. So initially, it was all textile assets that weren’t any good. And then, gradually, we built more things onto it. But always, we were carrying this anchor. And for 20 years, I fought the textile business before I gave up. If instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now.”

3. Warren Buffett holds over 99% of his net worth in one stock.

While Buffett teaches that most people not interested in serious investing should buy and hold a low-cost S&P 500 index fund, he has held his entire vast net worth in one stock his entire adult life.

Buffett has been investing for over seven decades, starting at a young age and steadily building his fortune. 99% of Warren Buffett’s vast wealth was built by owning just one stock: Berkshire-Hathaway. It was his management as CEO and Chairman of using his company’s cash flow to build a portfolio of companies and stocks that created one of the greatest companies of all time through acquisitions and portfolio management. Warren Buffett used Berkshire-Hathaway as an indirect wealth-building machine making himself and his investors wealthy.[3]

4. Warren Buffett’s value investing is done inside the Berkshire Hathaway portfolio, not his own

When you hear Buffett has bought a specific stock or made so many dividends from Coca-Cola stock in a year, that’s not his personal investment portfolio; that’s talking about the Berkshire Hathaway portfolio that Buffett manages. As noted above, Buffett personally only holds Berkshire stock, and all his investing in individual stocks is done with the cash flow from Berkshire’s subsidiary companies that it owns. This setup allows Buffett to pay minimal capital gain taxes. [4]

5. Warren Buffett optimizes his business and personal finances for minimal taxes

Little is said about how Buffett minimizes tax liabilities through his investing and business methods. He wants to optimize the compounding of capital and wants to do it with pretax dollars. His long-term holding of investments eliminates short-term capital gain taxes when his investments are not sold. Ideally, he wants to hold investments forever so they can compound, and he never has to pay long-term capital gains, either.

Berkshire doesn’t pay a dividend because it would result in double taxation, Berkshire would be taxed on its earnings, and then the investors would pay dividend tax on the payout to them. Buffett avoids these dividend taxes by reinvesting all the capital back into Berkshire and growing the business value tax-free instead of paying a dividend.

6. Warren Buffett’s biggest strategy is the math of compounding returns

Buffett’s biggest holy grail investing strategy is simply compounding growth on capital. Whether through consistent capital gains or the dividends paid by other companies in the Berkshire portfolio, he wants to see capital grow with little need for work. Capital compounding can become staggering over time, this was one of his biggest tools for wealth creation that few understand he used.

“Life is like a snowball. The important thing is finding wet snow and a really long hill. ” – Warren Buffett

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” – Warren Buffett

7. Warren Buffett is underrated as chairman and CEO.

Buffett may be the world’s most underrated chairman and CEO, as his investing skills overshadow his executive management and leadership skills. Buffett took a virtually bankrupt textile company and transformed it into one of the best companies in the world for its brand name, market cap, and profits. He also used insurance as his primary business pivot to generate cash flow to invest in other businesses.

His skill in acquiring other companies is unparalleled in corporate America in size, scope, and frequency of success. His management style is also to ensure the right people are in place to run his companies and to have a hands-off approach to running the world’s sixth-biggest corporation with a few corporate employees out of a rented building floor of offices for most of its existence. It’s all unheard of and was thought to be impossible.

What other CEO has anywhere near this level of success? Most CEOs can’t even maintain a successful business; after they take over leadership. [5]

8. Warren Buffett is not a pure value investor

Phillip Fisher, Charlie Munger, and experience taught Buffett that the quality of the business can be just as important as the price you pay. While Buffett learned directly under his mentor Benjamin Graham to be a value investor purist, over the years, others’ influences led to him evolving into a hybrid growth, quality, and value investor. Munger taught him that your exact buy price for a stock doesn’t matter as much if it goes on to double and triple in price due to growth and cash flow. Phillip Fisher taught Buffett to consider future earnings as the most important factor, along with price and valuations. [6]

9. Warren Buffett was able to avoid divorce

Unlike other major recent billionaire divorces like Jeff Bezos and Bill Gates, Buffett could separate from his wife without getting legally divorced and losing a large percentage of his net worth and Berkshire Hathway stock. His ability to stay on good terms with her saved him up to a 50% drawdown in his net worth. This is underappreciated in his many successes: staying on good terms with a wife who left him to pursue her life goals.

10. Warren Buffett made 99% of his net worth after age 50.

Warren Buffett didn’t even become a billionaire until he was 50, and 99% of Warren Buffett’s net worth was earned after his 50th birthday. It’s incredible to consider that one of the richest men in the world was a late bloomer in terms of world rank of wealth. His true mega wealth didn’t even begin until his early 50s, even after such an early start as a millionaire. [7]

Conclusion

Warren Buffett is fascinating for his wealth, business practices, investing method, and wisdom. I hope you learned some new things about him, his strategies, and his life from this article.