The 2008-2009 financial crisis was a watershed moment in modern history, with far-reaching consequences still being felt today. It was a time of great uncertainty, as the global economy teetered on the brink of collapse and ordinary people struggled to make ends meet.

Amid all this chaos, several brilliant movies explored the crisis and its aftermath in powerful and thought-provoking ways. These films offered a unique perspective on the events of the time, delving into the inner workings of the financial system and the human stories behind the headlines. Whether you’re a finance buff or just looking for a good movie, these films are sure to captivate and inform in equal measure.

First, a little context about the financial crisis that rocked the world.

What led to the financial crisis?

The financial crisis of 2008 resulted from several complex and interrelated factors. Some of the most significant causes of the crisis include:

- The housing market bubble: In the years leading up to the crisis, the housing market in the United States experienced a bubble, with prices for homes skyrocketing. This was partly fueled by the availability of subprime mortgages, which were offered to borrowers with poor credit histories.

- The use of mortgage-backed securities: Many banks and financial institutions packaged subprime mortgages into complex financial instruments known as mortgage-backed securities (MBS) and sold them to investors. This helped spread the risk of default across a wide range of parties but also created a fragile system vulnerable to collapse.

- Lack of regulation: The financial system was not subject to sufficient regulation, which allowed risky practices to go unchecked. This included using leverage, or borrowing, by financial institutions, which allowed them to make large bets with relatively small amounts of capital.

- Global imbalances: The crisis was not limited to the United States but was a global phenomenon. The crisis was exacerbated by imbalances in the global economy, including large trade deficits in the United States and surpluses in countries like China.

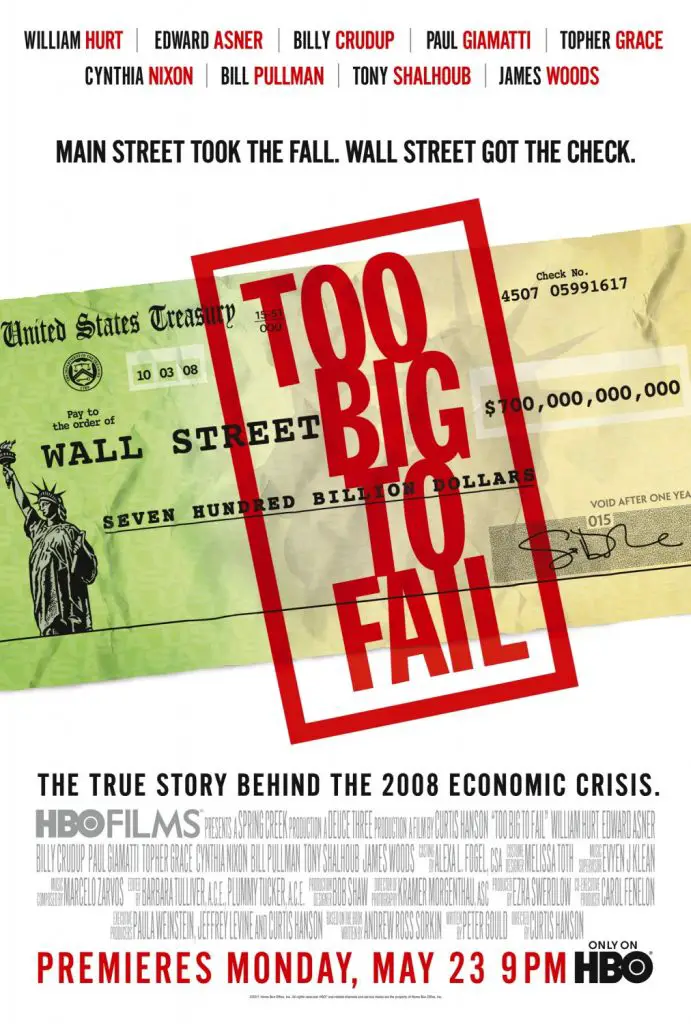

Movie #1: Inside Job

Inside Job is a 2010 documentary film that explores the causes and consequences of the 2008 financial crisis. The film, directed by Charles Ferguson and produced by Audrey Marrs, offers a comprehensive and in-depth examination of the events leading up to the crisis and how it impacted the global economy.

The film begins by setting the stage for the crisis, explaining how the housing market bubble and the use of mortgage-backed securities played a key role in the build-up to the crisis. It also examines the role of financial deregulation in allowing risky practices to go unchecked and looks at how global imbalances contributed to the crisis.

Throughout the film, experts and insiders are interviewed, including former Federal Reserve Chairman Alan Greenspan, former Treasury Secretary Timothy Geithner, and other key players in the financial industry. The film also includes interviews with ordinary people affected by the crisis, including homeowners who lost their homes and workers who lost their jobs.

Inside Job was critically acclaimed upon its release, with many reviewers praising its thorough and nuanced exploration of the crisis. The film won numerous awards, including the Academy Award for Best Documentary Feature, and remains a valuable resource for anyone looking to understand the complex events of the 2008 financial crisis.

Movie #2: The Big Short

The Big Short is a 2015 American biographical comedy-drama film directed by Adam McKay and written by McKay and Charles Randolph. The film is based on the 2010 book The Big Short: Inside the Doomsday Machine by Michael Lewis, which tells the story of the build-up to the 2008 financial crisis.

The Big Short follows a group of unconventional investors who saw the housing market bubble and the use of mortgage-backed securities as a potential opportunity to make a profit. These investors, including Michael Burry (played by Christian Bale), Mark Baum (Steve Carell), and Ben Rickert (Brad Pitt), bet against the housing market by purchasing credit default swaps, which would pay off if the mortgages underlying the securities defaulted.

As the housing market began to collapse, the investors’ bets paid off, and they made huge profits while the rest of the financial world was in turmoil. The film interweaves the stories of these investors with explanations of the complex financial instruments and practices that contributed to the crisis.

The Big Short was a critical and commercial success, with many reviewers praising its clever and entertaining approach to explaining the complex events of the financial crisis. The film received five Academy Award nominations, including Best Picture, and won Best Adapted Screenplay.

Movie #3: Margin Call

Margin Call is a 2011 American independent drama film written and directed by J. C. Chandor. The film is set in the early days of the 2008 financial crisis and follows the events that unfold at an investment bank as the crisis begins to unfold.

The film centers around Peter Sullivan (played by Stanley Tucci), a risk assessment analyst at the bank, who discovers a series of disturbing financial models while going through the files of a recently laid-off colleague. These models suggest that the bank is on the verge of financial collapse, as the value of mortgage-backed securities that it holds is plummeting.

As Sullivan works to understand the full extent of the crisis, he becomes embroiled in a high-stakes game of cat and mouse with his superiors, including the CEO of the bank (played by Jeremy Irons). The film explores the ethical dilemmas the characters face as they grapple with the consequences of their actions and try to protect their interests.

Margin Call was well-received by critics and audiences alike, with many reviewers praising its acting and its sharp portrayal of the inner workings of the financial industry. The film was nominated for several awards, including two Independent Spirit Awards.

Movie #4: 99 Homes

The film begins with Nash being evicted from his home by a ruthless real estate broker named Rick Carver (played by Michael Shannon). Desperate to get his home back, Nash agrees to work for Carver, who is making a fortune by buying up foreclosed properties and flipping them for a profit.

As Nash becomes increasingly involved in Carver’s business, he begins to see the human cost of the housing crisis and how it has devastated ordinary people. At the same time, he grapples with his morality and the compromises he is making to survive.

99 Homes was well-received by critics, with many praising its performances, particularly those of Garfield and Shannon, and its timely exploration of the housing crisis and its aftermath. The film received several awards and was nominated for several others, including the Grand Jury Prize at the Sundance Film Festival.

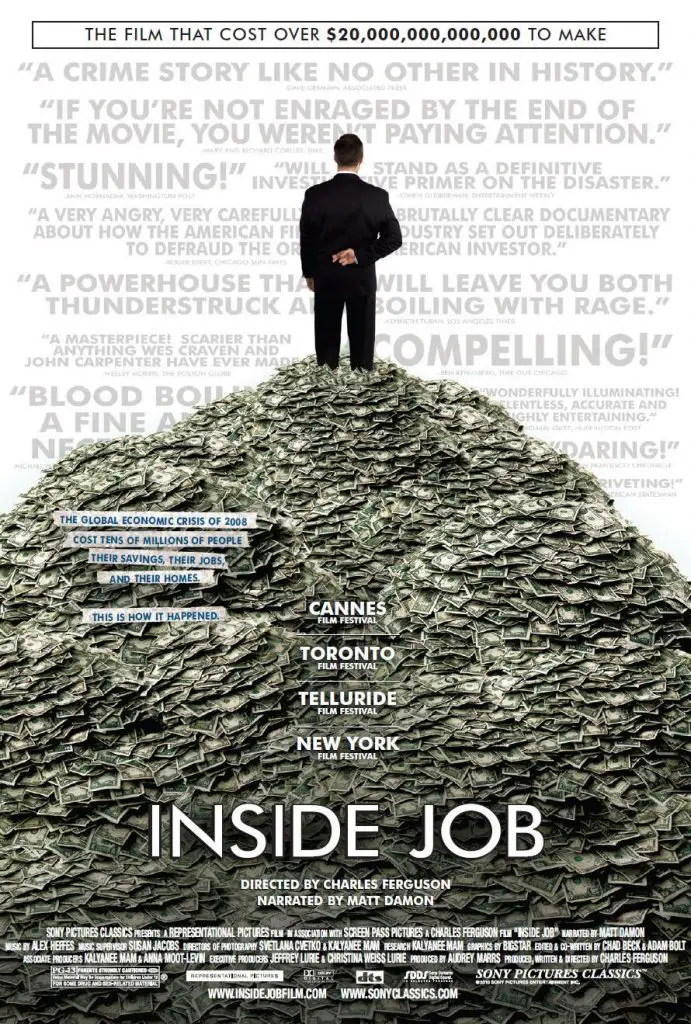

Movie #5: Too Big to Fail

Too Big to Fail is a 2011 American television film directed by Curtis Hanson based on the book of the same name by Andrew Ross Sorkin. The film tells the story of the 2008 financial crisis and the efforts of the U.S. government to prevent the collapse of the global financial system.

The film focuses on the key players in the crisis, including Treasury Secretary Henry Paulson (played by William Hurt), Federal Reserve Chairman Ben Bernanke (Paul Giamatti), and investment banker Jamie Dimon (Billy Crudup). It explores the complex negotiations and high-stakes decision-making that took place as the crisis unfolded and how the government’s actions impacted the lives of ordinary people.

Too Big to Fail was well-received by critics, with many praising its performances, particularly those of Hurt and Giamatti, and its detailed and nuanced portrayal of the financial crisis events. The film received several awards and was nominated for several others, including 11 Emmy Awards, of which it won two.