Options are a market of derivatives that gives traders and investors the right but not the obligation to buy or sell shares of stock over a time period at a strike price before an expiration date for the cost of the option contract. The options market is a zero-sum game where there is a buyer and seller for every contract until it’s closed. Option contracts are sold to open and bought back to close or bought to open and sold to close. There is always someone long and someone short each open option contract unlike stocks that don’t have equal shorts for every long stock. Options are not assets they are bets that depreciate over time if they don’t pay off.

An option contract represent 100 shares of a stock and are written on time frames of weekly, monthly, quarterly and yearly. The price of an option contract is based on the probability of it being in-the-money at expiration. The Black-Scholes pricing model for options is based on the factors of time remaining before expiration, current and historic volatility, the odds of it expiring in-the-money and how much it moves in correlation with the underlying stock. Current interest rates can also be a small factor in the option price.

An option contract isn’t an investment, it’s a bet on price action during a set time frame. Options can deteriorate in value as their price is tied to the movement of the stock they are written on. They do expire and their price can move quickly over the time before expiration based on the stock’s price movement toward or away from the strike price by expiration.

Options Greeks Explained

Options Delta Meaning

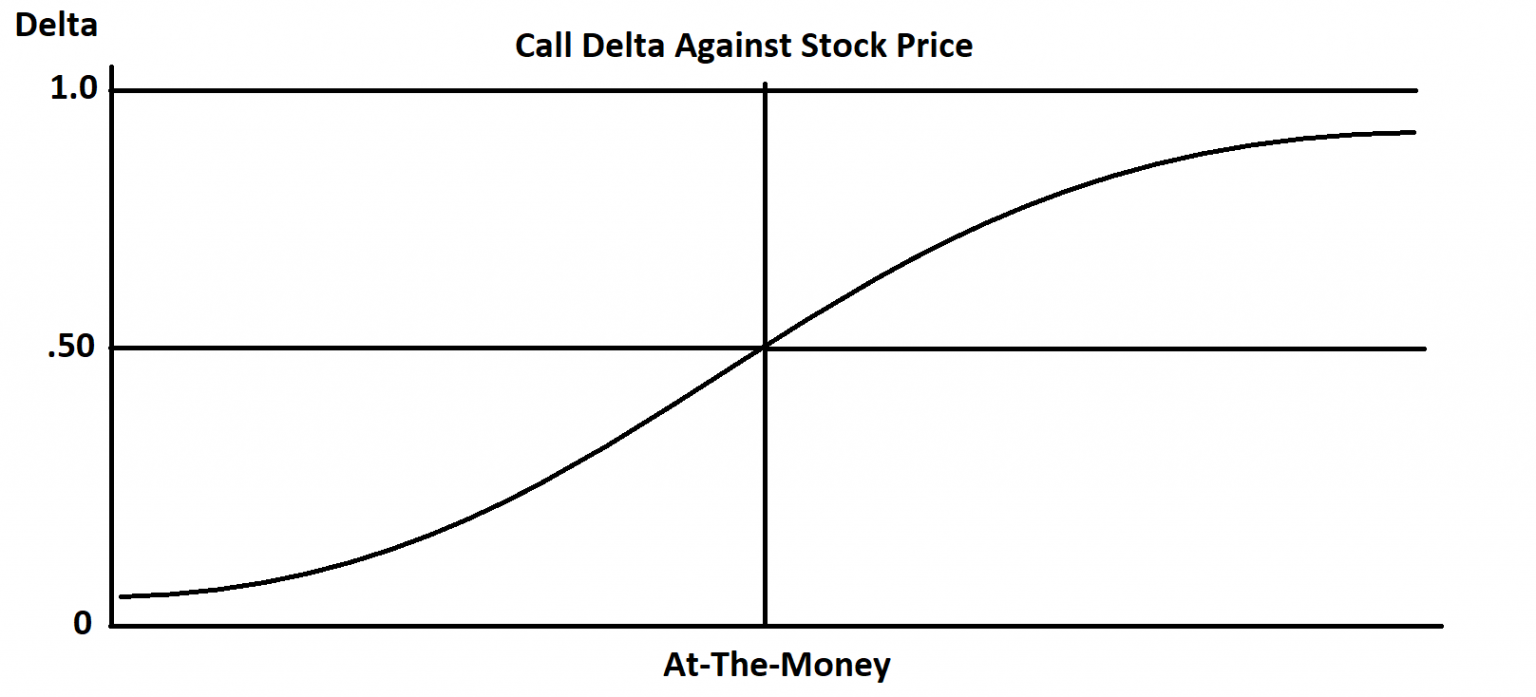

What is Delta in options? The Delta of an option contract is part of the options pricing model and it quantifies and prices in the magnitude of the move in the underlying stock that the option will capture based on the odds of the option expiring in-the-money.

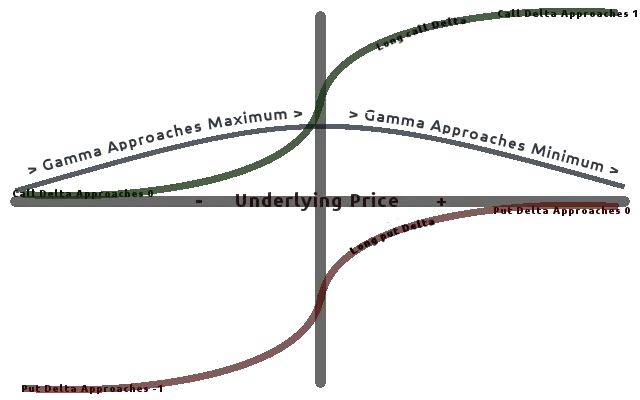

Delta is represented as the velocity of a price change in an option with a 1 point move in the underlying asset and is displayed as a decimal value most of the time. Delta values range between 0 and 1 for call options and -1 to 0 for put options. Delta quantifies the amount an option contract is exposed to moves in the price of the underlying asset. Delta values are set in a range of a positive 1.0 to a negative -1.0, some express a .50 Delta by saying 50.

The Delta of an option is the sensitivity of an option price to movement in relation to changes in the price of the underlying stock. It tells option traders how much the price of the option will change as the underlying stock moves. A deep in-the-money option that is close to expiration will move nearly 100% dollar for dollar with its underlier when it has a 1.00 delta. While an at-the-money option will have a delta of .50, and will move 50% in step with its underlying stock.

If your stock is at $100 and you have a $100 strike call option and the stock goes up $2.00, your option with a .50 Delta will only go up $1.00. As an option gets deeper in-the-money and the odds of it expiring with intrinsic value increases the Delta expands in relation to these probabilities. An at-the-money option has 50/50 odds for directional movement and how it expires in relation to its strike price. As it gets deeper in-the-money the odds grow to 60%, 70%, or 80% of it staying in-the-money as it becomes more probable of holding its intrinsic value at expiration. This is Delta reflected in the price movement of the option in correlation with the stock.

Calls and puts have opposite deltas, call options are positive and put options are negative. A put option moves inversely to a call option if it is the same distance from current price.

Whenever you are long a call option, your Delta will always be a positive number between 0 and 1. When the underlying asset increases in price, the value of your call option will also increase by the call options Delta value. When the underlier price decreases the value of your call option will also decrease by the amount of the Delta.

Put options have negative Deltas, which will range between -1 and 0. When the underlier price increases the value of your put option will decrease by the amount of the Delta value. When the price of the underlying asset decreases, the value of the put option will increase by the amount of the Delta value.

Delta can be a good measure of the current odds of an option expiring in-the-money but those probabilities can change fast. An at-the-money option has 50/50 odds of it going either way by expiration and that is reflected in the delta of .50. However if you are buying a far out-of-the-money option with a delta of .10 that moves only one tenth in correlation with the underlying asset the odds are about 90% that your option will expire worthless. One in ten are bad odds and if nine losses all come in a row as the first nine option trades it can blow up an account if the position size is too big for low probability option trades.

Option sellers like to write low Delta option contracts to sell them short for a high probability of keeping the premium as a profit. Option buyers should think in terms of buying higher Delta option contracts for better odds of making money with them on moves in their favor.

Options with .10 Delta can be looked at as lottery tickets with low odds of success. A 1.00 Delta option can be looked at as a replacement for stock but with less capital needed for the position. Delta shows you how much you make on a move and if your strike price is a good bet by expiration.

By combining different date and strike options in an option play you can create a combined Delta for the play through hedges. This will change as prices move and options approach expiration.

Options Vega Explained

Option contract prices will increase as the probabilities of them expiring in-the-money are greater and will go down as the probabilities of them expiring in-the-money decreases. As options get closer to being in-the-money they capture more of their underlying assets move, as they get farther away from being in-the-money they capture less of their underlying assets move. High volatility increases the odds of an option having the ability to be in-the-money on expiration. Extreme volatility also increases the risk of loss to the option seller with a strong adverse move and an option price will increase to account for the higher risk and compensate the option seller for this risk.

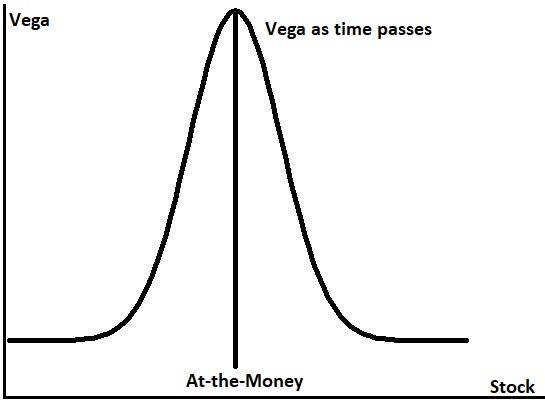

Vega prices in the risk of big movements in the underlying stock before expiration. Vega measures an option’s sensitivity when there are changes in volatility of the underlying asset. Vega is a compensation to the option seller for the risk they take on when the odds of an extreme move in one direction is likely before the expiration date.

Option Vega is the measure of the amount of money per underlying share that an option contract value will gain or lose as price volatility rises or drops by 1 percentage point. Both call options and put options will increase in contract value when price volatility rises.

Vega can be one of the most important Greeks to understand and track for an option trader. During more volatile markets and charts the value of option strategies will be very price sensitive to changes in volatility, especially with extreme price range expansion. The cost of at-the-money options, and especially straddle and strangle option plays will become more expensive with changes in volatility on the underlying stock’s price action.

The volatility of an asset is measured by the magnitude and speed that price moves up or down, and can be based on any changes in the recent price range or historical price action in a stock. Vega will change as there is large sudden price range expansion in a stock an option is written on. Vega value in the price of an option will decrease as the option gets close to it’s expiration date or it gets past a risk event like earnings or any other important announcement that could cause a big price move.

Vega is the component in the pricing of options to account for the risk that a seller is taking on based on the current and estimated volatility of the underlying stock before expiration. Options increase in value during times of greater volatility and decrease in times of less volatility and after risk events have passed. Vega value will plunge for a stock option after its company announces earnings. The Vega value for a stock option that expires after earnings will reflect the expected move for a stock through earnings. Vega is non-directional and both calls and puts will reflect volatility however puts usually reflect a little more as the downside tends to be larger than the upside most the time.

An at-the-money option will give you an idea of the expected move of a stock. If a stock is at $100 and an at-the-money $100 strike call option is normally $3 one week until expiration but earnings are before expiration and the $100 strike is $13 instead of the normal $3 then the odds are that the $3 is the normal theta value and the extra $10 is the Vega value pricing in a $10 move after earnings. One thing that can catch a new option trader by surprise is that that $10 Vega value will be almost completely gone when the option opens for trading the following morning after earnings are announced and reflected on the chart.

The stock could open at $110 and your option still be worth $13 as your Vega value has been replaced by intrinsic value and you could still have $3 in Theta value. To trade options through earnings you have to overcome the cost of the Vega that will be gone after the event with enough intrinsic value of the option going in-the-money to be profitable. Some Vega can also be priced into options before major events like Fed minutes, inflation numbers, gross domestic product (GDP), a congressional bill, or a big jobs report.

Always be aware that options are pricing in moves in time and volatility to compensate the option sellers for their risk taking. Option pricing is very efficient for the known volatility of events. It is the following of trends, systems, reactive technical analysis, and risk/reward ratios that can provide an edge.

Vega tends to expand and retract over time. Markets go from volatile to trending or range bound and back to volatile over time and Vega tracks the risk in volatility by pricing it into options contracts. Peak Vega pricing is with the at-the-money option in a chain and decreases as options get farther in-the-money or farther out-of-the-money as the probabilities change for the option expiring in the money due to volatility.

High Vega can help option sellers be profitable when Vega declines. It’s more difficult for option buyers to be profitable when Vega is high because big moves are already priced in on both directions.

Options Theta Definition

Theta is also called time decay in options trading as the value of an option declines day after day even when price doesn’t move much. Theta measures the time value that you pay to hold the contract, in essence you are paying to rent the stock shares for a set period of time. This is in addition to any intrinsic value of the option if it’s in-the-money. A percentage of your time value disappears out of the price of the option each day that you hold the contract after it’s purchased.

Options are wasting assets, their life span is set only until the expiration date and at that time the option owner has the right to call the stock to be bought at the strike price for a call option or to put a stock on someone for the strike price of a put option. The Theta value is like the countdown clock where time is money on the way to the expiration date that gives the option buyer the right to execute the contract.

At expiration the time value is zero and you are left with the difference in the intrinsic value that the option entitles you to buy or sell a stock for versus the current price in the market. The velocity of the time value decline starts out slower when the option is months away from expiration and accelerates faster and faster in the final month to expiration, and Theta quickly vanishes in the last week before expiration.

Options that are far out-of-the-money in price and far away in time are made up almost entirely of time value with Theta. Options far away in time and price don’t have any other type of value but Theta.

On the last day of an options expiration the option will have almost zero time value as only one day is left. Just remember that whenever you enter a long option trade you are on a timer with an ever increasingly fast countdown. The stock has to move close enough to the price of your stock to pay for the time you spend holding it. For a longer term trade you have to overcome the cost of time to be profitable in your option. The faster your option moves closer to being in-the-money the greater your odds of exiting with a profit with your remaining Theta value.

Long stocks have no time expense, you are not renting a stock when you own it you are taking on the full risk of the asset. With options you have to pay rent to own the rights to buy or sale a stock at a certain price over a period of time. The Theta value is what you are paying someone for the time they spend exposed to the risk of you calling or putting an asset on them at expiration. Remember that you don’t have to wait until expiration to sell an option for a profit you can exit as soon as it increases in value from your entry price. The longer your holding period for an option the higher the Theta cost will be, timing is a key factor with options.

Options Gamma Explained

Gamma is the measurement of the rate of change of the Delta.

Gamma is the Greek that shows how Delta will change with the underlier’s price moves. It’s the rate of change of an option’s Delta based on a $1.00 move in price of the underlying stock.

Gamma quantifies how much the options Delta changes as the price of the underlying stock changes. The option’s Gamma value is a measurement of the speed of change of the option’s Delta. The Gamma value of an option contract is a percentage and shows the change in the Delta when there is a one point move in the price of the underlying stock. The options gamma value measures the magnitude and the direction of a change in the option’s Delta.

When a long call option contract has a Gamma of 0.10 and a corresponding Delta of 0.50, When the underlier goes up $1.00 in price, that specific option will have a Greek delta of 0.60 as one dynamic of its price movement in correlation with the underlier. It’s important to understand the Gamma of a stock as it can show the risk and benefits of the rate of change as an option moves closer or farther from being in or out-of-the-money. Short option risks is one of the most important dynamics to consider with Gamma as the option price can move strongly against you quickly during a trend or gap in price with the underlier.

Deltas expand and become higher as price moves in favor of an option’s strike price. Options increase more in Delta value as price moves closer to being in-the-money versus your options strike price. Deltas become smaller as price moves away from your option positions strike price needed for the option to go in-the-money. As price moves away from your strike price needed for profitability the movement becomes smaller on the option as the Delta declines the Gamma also declines.

A Gamma scalper of options is simply trying to buy an out-of-the-money option with nothing but time value and a very low Delta and profit by the option Delta expanding and increasing in value during a move in their favor increasing the odds of the option going in-the-money. An out-of- the-money option with very little premium value can go up in price as the odds of it going in-the-money increases and the Delta capture rapidly expands.

A Gamma scalper will buy an option with only Theta value and profit from the gamma of a rapidly increasing Delta. These types of trades usually have lower win percentages but can be profitable with wins that are 100% or more of price value. The key with these types of trades which many new option traders like to try is to trade them with a small amount of trading capital. 0.25% or 0.5% of total trading capital at risk is a good position size for these types of high reward but low probability of success trades. A Gamma scalper does not need his option to go in-the-money to be profitable, he only needs the odds of it going into the money to increase so he can sell it for a profit.

Benefits of Gamma

Gamma can be most profitable for long option trades as it can grow profits fast when an out-of-the-money option gets close to being in-the-money. This can cause triple digit gains in option price on the long side. Losses also get smaller as an option moves farther away from being in-the-money to create a favorable risk/reward ratio. Gamma will increase until an option goes deep-in-the-money with a delta of 1.00. The ideal long option Gamma trade is a far-out-of-the-money option becoming a deep-in-the-money option that maximizes gains.

Short Options Gamma Risk

Gamma presents the single biggest risk to option sellers as the attempt to write options for the small gain from Theta can lead to big losses from Gamma, especially for short unhedged option plays that move all the way into the money. Hedges for short options are crucial for managing the risk.

Options Expiration and Gamma

The risk to long option Gamma traders is limited to the price of the option contract while the upside profit potential is theoretically unlimited. The maximum risk on the long side is that the option contract becomes worthless on expiration. The maximum risk for an option trader writing contracts short is theoretically unlimited with no hedge and the primary risk is the Gamma growing exponentially and turning into intrinsic value.

The Gamma curve plunges as expiration approaches as the odds of expiring in-the-money drops to lower probabilities. As the odds of Delta expansion declines Gamma declines along with it. Gamma expansion is great for option buyers but can cause option sellers large losses. Gamma growth can turn a losing long option trade into a winner quickly and also turn a winning short option trade into a loser just as quick.

Options Rho Explained

Rho measures the sensitivity of a stock option price to a change in interest rates. Rho measures and prices into an option contract the expected change in price for every one percentage point change in current interest rates. Rho shows option traders how much the price of an option contract should go up or down if the risk free interest rate like on U.S. Treasury-bills rises or falls.

Rho is was almost never considered in the options market in the last 14 years due to the stability of low interest rates the vast majority of the time when rates have gone flat or to zero. However with interest rates rising quickly again it has now become a consideration in pricing in the past year. Recent increases in rates could make Rho a real factor in option prices again.

Options Moneyness Explained

In options trading, moneyness is the relationship of the current price of the underlying stock in the market to the strike price of a call or put option contract written on that stock.

With options trading, the difference between in-the-money and out-of-the-money is entirely based on the relationship between the strike price to the current market price of the underlying stock, and the correlation of this position is known as moneyness.

There are three types of classifications for the moneyness of an option contract:

An option is in-the-money if the contract would have intrinsic value if it were exercised today.

An option is out-of-the-money if the contract would have zero intrinsic value if it were exercised today.

An option is said to be at-the-money if the current strike price is exactly the same as the current market price.

A call option is in-the-money if the strike price is less than the current price of the asset it is written on. A put option is in-the-money if the strike price is less than the current price of the asset it is written on. The reverse is true for an out-of-the-money option. Intrinsic value is measured by how deep in-the-money an option is.

The amount of the move an option captures starts at 50% for an at-the-money option when the strike price and the asset price are equal in value and expands as an option goes deeper in-the-money and declines as an option goes farther away from the strike price. This is the variance in option Delta.

Since in-the-money options have some level of intrinsic value they are priced higher than out-of-the-money options in the same option chain as their Delta is higher and captures more of the move in the underlying asset. In-the-money options have a higher probability of expiring in the money and capturing intrinsic value but the out-of-the-money options have a higher gain in percentage if they start moving closer to being at-the-money as the Gamma increases pricing in the growing chance of them expiring in the money.

Many times you will see options abbreviated as ITM, OTM, or ATM designating their relationship to their current strike price.

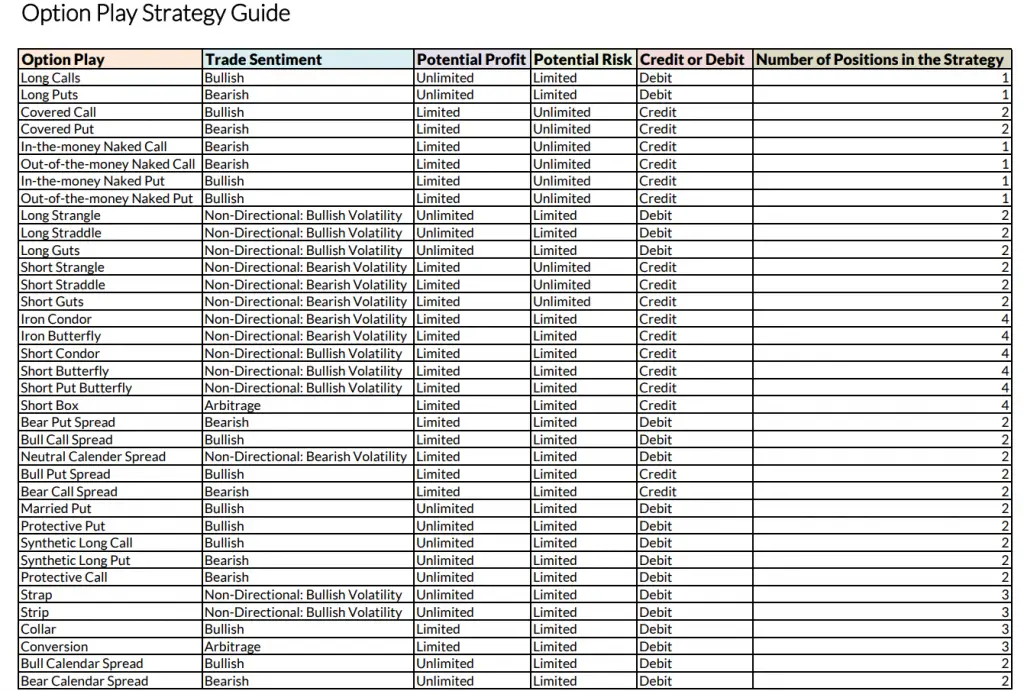

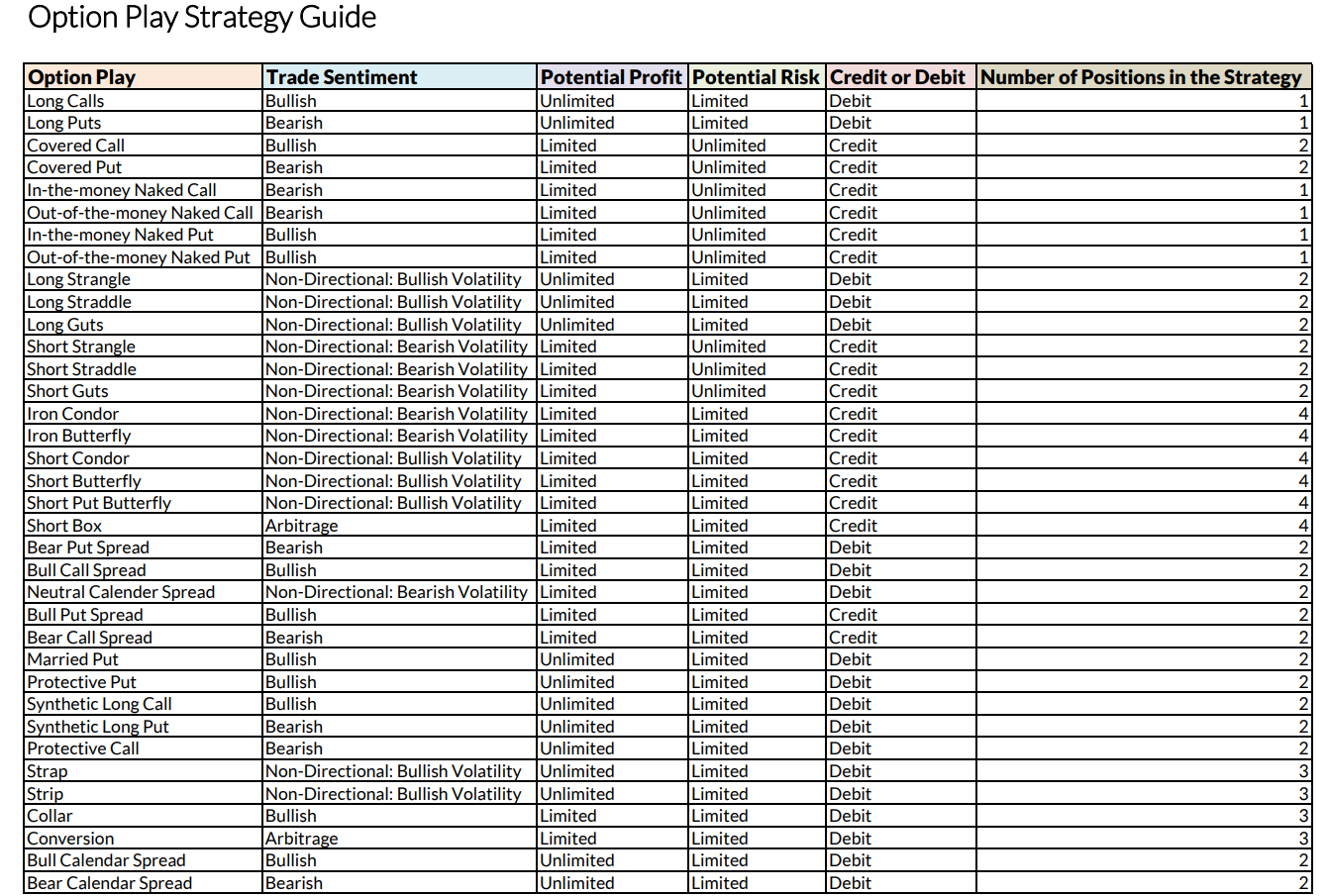

Options Trading Strategies

What are the 4 levels of options trading?

With options trading, brokers quantify different levels of risk exposure for different types of option plays and traders must be approved for each level. The level is based on the risk that the broker is exposed to with potential open ended unhedged short options. The option trader must have a correspondent hedge to limit the losses for any of his short option contracts or have the cash in their account to buy the stock if it goes in-the-money. Brokers are concerned with their risk exposure, not yours. Their business is trade commissions not your options trading success.

If an option trader doesn’t have enough capital for an option contract execution at expiration or the shares of a stock that is called from them or put on them, then the broker must step in to complete the transaction on the options market. Brokers want to limit their own risks and leave the risks primarily with the options trader.

Approvals for different levels of option trading is generally based on the experience the trader has in the markets, the size of their account, their financial education level, and their time with the broker as a customer.

Level 1: Option Selling on Stock Positions

- Covered Calls

- Covered Puts

- Buy-Writes

- Unwinds

- Covered Rollouts

The first level of option trading is selling option premium on existing shares of stock on an existing position. These option plays present no risk to the broker as they are hedged with shares. The worst case scenario is that the short options go in-the-money by expiration and the shares are called from the option writer.

These are income producing strategies for stock traders that also want to sell options on their long-term positions. These option plays can cap the upside profits for a stock trade or investment but they can also create profits when the short options fail to go in-the-money by expiration. The risk on these option plays are in the stock position moving against the trader or investor, the option premium will help reduce some of these losses if they occur by the amount of the option premium. All the risk is on the option trader and not the broker. Most of the time the broker will not allow the customer to sell the stock used as the hedge in the option play before the expiration or buy back of the short option side of the play.

Level 2: Buying Option Contracts

- Long Calls

- Long Puts

- Long Straddles

- Long Combinations

- Long Strangles

- Cash Secured Equity Puts

Level 2 option trading is simply buying option contracts limiting the risk of a trade to the price paid for the option contract. The most a long option trader can lose is the cost of the contract, so the maximum risk is defined at entry. The danger with options versus shares is that options can be all-or-nothing trades and can expire worthless or lose a large percent of value like 50% or more with a large move against the option buyer’s strike price. All risk is on the option trader and none is on the option broker with long option positions.

The one exception to this level with short options is the cash secured put. A cash secured put is a short option that is opened at a strike price where the option trader wants to buy shares at and has the capital in their account to make the purchase if the option goes in-the-money by expiration. The option seller takes the risk of having the stock put on them at expiration. The option seller hedges their short put option with capital equal to the share purchase at the strike price. The worst case scenario is the option seller gets to buy the stock at the price they wanted but it keeps falling lower leading them to buy at a loss on entry. The risk is on the customer with the stock falling under the strike price of the short cash secured put option.

Level 3: Multi-Leg Option Strategies

- Spreads

- Diagonal Call Spreads

- Diagonal Put Spreads

- Iron Condors

- Iron Butterflies

- Ratio Spreads

Level 3 allows options traders to take multiple leg option plays and create more complex strategies like spreads, iron condors and iron butterflies as examples.

Spreads and more complex multi-leg option strategies require experience in option trading along with in-depth knowledge of how the option pricing model works and what effects price moves have on the option plays overall Greeks and risk exposure. Level 3 option trading requires more capital for margin and using option hedges for risk management. Level 3 approves option traders for margin to use on their option trades.

Allowing traders to use margin in their option trading account can increase risk on the option broker. So the barrier for approval for level 3 requires vetting and approval before margin is granted. The brokerage reviews their past option trades, years of experience, and gives them a survey to complete. Brokers also have a minimum capital requirement for any accounts that want to qualify for level 3 option trading.

Level 4: Naked Options

- Uncovered Calls

- Uncovered Puts

- Uncovered Roll-outs

- Short Straddles

- Short Strangles

- Short Combinations

- Uncovered Ratio Spreads

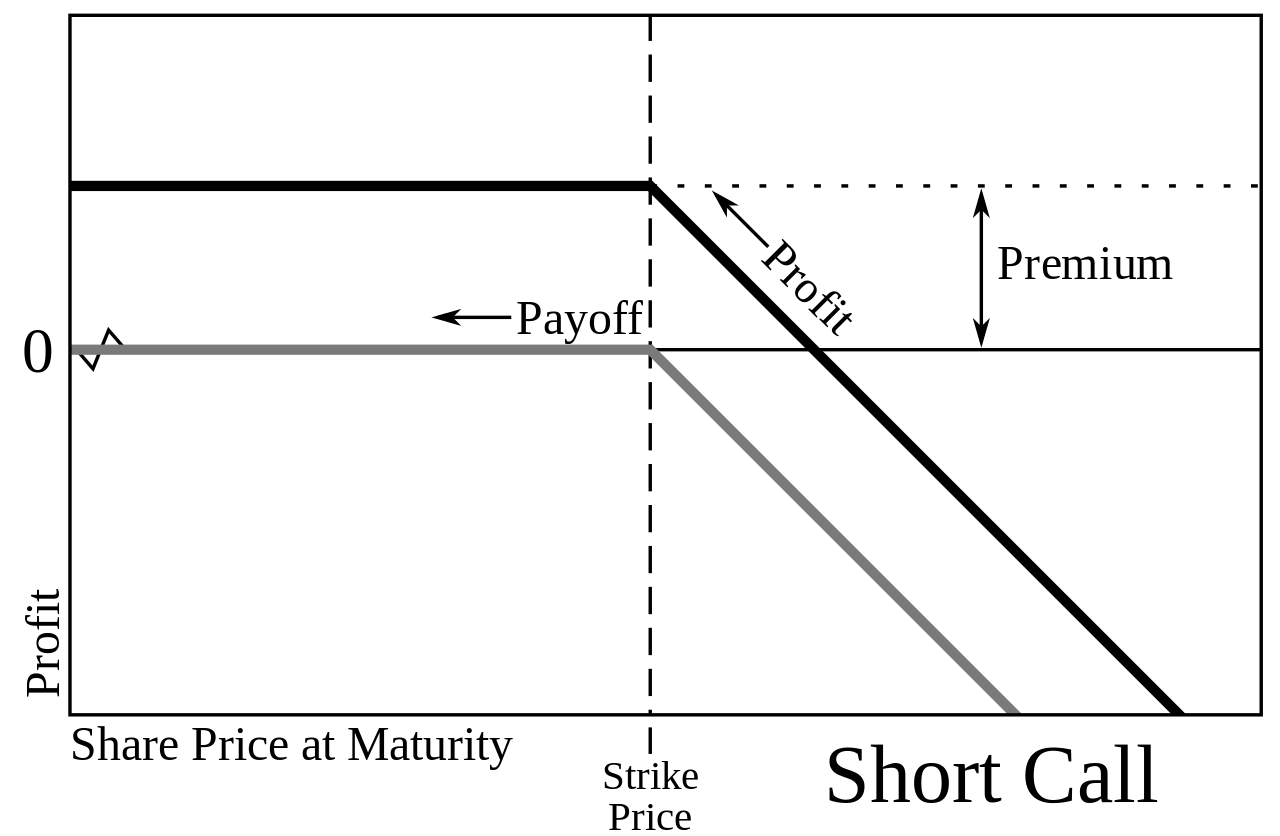

Level 4 options consist of selling option contracts short with no hedge. Naked contracts are sold without a corresponding option hedge to limit losses or shares underlying the position. Short option contracts can be 100% profits on the premium of the contract if they expire out-of-the-money but they can also lead to unlimited losses if the underlying stock has a big move against the option writer.

Level 4 options trading is primarily selling extrinsic option contract value to make profits from gamblers. It requires taking big risks with high probability trades for small consistent gains. This level has a terrible risk/reward ratio but a high win rate with occasional huge losses. This level of option risk has blown up many professional traders and can be dangerous with a high risk or ruin if position sizes are too big and there is no stop loss strategy.

Level 4 options trading is only approved for the most experienced people in the market with long track records and high net worth. The risk of a naked option is both on the option writer which would need to add money for margin calls and if the trader can not cover it then the broker would have to settle with the options clearinghouse. If the broker was unable to settle then the options clearinghouse would need to settle accounts with the long option traders on the other side of the trade.

Naked option plays have led to the ruin of many legendary option traders, money managers, and hedge funds. The tail risk events can take markets to price levels far beyond what anyone thought probable of even possible. With no hedge in place the losses on short options can become staggering quickly even growing to levels more than the value of the option trader’s account or in extreme cases their entire net worth.

It’s crucial for option traders to understand the risk involved with trading options at any level and plan accordingly. Option traders need to be experts on the Black-Scholes option pricing model and position sizing to avoid the risk of ruin before they begin to trade options. The option market provides huge opportunities but traders must manage the risk during their pursuit of profits with whatever option strategy they choose.