Roth IRAs and traditional 401K accounts are designed to enable people to save money in investment accounts by offering tax advantages. These retirement accounts were meant to replace the defined employer pension plans of the past. With a pension plan an employee received a defined payment every month from their employer based on years of service and other factors. IRAs and 401Ks are undefined, benefits are determined by the amount saved, investment returns and the rate of compounding returns over the period before retirement.

There are several types of retirement accounts available in the United States.

The big difference with a Roth IRA versus a traditional tax deferred IRA is the sequence of paying income taxes. Deposits into a Roth IRA account are not tax deferred, you will pay income taxes for the earnings the year of the deposit. However, you don’t pay income taxes on your Roth IRA withdrawals at retirement because you already paid them at the time of deposit. You also don’t pay capital gains taxes on the returns of your investments over the years they are in the account.

A Roth IRA lets you deposit up to $6,000 a year after taxes, it can grow tax free and you can withdraw it without income taxes at the age of 59 and a half years old. A Roth IRA is held outside an employer’s retirement plan and gives the investor the full universe of mutual funds, stocks, and ETFs to invest in. You can withdraw your deposits tax free at any time from a Roth but must leave your investment returns in to not have a tax penalty.

A traditional 401K is a tax deferred account set up and managed by the brokerage firm of your employer’s choosing. A 401K is in your name and the investment options are usually limited to the mutual funds chosen by the employer sponsored program and sometimes you can invest in the company’s stock.

Your ability to buy and sell positions is usually limited to the end of day. Most 401k accounts allow for mutual fund investing only as they are usually teamed up with a mutual fund company. Mutual funds are only traded at the end of the day.

When you contribute to a traditional 401K account your deposits are tax deferred and lower your taxable income for the year of the deposit. This can be automatic deposits made into the 401k account directly out of your paycheck. Your paystub will keep track of your deposits and they will be on your W2 at the end of the year.

Income taxes on 401K deposits are deferred until the time of withdrawal as it’s needed in retirement. If you withdraw 401K money before you are 59 and a half years old the withdrawal becomes taxable income and you have to pay a 10% penalty on top of your income tax rate.

Many employers will discount purchases of a company stock or match deposits on any contributions into the account. If the company offers a discount percentage on a stock purchase that is an investment return on entry and should be considered as a great opportunity.

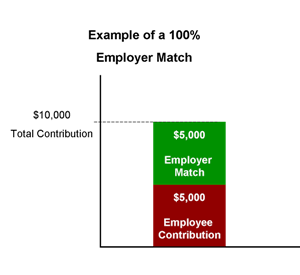

A company match on a deposit is a 100% return at the time of the deposit. Always try to deposit enough to get the full company match, it’s the only free lunch you will get in investing. A company match is usually set at a percentage of your total annual income, they would match up to 5% of your income that is deposited as an example. So if you earned $100,000 a year and deposited 5% of that or $5,000 the company would match your deposit and you would end up with a total of $10,000 deposited in your account for that year.

There are no capital gains taxes inside your 401K so your capital grows tax free you only pay income taxes on the capital as it’s withdrawn.

There is also a Roth 401K. The Roth version of the 401K is the sequence of taxes just like the Roth IRA. You do pay income on the deposit now on a Roth 401K so you don’t have to pay the income taxes on your withdrawal later while also allowing your investments to grow tax free.

Is it better to max out Roth IRA or 401k?

It’s always better based on the math to deposit enough in your employer’s 401k plan to receive the full 100% matching funds that they offer. Even with tax considerations now or in retirement a 100% return is better. 401k plans also offer S&P 500 index funds and other ways to invest to keep up with a wider range of options in IRAs so returns should also not be affected over the long term. Get your full 401k match first and then consider other options.

Does Roth make sense for high earners?

Whether a Roth account makes sense to you depends on when you want to pay income taxes. Do you want to pay taxes on the capital you invest this year with a Roth IRA or Roth 401k or later at retirement with a traditional tax deferred account?

It makes sense to do a Roth now if you’re in a very low tax bracket or if you plan to grow your income substantially over the years then you don’t have to pay taxes at a higher income level after retirement. If you’re in a very high tax bracket it makes more sense to get relief from income taxes now and defer them until retirement where you will likely be in a lower bracket after your earnings years are over and you live off withdrawals.

With taxes being the biggest expense for most high income earners it can make more sense to make the maximum contribution in a tax deferred account and let what would have been a tax payment grow tax free free for decades in investments. The math shows that the combination of tax free capital and the compounding of returns tax free over decades can work out better than using after tax dollars.

How long does it take to be a millionaire with a 401k?

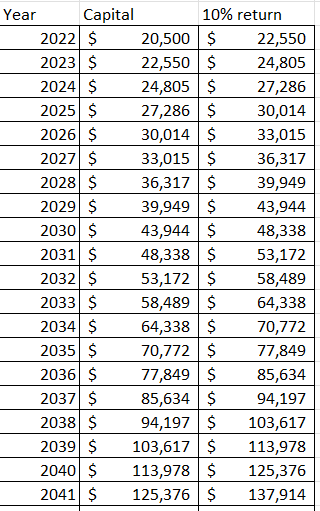

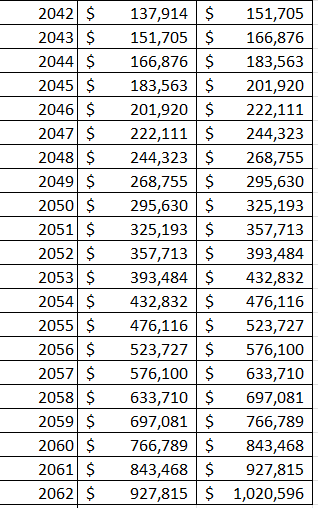

With a 10% annual rate of return, a single $20,500 investment can become $1,000,000 in 40 years. If you’re able to save and invest $20,500 in your your 401k account by the time you’re 25 years old then it could compound to one million dollars by the time you’re 65 years old. This is with only using the initial capital of $20,500 and not adding any more money, just letting the return compound year over year.

Where would you put this capital to grow for 40 years? A low cost S&P 500 index mutual fund inside a tax deferred 401k plan is a great place to have the best odds of reaching this goal. You could allow it to compound without the drag of capital gains and dividend taxes and be invested in a diversified portfolio of the top 500 companies in the U.S. by sector.

The historical average yearly return of the S&P 500 is 10.314% over the last 50 years, as of the end of September 2022. This assumes dividends are reinvested. [1]

Of course inflation will make a million dollars have less buying power in 40 years and you can speed up the process with a higher savings rate or a more aggressive investment approach but this shows the power of compounding returns and starting early. The biggest danger is not doing anything and not having a million dollars in 40 years.

This is one high probability path to millionaire based on the math.

This blog post is for informational and educational purposes only and is not meant as investment or tax advice. Always seek the advice of a registered investment advisor and tax professional before making specific retirement decisions.