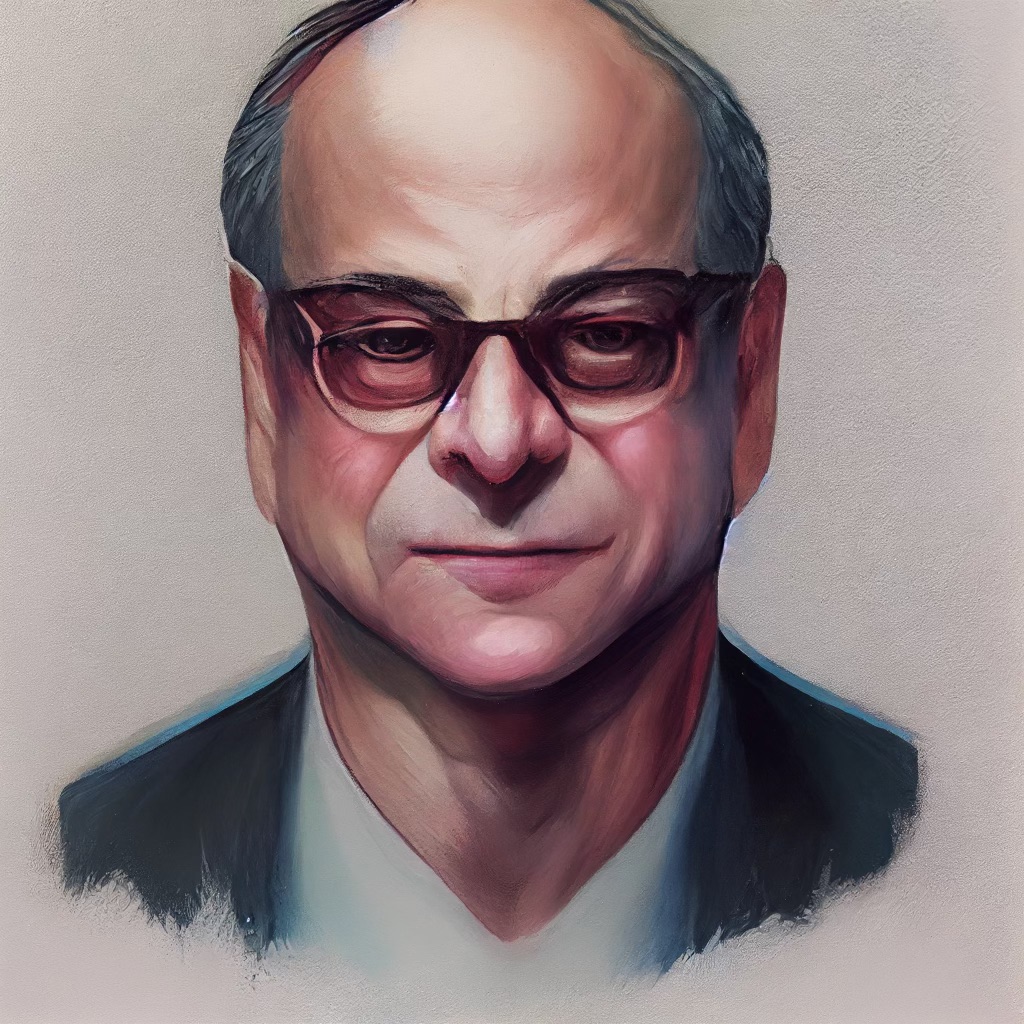

Steve Cohen is arguably the most profitable hedge fund trader ever. His SAC Capital returned 30% annually for more than 20 years since its inception in 1992 making Cohen a billionaire. What many people don’t know is that Cohen started his career as a day trader. [1]

How good is he? Showtime’s Billions is inspired by Steve Cohen’s life. Cohen is Bobby Axelrod in real life.[2]

He started as a young poker player in high school and college but wanted a larger casino to play in so he moved to the stock market. He started his trading career as a predictive and intuitive trader with a great skill for tape reading. He was able to sit in front of his screen, scan the news, watch the price action and consistently make a lot of money. He loved day trading, it was his favorite time frame from the start.

Who is the best day trader?

Cohen started his trading career after graduating from Wharton college and began working as a junior options trader for a small investment bank Gruntal & Co. By 1984, he was managing a trading group at the company. Cohen’s trading generated $100,000 a day for the firm and made him wealthy fast. Early in his career he was making $10 million a year with positions in takeovers and IPOs.

Inflation adjusted, $100,000 in 1984 is $285,000 a day in 2022. This is a staggering amount and his future career and wealth accumulation really shows how good of a day trader he really was in the context of his entire career. A day trader with this level of average daily earning power could be the best day trader of all time.

In the 1987 Black Monday stock market crash Cohen’s group lost half of their trading capital and the trading firm Gruntal & Co. was put out of business. Almost all the firm’s traders were ruined. How traders manage a market crash shows whether they have skill or are relying on luck and a bull market. After the shutting down of Gruntal & Co. Cohen went out to start his own firm.

He launched his hedge fund SAC Capital Advisors in 1992 with $23 million and $10 million of that Cohen’s own capital and 9 employees. SAC used an aggressive, high-volume trading approach with stock positions being held for 2-30 days and sometimes hours. Cohen continued with a lot of day trading in his early money management career. In three years SAC quadrupled in size to $100 million under management.

Cohen has said that SAC regularly traded 20 million shares per day in 1999. His firm’s active trading accounted for approximately 2% of all stock market trading activity by 2006. SAC bought and sold 100 million shares daily by time. Cohen individually accounted for 10% of SAC Capital’s profits.[3]

Cohen’s SAC success used high-risk, high-reward trades. He traded the late 1990s dot-com bubble for 70% returns and earned another 70% shorting those same dotcom stocks during the dotcom bubble popping in 2000. [4]

There were three categories of information according to the book Black Edge. White Edge information was publicly available while Gray Edge was inside information that was immaterial, or perhaps the source was not directly from the company. The legality of trading on the Gray Edge information was questionable.

Black Edge information was known to be illegal to base a trade on, because it was directly from inside the company and not yet publicly known. Black Edge information was what was most reliable and most desired but also dangerous to use. This type of information should have been avoided.

The end of SAC capital came when eight SAC employees were found guilty of insider trading from 1999 through 2010, along with portfolio manager Michael Steinberg. Mathew Martoma was convicted criminally and sentenced to nine years in prison, and also ordered by the court to return $9 million in wages. Cohen was never charged with any insider trader but a civil suit was brought against him by the SEC for failing to supervise senior employees but was dropped in 2013.

SAC Capital was charged directly for insider trading and pled guilty. SAC received a $900 million criminal penalty and $1.8 billion in financial penalties. The plea deal and settlement included terms that barred Cohen from managing any investor assets for two years. Steve Cohen was not fined directly and didn’t admit to any wrongdoing. He never faced criminal charges, the investigation focused on him not reasonably supervising his senior employers.

Steve Cohen Trading Style

He believes trading and investing is all about smart risk taking.

He is a master of risk management.

He didn’t get emotionally attached to his trades.

Cohen had discipline in cutting losses and exiting trades that started to meaningfully go against him.

He doesn’t have an ego problem and will quickly admit when his trade isn’t going to work out.

Cohen is detached emotionally from his trades and thinks more in probabilities and expectancy.[5]

What company does Steve Cohen own?

Steve Cohen converted his investment operations from SAC Capital to Point72 Asset Management in 2014. By January 2018, the firm was granted regulatory clearance to raise outside capital and allowed to resume money management operations. Point72 Asset Management is a $26 billion hedge fund firm.

Cohen bought the New York Mets in 2020 for $2.4 billion as the majority owner. This the highest sale price ever paid for a major league baseball team.

Current Steve Cohen Net Worth 2022

What is the net worth of Steve Cohen?

Steve Cohen’s current net worth is $17.5 billion dollars making him the 83rd wealthiest person in the world. This is the level of wealth we should expect to see the best day trader in the world rise to as proof of skills.

The only limitations a day trader with the skills to print money daily would have is the ability to scale their strategy. Compounding capital in a single stock or market has its limitations and a successful trader must find bigger and bigger markets than can handle their trade size as they grow. SAC scaled to be 2% of the U.S. stock market, they had to pick their markets carefully or they would have become the market with their price moving volume.

He is also the richest owner in major league baseball. Most of the time he finds himself the richest billionaire in a room full of billionaires.

Steve Cohen is on Twitter @StevenACohen2