Selling short a stock reverses the normal order of buying it and then selling it. Selling short means to sell something you don’t own. When hedge funds and large players sell a stock short they borrow the stock from their broker and sell it to a buyer in the marker. They then owe the broker the shares. They receive cash from the sale but have to use it to buy the shares later to pay back the broker for the loan of borrowed shares. A short seller is long cash and short the shares on their short trade. These shares they sold short must be bought back on the market so the shares can be returned to the broker that allowed them to be borrowed.

The short interest in a stock is the amount of shares outstanding that are currently sold short and still need to be bought back to cover those positions. The short interest in a stock can be a number or percentage of the total shares outstanding. A short interest number quantifies how many shares of a stock are currently short while a short interest percentage expresses what percent of the total outstanding shares that are short.

The short interest for a stock shows the market sentiment on that stock. A high short interest shows there are a lot of bearish bets against the stock and a low short interest can show that sentiment is bullish. The most important thing to consider with short interest is when it reaches extremes in either direction.

What is a high short interest percentage?

- Short interest below 10% signals bullish sentiment.

- Short interest over 10% starts to signal bearish sentiment.

- Short interest over 20% starts to show extreme bearish sentiment.

- Short interest over 30% can start signaling it is late in the bearish price cycle lower.

- Short interest over 40% can start exposing short sellers to the dangers of a short squeeze or a temporary dead cat bounce.

The stocks that have reached maximum bearishness can also be the ones with the greatest potential for upside moves in percentage terms when short sellers have overstayed their welcome and overplayed their hand. Let’s take a look at what I’m talking about.

How do you find a short squeeze stock?

A list of the current highest short interest stocks can be a great place to look for stocks on potential short squeeze watch. The most shorted stocks on major U.S. stock exchanges is a good list to stay updated on so when they begin to move you will have the best candidates on your watchlist to buy when you get your signal.

What you want to see are positive headlines that set off a rally with momentum likely caused from short covering due to fear of losses getting out of hand. The headlines can just be better news than is expected to cause deep value buyers and shorts to cover sending the share price up dramatically in a short period of time.

Also be aware that these stocks can be wildly volatile so it’s important to position size an amount of capital that you can trade without your emotions getting out of control. Another thing to consider is having a plan to lock in profits while they are there, the volatility can cut both ways and if you don’t take your profits someone else will. The stocks on this list are not investments and most have severe fundamental problems in their business and may never comeback as a long term investment. These are short term trades in almost every case.

The higher the short interest percentage rises in ranking on the list the greater the probability of a short squeeze higher on any positive news. Only the stocks with the real potential of near term bankruptcy have the risk of really going to zero. Most others will have at least one short covering rally eventually even if it is only temporary.

What is the most heavily shorted stock?

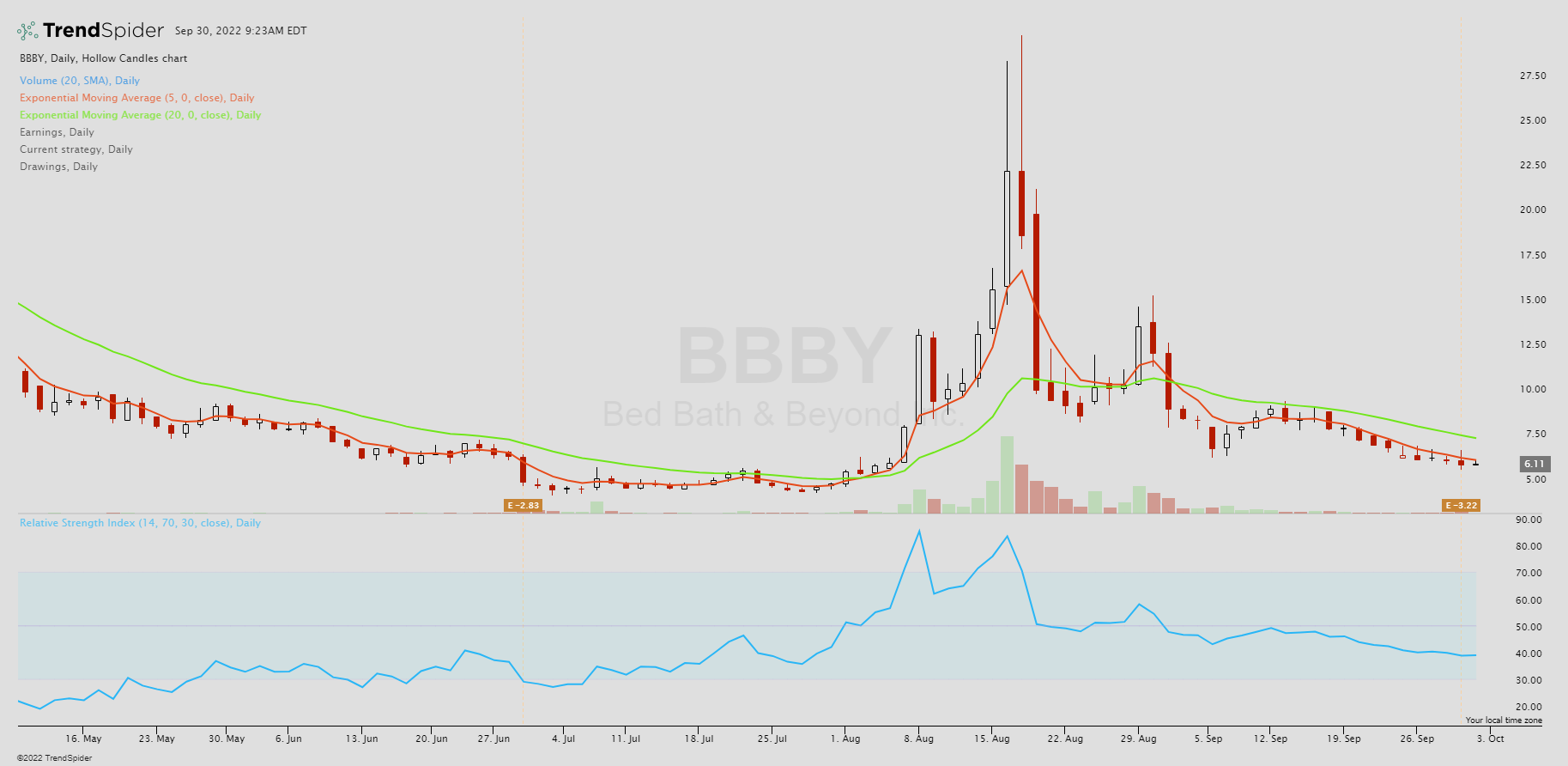

Currently the most shorted stock right now is Bed Bath and Beyond, ticker symbol BBBY traded on the NASDAQ exchange with a 39.26% short interest. BBBY has fallen from a recent high of $30.00 on August 17th, 2022 to a low of $5.82 on September 29, 2022.

This company had one of the biggest short covering rallies in the market in August 2022 and the 5-day / 20-day EMA crossover has been a good signal for swings and trends to the upside. The cross under signal also keeps you in cash or short during downtrends.

What are the most shorted stocks right now?

Here is a list of the current most shorted stocks going into October 2022.

Rank/Ticker/Company/Exchange/Short Interest/ Industry[1]

- BBBY Bed Bath & Beyond Inc. Nasdaq 39.26% Retail (Specialty Non-Apparel)

- BYND Beyond Meat Inc Nasdaq 37.38% Food Processing

- BIG Big Lots, Inc. NYSE 36.69% Retailers – Discount Stores

- UPST Upstart Holdings Inc Nasdaq 35.34% Consumer Lending

- MSTR MicroStrategy Inc Nasdaq 34.57% Software & Programming

- HRTX Heron Therapeutics Inc Nasdaq 31.94% Biotechnology & Medical Research

- EVGO Evgo Inc Nasdaq 31.53% Utilities – Electric

- BGFV Big 5 Sporting Goods Corp Nasdaq 31.00% Retailers – Miscellaneous Specialty

- CVNA Carvana Co NYSE 30.40% Retail (Specialty Non-Apparel)

- NKLA Nikola Corporation Nasdaq 28.80% Auto & Truck Manufacturers

- REV Revlon Inc NYSE 28.63% Personal Products

- W Wayfair Inc NYSE 28.48% Retailers – Department Stores

- FUBO Fubotv Inc NYSE 28.26% Online Services

- FUV Arcimoto Inc Nasdaq 26.80% Auto & Truck Manufacturers

- IBRX Immunitybio Inc Nasdaq 26.27% Biotechnology & Medical Research

- BLNK Blink Charging Co Nasdaq 25.80% Utilities – Electric

- MVIS Microvision, Inc. Nasdaq 25.07% Electronic Equipment & Parts

- WKHS Workhorse Group Inc Nasdaq 24.61% Auto & Truck Manufacturers

- JWN Nordstrom, Inc. NYSE 24.43% Retailers – Department Stores

- SPCE Virgin Galactic Holdings Inc NYSE 24.42% Aerospace & Defense

- VUZI Vuzix Corp Nasdaq 24.10% Electronic Equipment & Parts

- HYZN Hyzon Motors Inc Nasdaq 24.08% Heavy Machinery & Vehicles

- NERV Minerva Neurosciences Inc Nasdaq 23.91% Biotechnology & Medical Research

- RIDE Lordstown Motors Corp Nasdaq 23.91% Auto & Truck Manufacturers

- LCID Lucid Group Inc Nasdaq 23.27% Auto & Truck Manufacturers

Short Squeeze Strategy

Pick any stocks that you may have a bullish case for on a business recovery or a deep value play. Look at each chart for potential signals for entries and exits and backtest them. Place the ones that fit your strategy on your watchlist. Position size right, set a stop loss, set a profit target, use a trailing stop, and manage the trade as it plays out.