People that are financially successful tend to all use a budget to manage their monthly bills. Even the ones that don’t use a budget have the self discipline to control their spending within the parameters of what their income allows. A budget spends all of your monthly household income on paper before the month begins.

You can think of your budget as a written spending plan allocating your dollars to different categories based on priorities. You must have food but it’s usually more cost effective to buy groceries than go to a restaurant. A budget makes you decide on how you will allocate your fixed amount of dollars before the month begins. It forces you to make specific decisions by category with limited dollars.

What is the 50/30/20 rule?

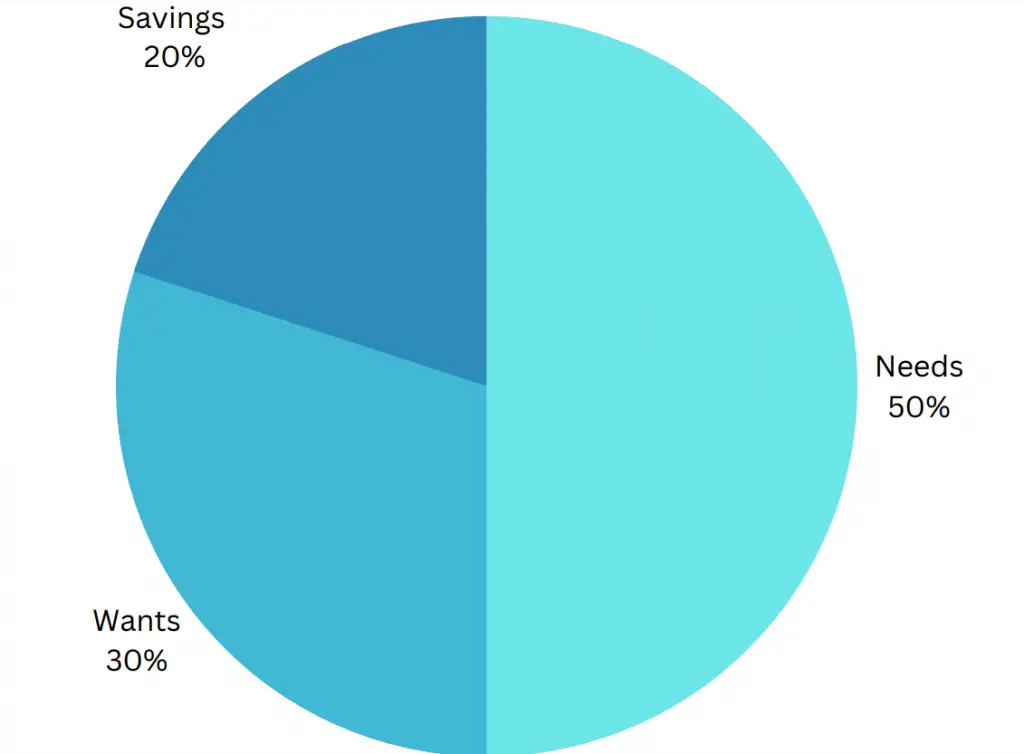

The 50/30/20 rule budget is a method that gives you a template for allocating your spending by percentages to three broad categories: needs, wants, and savings.

It’s a larger framework you can use to allocate your income by dollars into three spending categories based on the priorities they are to you.

The most you can spend on any of the classifications are limited to the percentage of the budgeted dollars. This can force restraint where it’s needed by limiting expenditures in areas that are just wants.

What are the three categories in 50/30/20 budget?

- 50% of your money is budgeted for your needs.

- 30% of your money is budgeted for you wants.

- 20% of your money go into savings or paying off debt.

This would mean that if you earn $10,000 a month in total net household income after taxes then you would budget like this:

$5,000 would go to the things you need like housing, transportation, food, utilities, and healthcare etc.

$3,000 would go to what you want like owning nice things, entertainment, having fun, dining out, and hobbies.

$2,000 would go your savings or paying off debt.

What makes up the 50/30/20 rule? An example of each:

50% Needs

This is the must have category, these items are not optional.

- Mortgage or rent for a place to live.

- Utility bills for electricity and water.

- Grocery shopping for food to eat.

- Health insurance for medical emergencies.

- Automobile expenses like car payments, gasoline, or maintenance for transportation to get to work.

- Internet is a need for most people in the 21st century for work and school.

30% Wants

This is the category that is optional even though many people think it’s mandatory.

- A huge home or large apartment, you only need one big enough for you or your family if you have one. Many people, especially Americans have extra rooms that they don’t need or use. You just need a place to live but many people think they need a huge home as a status symbol. There is a difference between what size you need and what you want.

- You don’t need every streaming service on television for entertainment, this is a want.

- You don’t need to dine out at restaurants you can eat cheaper food at home, this is a want.

- A gym membership is usually a want as it’s possible to exercise for free.

- A car is a need to get to work but an expensive new car with a large payment is a want.

- Spending money on hobbies is a want.

- Spending money on entertainment like going to a movie or show is a want.

- Name brand items over similar generic items is a want not a need.

- Expensive travelling vacations are wants not needs. You can take a vacation at home.

Having wants is not wrong, it’s what brings a lot of joy to life. The key is to limit spending only 30% of your income on expenses above basic needs. Also, focusing on only the things most important to you.

Most people’s budget’s only allow for a splurge or two. If your priority is owning a nice home you may need to drive used cars. If the car you dive is the most important thing to you then you may not be able to afford as much dining out and movies as you like.

Allocate the 30% of budgeted wants to only your top priorities that bring you the most happiness and improve the quality of your life. The key is you must choose not try to have it all until your income is enough to afford it.

20% Savings

One-fifth of all your earned income must consistently go to savings unless you have consumer debt like credit cards then it must go to paying that debt off first. This 20% allocation forces the discipline of paying yourself first to either build up some savings or get out of debt to depreciating assets. Paying off credit card debt will give you the best return on your money so it’s the first to go.

- Pay off all personal, consumer, and credit card debt first.

- Save up an emergency fund of at least 3 months of living expenses and keep it in a savings account.

- Contribute to your 401k plan to get the full match if you have that option.

- Deposit money in a brokerage account to build up investment capital.

The goal with this savings allocation is to convert earned income from your paycheck into investment capital over time and put it to work growing for you.

Many financial authors recommend putting your savings as the number one priority and to pay yourself first as you should be your #1 priority above all others when it comes to your own money. However, paying taxes will always come first for employees as the government wants it taken out of your paycheck before you even see that money.

To be able to invest and grow your money you must first master your personal finances. If you can’t master your own behavior in earning and spending your money you will never master investing in the stock market.

How do you spend money wisely?

Put as much thought into spending your money as you do in earning your money in your career. Only give your money to businesses, products, and services that you feel are worth the amount spent.

Better yet, look for value where you feel things are worth far more than they cost. Everyone is different in this regard and some people could find great value in hiring people to do the work they hate to do like cleaning their house or lawn care while others may not mind that but want to own a home a short commute from their job for a better quality of life.

The most important step in spending money wisely is cutting off any spending in a category when your budget runs out of an allocation dollars. It’s unwise to keep spending using debt above your monthly income.

If you want to spend more money than you must increase your income with more hours of work, a higher paying job, or cash flowing assets not through debt.

Always trade your dollars for at least equal value and stay within the guidelines of your budget if you want to win at personal finance.