Real estate and stocks are two different asset classes. Real estate is owning properties, buildings, or homes while stocks are owning equity in a publicly traded company. Both types of assets can appreciate in value for capital gains and both can be used to create cash flow.

Many factors effect which investment could be right for you and how each may perform based on your own specific timing and goals.

Let’s take a look at them for the contrasts along with benefits and risks.

Is real estate or stocks more profitable?

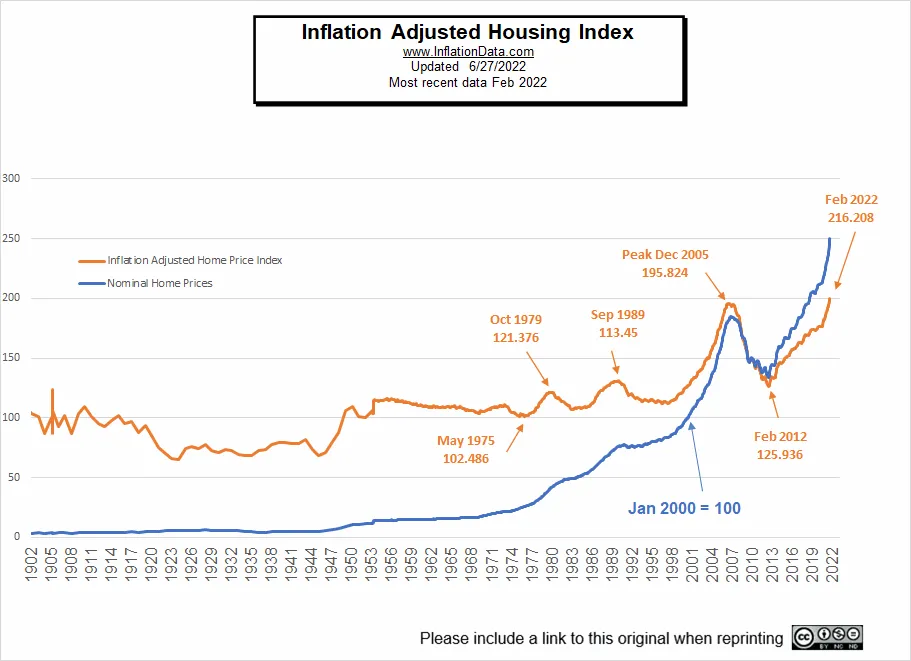

Investments in real estate have historically earned 3% to 4% per year on average; contrasted to investments in stock market indexes earning approximately 10% annually over the long-term.[1]

While the stock market beats the real estate market on average by almost tripling the returns over the history of both asset classes there are specific factors to consider.

Nominal U.S. real estate returns historically have simply been based on inflation rising and the replacement value of homes. (The nominal rate of return is the amount of money generated by an investment before factoring in expenses such as taxes, investment fees, and inflation).

Is it better to invest in property or shares?

The housing market like the stock market can go through boom and bust periods caused by low interest rates, Federal Reserve easy money policy, and speculation by investors. Real estate values are also very location dependent and rise based on supply and demand in specific areas as a local economy booms. When jobs are created employees need places to live and it creates geographic demand. The supply of new homes from builders in an area also determines supply and prices.

Buying your own home in a growing area or buying a rental or investment property in an area in high demand can be a great investment. It’s possible to outperform the stock market with the right property timing in the right area. However both must be correct where you buy and when you buy in real estate. Also real estate is less liquid and has high transaction fees and not as easy as just buying a mutual fund or index exchange traded fund (ETF).

Buying individual stocks in the right company can give an investor the best returns of any asset class as stocks can have upsides of 100% to 1000% when the right ones are chosen and held long enough. The upside of stocks are greater but the risks of stocks are also more as they can also fall 50% to 90% which real estate almost never does. Of course stock index funds create a smoother return over time.

With stocks and real estate you can choose your level of risk and upside potential for returns in both asset classes.

Four things determine whether real estate of stocks will be more profitable for you:

- When you buy.

- What you buy.

- How long you hold it.

- Your knowledge of what you’re buying.

Returns in real estate and stocks are based on where in a market cycle you buy and when you sell to lock in profits. Buying late in a bubble in either market will lead to losses and buying after a crash in either market can lead to outsized gains. The key is buying at reasonable fundamental value during a trend.

The quality of what you buy is more important than the asset type of buy. Price is what you pay, value is what you get. A high value property will beat a low value speculative stock. A stock index fund can beat a terrible property in a bad geographic and economic area.

If you buy and hold either asset class over long periods of time like 10 to 20 years then returns can start to average out regardless of the entry buy point and you can expect the average historical return all else being equal with a diversified portfolio of stocks or properties.

Don’t invest in things you don’t understand. If you’re an expert on an area you buy a property in or in real estate in general you will do better than if you know nothing about it. Investors also do better in the stock market if they have studied it or know the company behind the stock that they own. Study and competence comes before confidence in any successful pursuit.

Real estate or stocks, which will make you richer?

If we look at the list of the richest people in the world the majority of them built their wealth through founding companies, taking them public, and holding on to a large share of the stock as they built them into large cap companies.

Looking at this list it shows that owning shares in the best companies is the most common path to world class wealth. Nothing creates net worth on a larger scale than the leverage of building a business that can be taken public. At the same time investors can participate in this wealth building by owning the shares the billionaires own or copying the portfolios of legendary investors. You can start small and grow your own portfolio.

Surprisingly no one is on the top 20 list through real estate investments, as it does not create the same level of opportunity of scale, leverage, compounding, and growth that stocks can create. Owning the earnings value of a good company through shares has a lot more future cash flow value than a piece of real estate.

Steve Balmer is the only employee on this list as he was able to use his position as Microsoft employee #30 and CEO to get a large amount of equity in Microsoft early in its growth cycle.

Other members of this list were founders or children of the founders of major corporations excluding Warren Buffett who took over Berkshire-Hathaway and turned it into an insurance holding company and corporate conglomerate.

We all have the opportunity to invest in and trade the stocks of the public companies that these capitalists founded and grew to create their own large net worth.

Everyone has a different risk tolerance and return goals so they must choose the asset class that fits them. There are plenty of real estate millionaires but more billionaires used stock ownership to create their wealth.