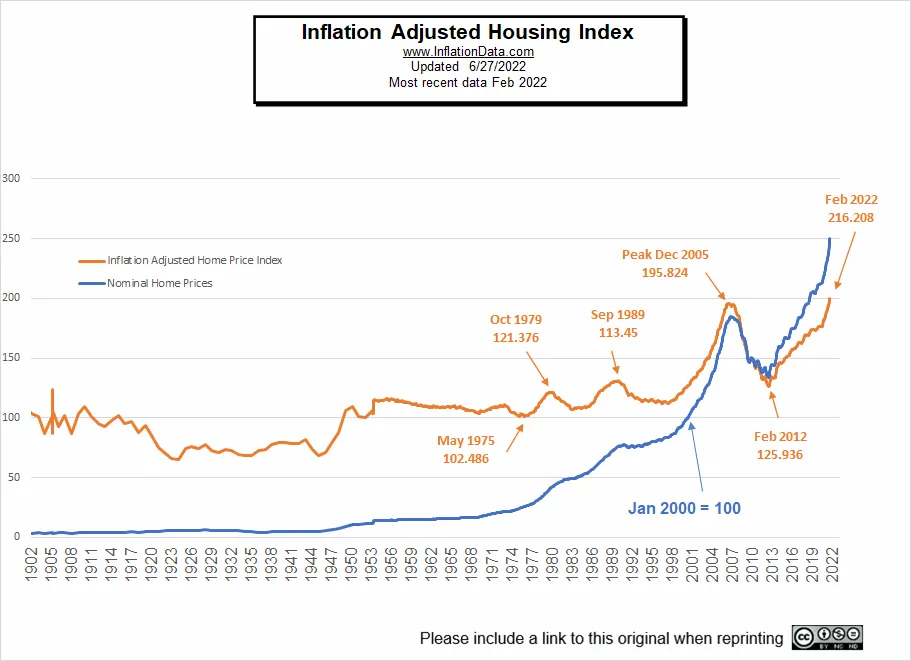

Home prices minus the inflation rate equals real home prices. The historical performance of home prices has to be looked at in terms of inflation adjusted returns not nominal home prices. If your house goes up 10% in one year but inflation also goes up 10% you didn’t have a 10% return, your house was just acting as a hedge against inflation and the increase in value could just be the rise in replacement costs of building a new one with the same materials and labor.

What will cause the housing market to crash?

Also, if you live in a growing area and see your house increase 50% in value in two years that could simply be a short term speculative bubble based on buyers fear of missing out on getting any home. Over the long-term houses are primarily a hedge against inflation by locking in a mortgage a home owner avoids the risk of rent increases over the lifetime of purchasing the home.

The farther that nominal housing prices move away from intrinsic value and the inflationary trend the greater the odds that it’s a housing bubble, The farther home prices move from the average historical price the greater the odds of a reversion back to the mean.

Housing Market Indicators

The current move higher in nominal house prices from 2012 to 2022 is very similar to the same housing bubble from 1998 to 2007 where houses far outpaced the inflationary rate and generated returns as investments on a national scale.

Historical inflation adjusted and nominal returns on houses have been very steady in the U.S., when either line starts a sharp incline upwards it generally signals a bubble that could burst, but most housing bubbles last for many years.

Leading indicators for real estate prices can signal that a housing market top is near and could be about to begin a decline.

Leading indicator requirements are that they make logical sense, have a proven track record, and have a large historical sample size.

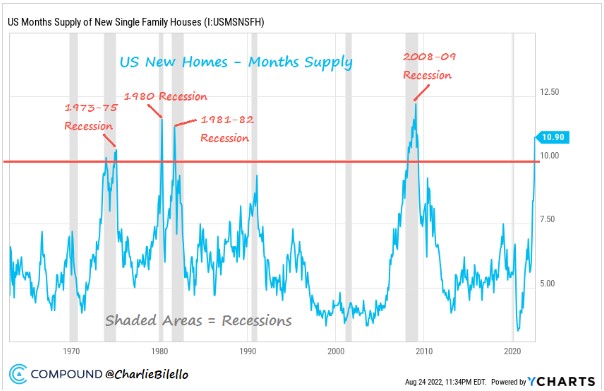

The months supply of new homes for sale is now over 10, which has been an accurate predictor of a recession going back to the 1970s. At nearly 11 months, the supply of new homes in the U.S. is near multi-decade highs.

The months’ supply is the ratio of new houses for sale to new houses sold. This stat is an indicator of the size of the new for-sale inventory in relation to the number of new houses currently being sold. The months’ supply indicates how long the current new for-sale inventory would last given the current sales rate if no additional new houses were built.[1]

The monthly supply tracks the available houses coming on the market and helps meet the demand curve of homes of buyers and can decrease prices as it grows. The higher the supply the more it gives buyers choices and sellers must compete to sale their house, slowly turning the housing market into a sellers market.

The lows in monthly home supply happened near the end of 2020 after which more house came onto the market as prices motivated home builders to ramp of production and also at the same time led sellers to cash in on their equity by putting homes on the market.

Monthly supply reaching near 11 likely is the signal of a near-term top in the housing market prices as it was a signal in all previous housing recessions. However this can take time to play out as both buyers and sellers find equilibrium with prices as the market adjusts to supply and demand in each specific geographic area.

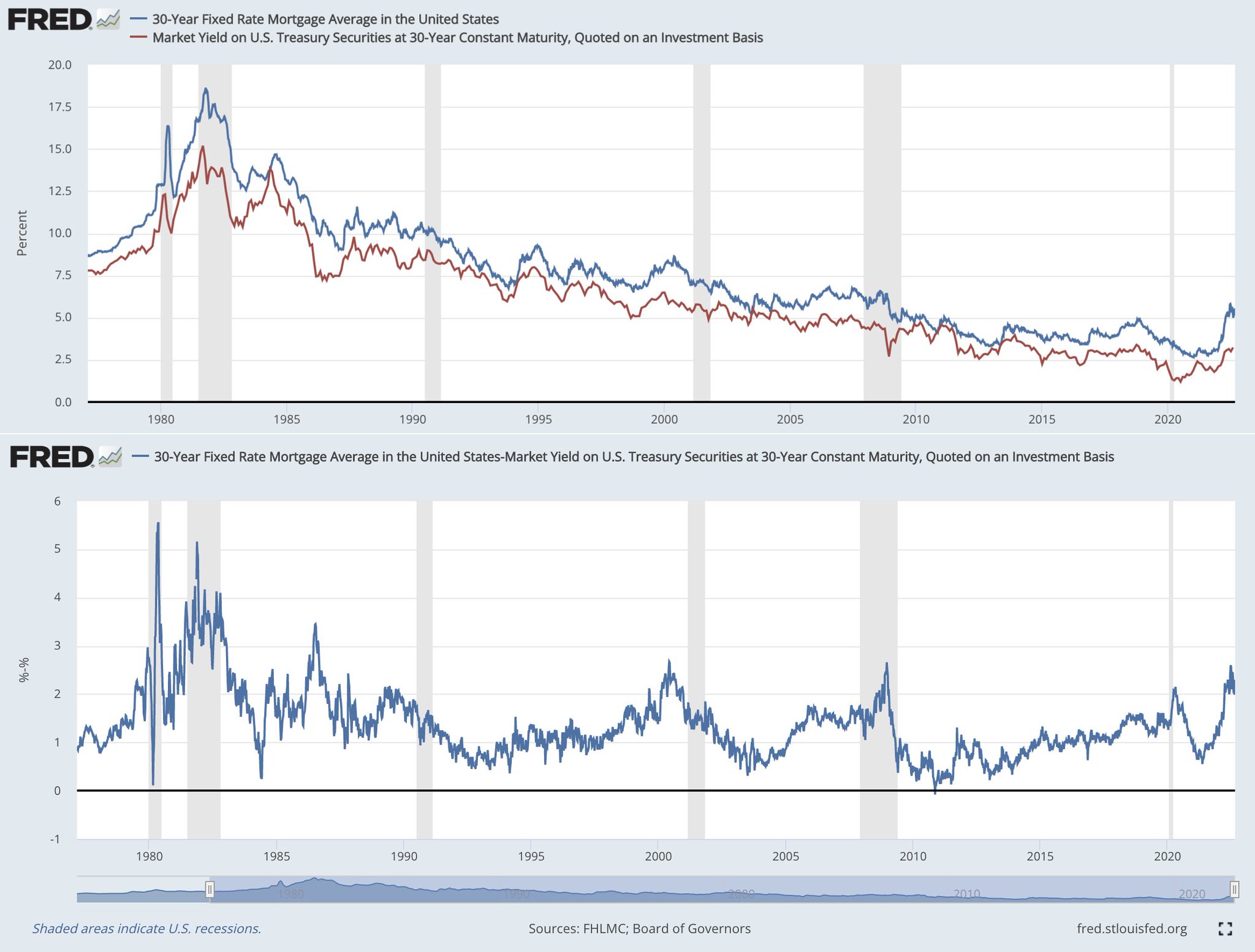

The 30-year fixed mortgage spread represents the difference in interest rate between the 10-year United States Treasury bill and the average rate on a 30-year mortgage. Typically, mortgage rates remain about 1.5% above the rates being paid on 10-year Treasuries. However, prices fluctuate on a daily basis and the spread constantly changes.

The spread between the 10-year Treasury rate and the average 30-year mortgage rate grows during recessions when high numbers of borrowers default on mortgage payments and eventually the loans. Conversely, the spread can narrow and become small when Treasury rates are low and real estate investors are willing to take on the risk posed by mortgage-backed bonds to try to achieve higher returns. [2]

The spread represents the risk.

30-year fixed mortgage rates has exceeded it’s 2018 highs, while 30-year bond yields haven’t. Both are correlated, with mortgage rates leading. If history is anything to go by then 30-year treasury yields still has more upside. (Spread for below charts is 2.3%)

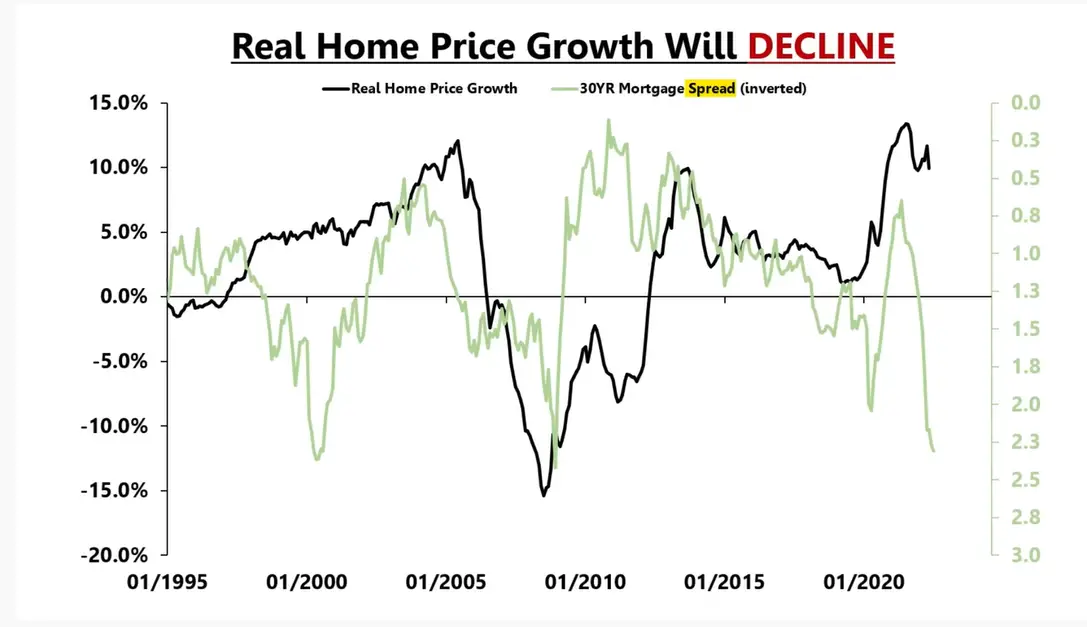

Mortgage rates can decline because treasury rates are declining or because mortgage spreads are tightening. Declining treasury rates can indicate economic conditions growing worse. We must separate whether the mortgage decline is coming from the treasury rate or the spread. I widening mortgage spread preceded the housing decline in 2007 and the tightening of the mortgage spread preceded the housing recovery in 2010. This has been a good leading indicator of risk off or risk on in the housing market over the past two cycles.

This signal did not work in 2007 so it’s important to use a confluence of multiple indicators for a full picture of a market environment. The monthly supply indicator was not showing signs of growth in 2000. The more indicators that line up at the same time the greater the odds of success.[3]

Will real estate crash in the future?

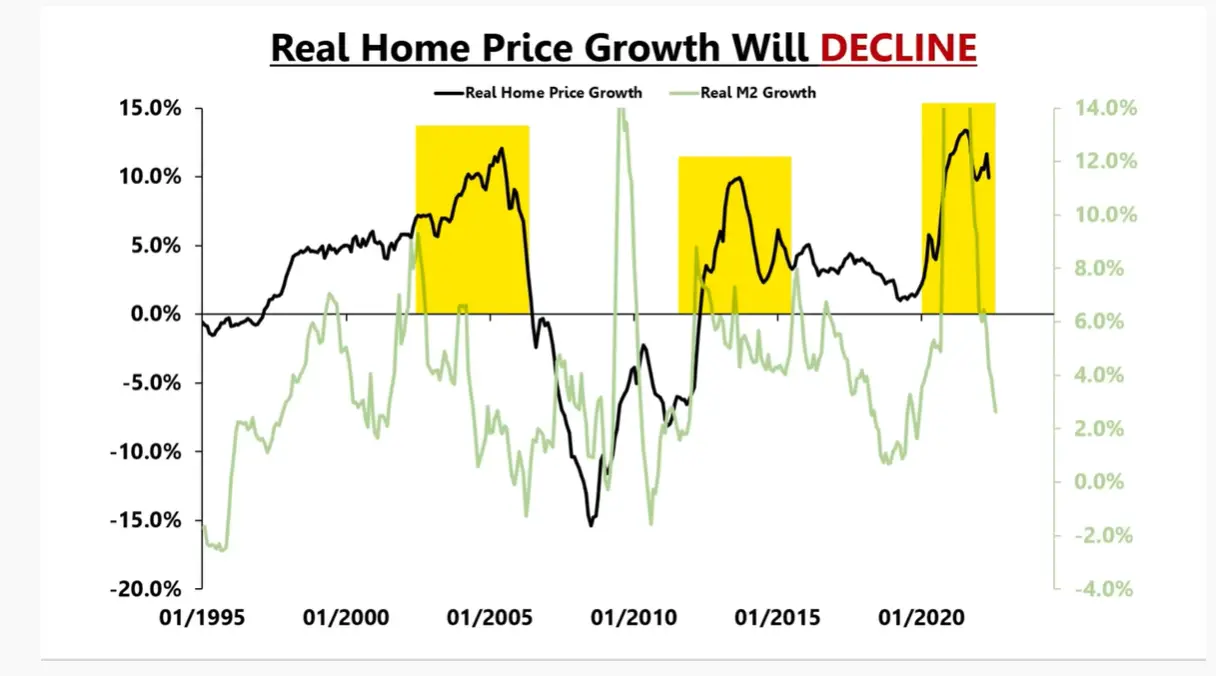

M2 money supply growth can also lead to increasing home prices as the liquidity of currency in the market can be used as investment capital to increase asset prices.

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds. [4]

The more money that the Federal Reserve allows in the system the more of that money can be used to buy, flip, or invest in real estate. Expanding M2 money supply can signal increasing real estate prices, declining M2 money supply can show decreasing real estate prices. Liquidity and the quantity of investment capital in the financial system is the most important fundamental of the housing market. Easy monetary policy is a home price stimulant.

Currently as the Federal Reserve is using monetary policy to fight inflation, raising rates, and going through quantitative tightening and trying to contract the M2 money supply it’s a signal that the housing market could be peaking.

We currently have the trifecta of bearish housing signals. More homes coming into the market as high prices motivated sellers and declining prices made selling more urgent reflected in the monthly supply. Rising mortgage spreads showing risk is increasing for borrowers and investors. Also, the Federal Reserve trying to deflate asset prices with tightening the money supply.

Home prices haven’t crashed yet because we are still in the first stage of price decline coming off the previous run up and potential bubble.

Image created by Holly Burns