This is a guest post by David Roads, Technical Analyst & Author

The pin bar is a candlestick bar which is a very powerful formation if you use it correctly. You can catch significant market moves as this bar signals to take the trade from the beginning of the trend. We find these ideal pin bars when the market moves sharply and then dries the volatility or loses the strength of its trend.

There are two types of pin bar.

- Bullish pin bar

- Bearish pin bar

Ideal pin bar characteristics

The wick in an ideal pin bar will be at least 3 times bigger than the body. After the end of the uptrend, we will find a bearish pin bar, and after the downtrend, we will find a bullish pin bar.

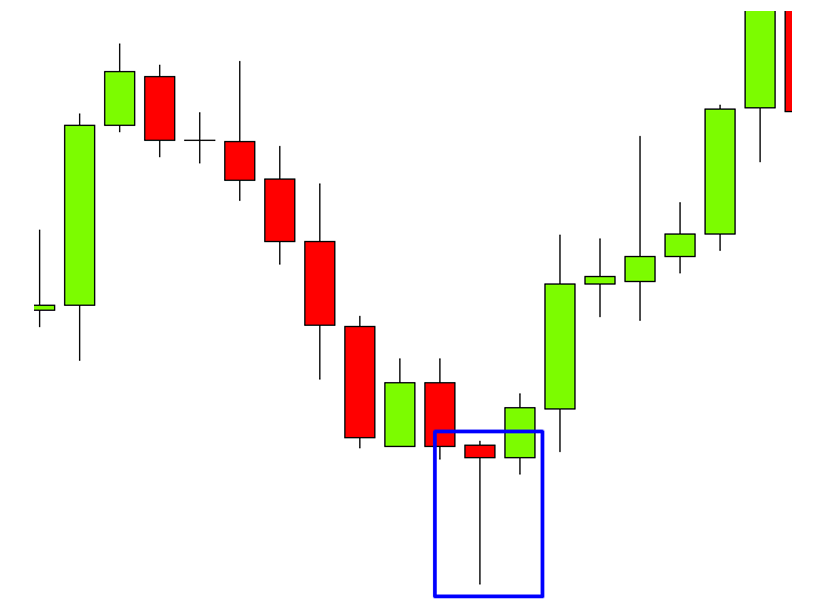

Look at the picture. We find a bullish pin bar that is formed after a downtrend. And the wick is also 4 times bigger than the body. When you find such types of solid pin bars, that is something you should like. A piece of cake. Just take the trade. You will not regret it. The trade is worth taking.

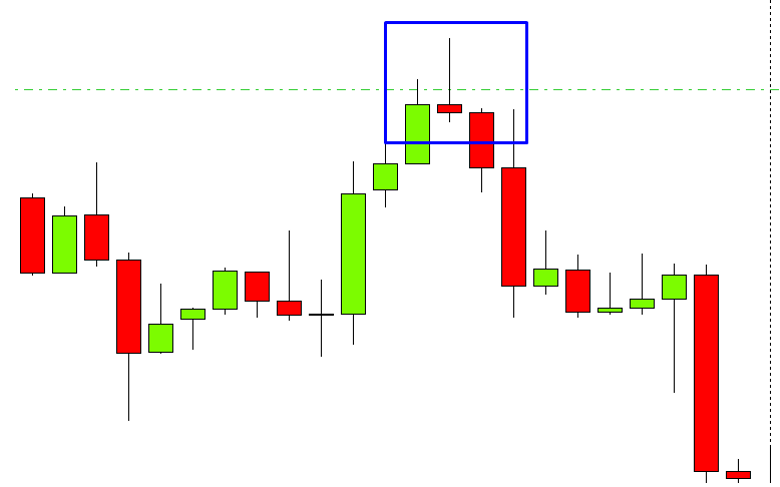

The same rules will be applied to the bearish pin bar. Just look at the strong bearish pin bar.

You find it after the uptrend. And the wick is also three times bigger than the body. See, if you take this trade, the market will give you a bulk amount of pips.

Buying and selling rules

When you find such types of pin bars, then wait for the next candle to break the pin bars low or high. For buy, when it breaks the high, then open a buy trade, your stop loss would be below the low + 10 pips of the pin bar. When the next candle breaks the pin bars low for sell trades, open a sell trade. Your stop loss would be above the pin bar + 10 pips.

For take, profit use a 1:1 risk reward ratio in both buy and sell setup.

Which pin bars should you avoid?

Most traders make a big mistake. They take every trade when they find any pin bars. But remember that there is a pin bar does not mean that there is a trade. A pin bar is only valid when it forms at the end of the trend. Just avoid these setups when you find pin bars in the middle of the trend. If you took these pin bars, then for sure, you will lose those trades.

For example, look at this pin bar.

You find a pin bar that forms in the middle of the trend. But as per your rules, you know that you need to find a bullish pin bar at the end of the downtrend. So you will avoid these types of setups. Secondly, if you find any pin bar whose wick is not at least 3 times bigger than the body, then avoid that setup.

A pin bar is like a sharp knife. If you are not a professional, you will cut your hand with that sword. That way, if you don’t use the pin bar professionally, you will make a huge loss at the end of the day. But if you consider the big picture and follow all the rules I stated above, then the pin bar could be a great weapon to trade like a pro. I hope this strategy will help you improve your trading style!

You can learn about more candlestick chart patterns in my book The Ultimate Guide to Candlestick Chart Patterns.