During Berkshire-Hathaway’s 2021 annual shareholders meeting they were asked by Becky Quick:

“What do you think of quants?”

“Jim Simons Medallion Fund has done +39% net of fees for three decades, which proves that it works.”

Warren Buffett’s response: “But they were very smart.”

Charlie Munger: “Yes, they got very rich. And very high grade by the way, Jim Simons.”

“But we are not trying to make money trading stocks. We don’t think we know how to do it.” Buffett summed up. [1]

It is incredible to see Buffett and Munger admit the greatness of a quant trader like Jim Simons whose firm does use day trading strategies. Buffett and Munger have both dismissed trading stocks and especially day trading in the past. However they can’t deny the success of Jim Simons quant trading record using math and technology to beat the market with speed, timing, and an edge.

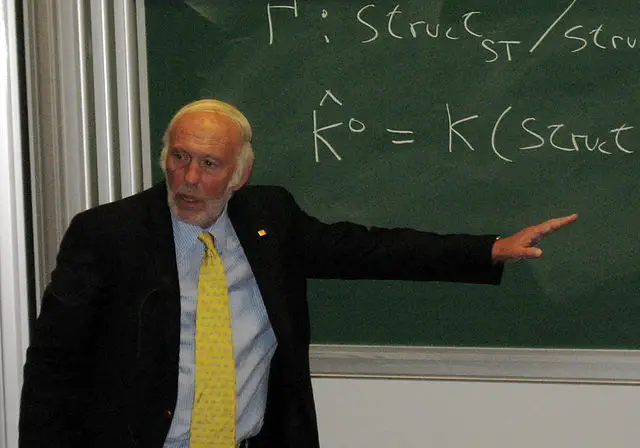

Jim Simons Trading Strategy

Jim Simons’ medallion hedge fund has the best track record of any hedge fund of all time with 62.9% average annual returns before fees. They earned 37.2% annually net of fees for their clients versus the S&P 500 average return of 11% a year during the same period. Simons’ fund has a trading record that beats even Buffett but it is with less capital and over a shorter time period.

Simons is a trained mathematician and quantitative trader and the founder of Renaissance Technologies. His hedge fund specializes in diversified system trading using individual quantitative models derived from statistical analyses of historical price data. His primary models are on pattern recognition. Jim Simons was a mathematics professor from 1968 to 1978, and chair of the mathematics department at Stony Brook University. He started in the hedge fund industry in 1982.

Renaissance Technologies specializes in systematic trading using quantitative models derived from mathematical and statistical analyses. The Medallion Fund was created in 1988, it started to use a better and broader version of Leonard Baum’s mathematical models, that were made even better by algebraist James Ax. It explored the correlations that could be used to create an edge to profit from. The Medallion fund was named by Simons and Ax after the math awards that they had both won.

While he keeps the specific holy grail trading system top secret that the Medallion Fund uses we can get clues from the research Gregory Zuckerman did for his book The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution to understand the principles behind his strategy.

Quantify your edge through backtesting.

Backtesting past historical price data can give you an edge in trading current price action. Markets are traded and invested in by people with emotions and opinions who create patterns. Price action patterns can repeat, learn to find a way to trade those patterns with an edge.

Trade your system with discipline.

“We don’t override the models.” – Jim Simons

After you create a trading system with an edge, you have to trade it consistently with discipline. No trading system will work if it is not followed long enough to let it play out and be profitable. All systems have drawdowns and losing streaks even the ones used by the Medallion fund, all traders have times when they want to override their trading plan, even Jim Simons did this a few times. In the long run all profitable trading requires discipline.

Trade a diversified watchlist for more opportunities.

Be open to looking for trading signals across all liquid asset classes. On a side note, avoid illiquid stocks, options, futures, and crypto currencies due to the dangers of losing money in the bid/ask spreads, not being able to trade with size, and not being able to get in and get out when you want.

Trading different types of signals on a diversified watchlist of markets, stocks, and currencies that backtest well can increase your opportunities to make money in different market environments.

You don’t need a high win rate to make big returns.

“We’re right 50.75 percent of the time… but we’re 100 percent right 50.75 percent of the time. You can make billions that way.” – The Man Who Solved the Market

Jim Simmons models did not need a high winning percentage to make money. If you have a 1:2 or 1:3 risk/reward ratio you can make large returns as long as you don’t have any big losses.

Example of a 1:2 risk/reward with a 50% win rate:

$100+$100+$100+$100+$100-$50-$50-$50-$50-$50=$250 profit

Example of a 1:3 risk/reward with a 50% win rate:

$150+$150+$150+$150+$150-$50-$50-$50-$50-$50=$500 profit

It is the magnitude and frequency of both wins and losses that determine profitability not just win rate. A small edge can make a lot of money over the long term as long as you keep the losses small.

There are universal principles of profitable trading.

No trading system works all time in every market but the principles of profitable trading stay valid. Profitable trading comes down to math, the math of risk management, the math of position sizing to avoid the risk of ruin, modeling of a trading system with a positive expectancy, along with cutting losses short and letting winners run.

The biggest lesson from Jim Simmons is that profitable trading is built on the foundation of math but a human has to have the discipline to follow the math without allowing bad emotions to override a good system.

Jim Simons Net Worth

Jim Simons is currently the richest trader in the world with a $28.6 billion dollar net worth according to Forbes making him the 40th richest person in the world. His wealth was acquired through founding the Renaissance Technologies Corporation hedge fund and the money management fees it produced on capital for its clients and the compounding he made on his own money being invested in the Medallion Fund.

Jim Simons Book

I recently read Greg Zuckerman’s book The Man Who Solved The Market has done a great job giving readers a peak inside the secretive world of Jim Simons and Renaissance Technologies hedge fund operations. Simons did not want this book published but accepted it was going to happen.

Jim Simons belief system started with: “There are patterns in the market, I know we can find them.” With this foundation he hired some of the best mathematicians, statisticians, computer programmers, and scientists to find them. He was successful in finding them.

His fund started out with a successful futures trading system and branched off into other markets including bonds, currencies, and the stock market.

Renaissance was one of the first quantitative hedge funds that compiled a huge data base of end of day and intra-day price action history of financial markets and ran powerful computer backtests on the historical data to find market patterns of correlations and repeating price moves in short time frames based on relationships between catalysts and investors behavior.

His fund reduced the financial markets to a math problem and ignored the fundamentals and focuses on the way prices move. Renaissance makes thousands of trades a day on short time frames from hours to days and makes money on a little over 50% of their trades but their winners are bigger than their losers and the edge creates windfall profits on an astounding risk adjusted basis.

His money making fund is very similar to a casino exercising his mathematical edge over and over with small bets in relation to his total capital. The fund does use leverage but it is for trading in smaller diversified trades in volume not making large bets on any one trade in size.

Jim Simons was a master administrator in hiring the right people for his fund and leading them in the right direction for developing robust trading systems using scientific methods. One of the biggest edges his quant fund had was being one of the first to the market using his method, he had one of the most thorough historical price action data bases, and he removed the human weaknesses of emotions and ego out of his trading method with technology and quantitative analysis.

If you love math and you love trading you will enjoy this book as it takes a deep dive into both. It is an easy and enjoyable read and is written more like a novel than a trading book.

I have read several hundred trading and investing books and I would put this one on my list of the top five trading books every written. This is a unique look into how quantitative trading works. Simons results speak for their self.

If you are interested in trading the price action in the stock market you can check out my best selling books on Amazon here or my eCourses on my NewTraderUniversity.com website here. They could be life changing.