Many of the world’s best investors have been warning about runaway inflation coming to financial markets like Michael Burry, Warren Buffett, and Ray Dalio among others. Consumers have seen this first hand with the explosive move higher in most commodities, food, energy costs, and services. The majority see an inflationary uptrend for the foreseeable future including the Federal Reserve.

Cathie Wood Sees Deflation Returning

Cathie Wood is one of the few contrarians that believe the true black swan event could be deflation. Cathie Wood sees data that she believes backs up her claims.

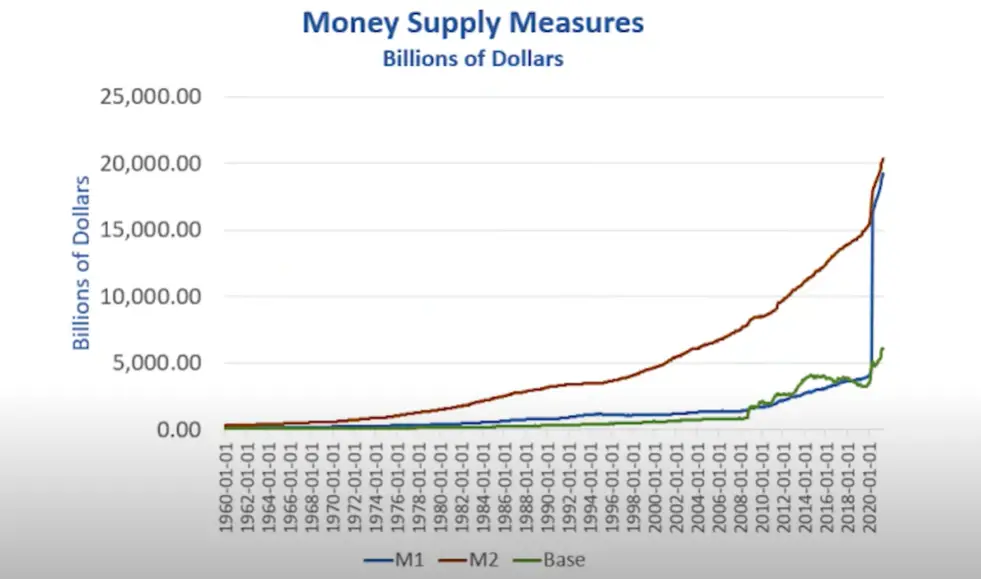

According to Cathie Wood the M1 money supply in the markets is beginning to decline after the huge expansion since the pandemic began. Part of this reversal in money is due to rising interest rates and quantitative tightening by the Federal Reserve as they reduce their own balance sheet of assets. The rate of M2 money growth has also declined from 27% in April to 17% in May.

Cathie Wood Interest Rates

Bonds prices could have been increasing due to the money supply and the drop in prices and rise in yields could be showing money leaving the bond markets. The Federal Reserve buying bonds could have been a driver of lower yields and their winding down of buying could be the cause of rising yields paradoxically showing deflationary pressures in bond and debt pricing.

Cathie Wood expects more inflation short term but deflation after a few more months of inflation. Cathie believes that oil prices will deflate by over -84% from its current price to $3 to $17 a barrel in coming years as electric vehicles are used by the majority of drivers over the next decade. This is why she has been a long term Tesla holder and is long the electric car industry. She believes that OPEC countries are artificially keeping oil prices too high by not producing at their full capacity to support their budgets and creating demand destruction with price. High oil prices are leading consumers to make different decisions about what type of automobile they purchase, how far they live from their job, and whether they use mass transit.

The U.S. Dollar is also increasing purchasing power versus other fiat currencies based on the U.S. Dollar bullish index.

Consumer goods consumption is down -3% month-over-month with a -0.05% decline in non-consumable goods. The use of services is up only 0.04% month-over-month showing a loss of economic growth. Housing starts have begun to decline along with existing home sales going lower for several months in a row. Most commodity chart prices are also down over -20% from their peak prices. She is one of the few portfolio managers not predicting hyperinflation in coming months but the exact opposite: deflation.[1]

Cathie Wood On Bitcoin

Cathie Woods also said in an interview that “Bitcoin is a hedge against inflation and deflation.”

She is the true ultra contrarian in the financial markets who is both right big or wrong big on her monetary, macroeconomic, technology, and investing themes.

For those interested in trading the price action in the markets you can check out my books on Amazon here or my eCourses on my NewTraderUniversity.com website here.