Michael Burry is usually a year or two early in his trades and gets out a few months early but he is usually right in a huge way whether it was his early value stock picks, legendary short mortgage loans trade, Gamestop deep value investment in 2020 or Tesla short in 2021.

Here are a few of his past examples.

Michael Burry did his first subprime-mortgage deals on on May 19, 2005. He bought $60 million of credit-default swaps from Deutsche Bank—$10 million each on six different bonds. [1]

He sold them all by April of 2008 and made $100 million for himself and $700 million for his investors when his bet against the housing market paid off. [2]

In August 2019, Scion Capital announced that it had bought three million shares worth $16.56 million in gaming and electronics retailer GameStop. This means that Burry accumulated shares of Game Stop Stock at approximately $5.52 a share on average.

While he did not capture the parabolic run up in Gamestop (GME) stock to $438 a share in January of 2021 he did accumulate his position in the low single digit prices so he likely doubled, tripled, or quadrupled his money at least whenever he exited in the 4th quarter of 2020. We don’t know when he exited in the fourth quarter but we do know he missed the entire Wall Street Bets/Reddit 2021 run up. He was very close to pulling off the ultimate big long and they would have had to make a new movie if Christian Bale was available again. He was likely very happy to have made the triple digit return on his exit in 2020 as that is the goal of a deep value investor which is his primary methodology.

It appears he gave up on and exited his large positions in Tesla puts and ARKK puts and reduced his holdings dramatically on the last Q3 2021 13F filing as of 9-30-2021. He believed hyper inflation was inevitable but had trouble with his bearish stock bets going against him in the short term causing him to exit. He was very close to having another two huge big short positions pay off exponentially due to the position size and leverage of the put options but was just too early.

Now that we have established how accurate he usually is and how early he is let’s look at some of his recent predictions and what he is seeing on a macroeconomic level.

Michael Burry Warning Tweet

On February 19th, 2021, Burry began warning about inflation and excessive government stimulus.

When he turned bearish in early 2021 he was in the minority, as most people in the financial world were bullish and central banks and politicians believed inflation was transitory.

A the time he warned about inflation it was still under the Federal Reserve’s target rate of 2%.

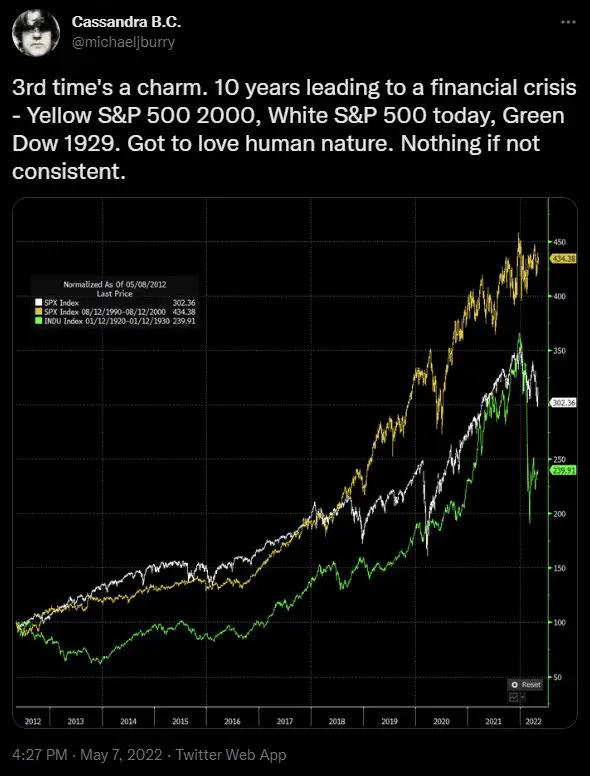

Michael Burry seems to be predicting a market crash in late 2022 in the below tweet. This was tweeted on June 13th, 2022 after the recent majority of the downtrend on stock charts meaning he sees more downside this year.

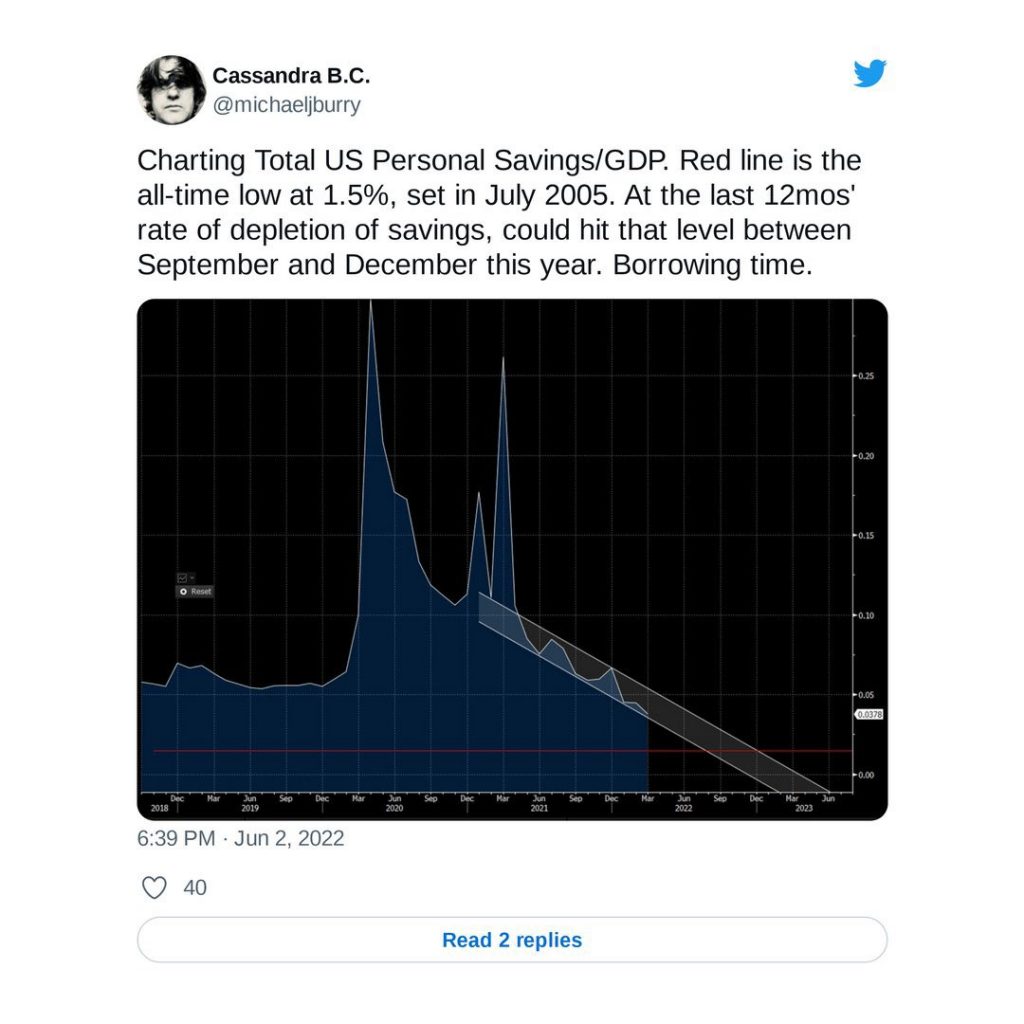

Michael Burry explaining below why he sees a recession coming, consumer depletion of savings.

He explains why he doesn’t like being bearish.

A market crash is considered to be a 50% plunge from the peak and this is what he seems to be hinting at throughout his tweets. He starting thinking and tweeting this about 16 months ago so the time frame of this playing out is in the second half of 2022.

Be aware the biggest rallies happen in bear markets.

How do you short a market crash?

The easiest way to short a market crash is with selling a stock index short like the S&P 500 index by borrowing SPY ETF shares to sell then buy back later at a lower price. I explain this process here.

What is considered a bear market?

A bear market on a chart is considered to begin after a drop of over 20% from the price peak. Once price rallies back from being down from the peak less than 20% it’s considered to have come out of a bear market.