Ray Dalio Short European Stocks

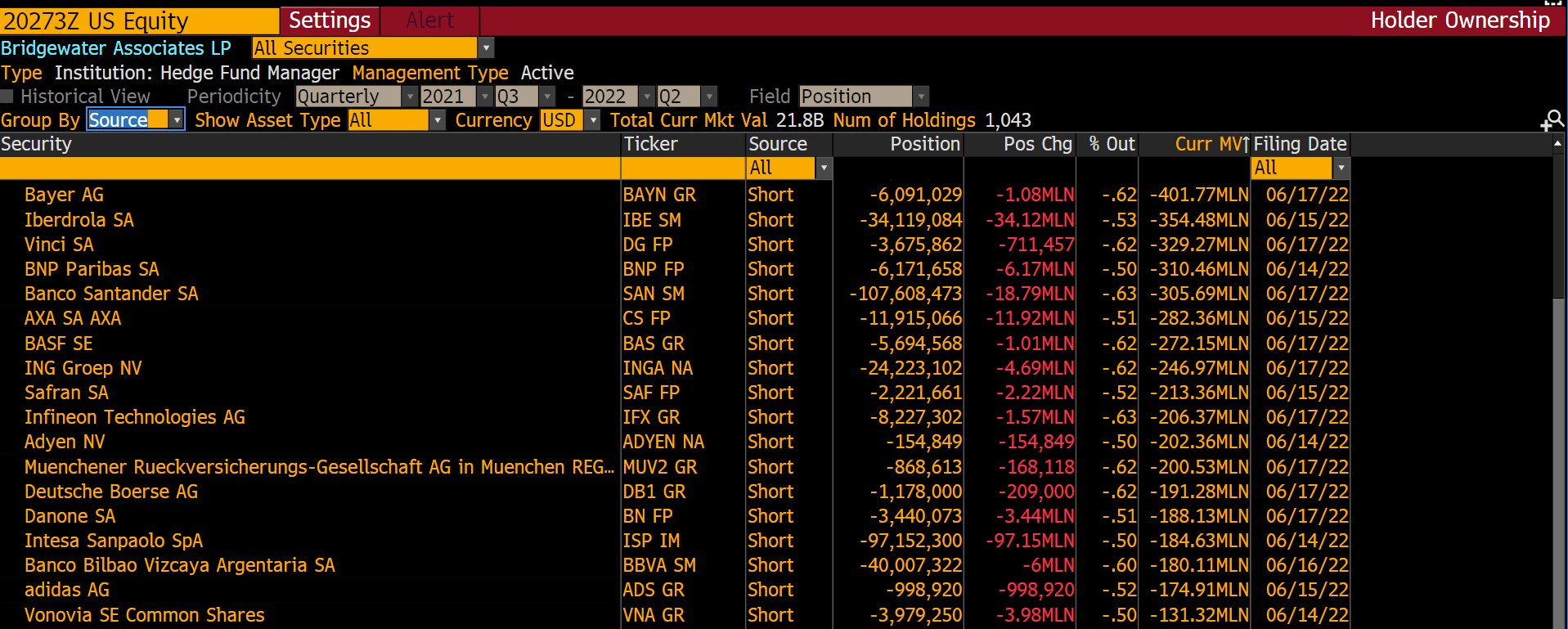

Dalio’s firm Bridgewater Associates has sold short approximately $10 billion in European stocks. The biggest short position being in ASML. [1]

All of the 26 stocks he shorted are based in Europe and are part of the Euro Stoxx 50 which is an index like the U.S. S&P 500 and NASDAQ 100.

Ray Dalio Stagflation

Stagflation is persistent high inflation combined with high unemployment and stagnant demand in a country’s economy.

Ray Dalio says stagflation is likely because the Federal Reserve is failing to “Drive the markets and economy like a good driver drives a car.”

“Central banks should use their powers to drive the markets and economy like a good driver drives a car—with gentle applications of the gas and brakes to produce steadiness rather than by hitting the gas hard and then hitting the brakes hard, leading to lurches forward and backward.” – Ray Dalio [2]

He says “Stagflation will be the cost of reducing inflation.” He says that stagflation will force the Fed to slash interest rates by 2024. “We are in a tightening mode… the pain of that will become great,” Dalio said. [3]

Ray Dalio on the Markets

Ray Dalio says “Cash is still trash… but stocks are trashier.”

During a time when inflation is weighing heavily on real returns, Dalio said investors would be better off with real assets like real estate.

Ray Dalio doesn’t think the Federal Reserve can achieve a soft landing in the economy after it has become so overheated with high asset valuations and inflation. Dalio said that the Fed can not slow down demand without breaking the economy.[4]

Dalio sees inflation evolving into stagflation and the dollar losing its buying power as the Federal Reserve tries to combat inflation that has gotten out of control.