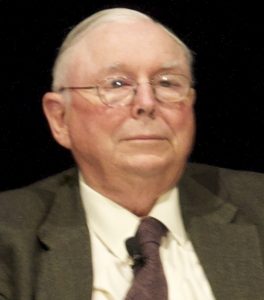

Charlie Munger at 98, remains the vice chairman of Berkshire-Hathaway and partner of Warren Buffett and they both appear at annual shareholder meetings.

Current Charlie Munger Stock Portfolio 2022

Period: Q1 2022

Portfolio date: March 31, 2022 13F filing

Number of stocks: 5

Portfolio value: $212,603,000

Size Rank/Ticker/Company/Portfolio%

- BAC – Bank of America Corp. 44.59%

- WFC – Wells Fargo 36.28%

- BABA – Alibaba Group Holdings 15.35% (Recently reduced his position by 50%)

- USB – U.S. Bancorp 3.50%

- PKX – POSCO 0.27%

Charlie Munger Net Worth

The current Charlie Munger net worth in 2022 is $2.1 billion and he currently ranks #1394 on Forbes Billionaires list.

Most of his wealth was created through his shares in Berkshire-Hathaway. Charlie’s family has 90% or more of its net worth in Berkshire shares. In his personal portfolio Charlie Munger still owns approximately 4370 Berkshire Hathaway class A shares and 643 Berkshire Hathaway class B shares not part of his 13f portfolio filing. [2]

Charlie Munger Quotes

Charlie Munger is looked at for his investment wisdom and philosophies on life here are some of his greatest investing quotes.

“In my whole life, I have known no wise people (over a broad subject matter area) who didn’t read all the time — none, zero. You’d be amazed at how much Warren reads–and at how much I read. My children laugh at me. They think I’m a book with a couple of legs sticking out.” – Charles Munger

One of the best returns you can get on your money is investing in great books to read. Knowledge can change your life if you put what you have learned into action. If you want to be a great investor read the books written by legendary investors.

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, and at the end of the day-if you live long enough-like most people, you will get out of life what you deserve.” – Charles Munger

Compounding growth is one of the most powerful forces in investing and for personal growth.

“There is no better teacher than history in determining the future… There are answers worth billions of dollars in a $30 history book.” –

Historical patterns repeat, if you can research the patterns of the past they will help you make good investment decisions today.

“We all are learning, modifying, or destroying ideas all the time. Rapid destruction of your ideas when the time is right is one of the most valuable qualities you can acquire. You must force yourself to consider arguments on the other side.”- Charles Munger

Always stay open minded and accept the possibility that you could be wrong. Stay flexible with your investment decisions and accept when things have changed or you are wrong and make adjustments.

“It takes character to sit with all that cash and to do nothing. I didn’t get top where I am by going after mediocre opportunities.” – Charles Munger

Cash is a position and when there are no better places to put your money, it is the best position. Only put money at risk when there is a great opportunity.

“What are the secret of success? -one word answer :”rational” – Charles Munger

Successful investors are rational. Reason and logic in investing beat emotions, predictions, and opinions.

“I believe in the discipline of mastering the best that other people have ever figured out. I don’t believe in just sitting down and trying to dream it all up yourself. Nobody’s that smart.” –

Focus on learning from the best investment minds in history. Model your own investment strategy after the investors that most fit your own risk tolerance, return goals, and beliefs about the markets.

“If you don’t get this elementary, but mildly unnatural, mathematics of elementary probability into your repertoire, then you go through a long life like a one-legged man in an ass-kicking contest.” – Charles Munger

Understanding basic probability is one of the most important math skills for an investor to possess.

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments. And that is why we say that having a certain kind of temperament is more important than brains. You need to keep raw irrational emotion under control. You need patience and discipline and an ability to take losses and adversity without going crazy. You need an ability to not be driven crazy by extreme success.” – Charles Munger

Emotional intelligence is more important than IQ in investing. Without patience and discipline no investing strategy will work. Overcoming adversity during losing streaks and not becoming arrogant with success are mental skills an investor must have.

“Crowd folly, the tendency of humans, under some circumstances, to resemble lemmings, explains much foolish thinking of brilliant men and much foolish behavior.” – Charles Munger

The majority can be wrong no matter how strongly they believe something. Ignore the noise of the crowd and follow your own investing methodology.