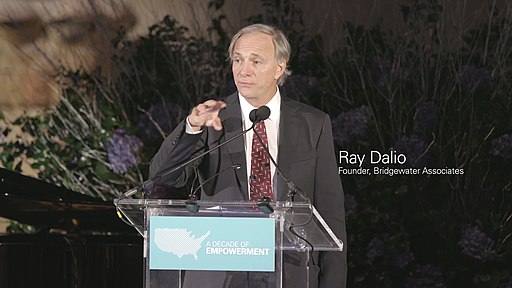

Ray Dalio founded Bridgewater Associates in 1975 and grew it into one of the world’s largest hedge funds by 2005. As of 2022 his hedge fund has 107 clients with over $235.5 billion in total assets under management. Ray Dalio is ranked the 67th richest person in the world according to Forbes with a net worth of approximately $22 billion.

Ray Dalio Market Predictions

At the 2022 World Economic Forum in Davos, Switzerland, Ray Dalio made clear he believes that “cash is trash.” He elaborated: “Of course cash is still trash. You know how fast you are losing buying power in cash? Equities are trashier.”

Dalio believes that the next two to four years will see both global economic and political systems change in unpredictable ways as so many uncertain events play out in geopolitics and supply chains.

Ray Dalio said the U.S. dollar is on the verge of devaluation on a level last seen in 1971 and that China is threatening the greenback’s role as the world’s reserve currency.

Ray Dalio sees three primary trends driving the markets in 2022:

- Continued Inflation: The creation of enormous amounts of debt, and the monetization of that debt, which is having its affects as runaway inflation.

- Political Risk: The second is the amounts of internal conflicts that are going on, populism of the left and populism of the right due to the largest wealth gaps and values gaps. That internal conflict is having a big effect on the division of the U.S. and other Western countries. Unionization of corporations and a labor shortage are very strong trends as workers demand a fair share of corporate profits.

- Geopolitical Risk: And the third thing is a world power conflict — the rising of China as a super power and the relative decline of the United States in influence in world politics. This power struggle is seen in the conflict between different power sources in the Russian-Ukraine-NATO conflict. [1]

What does Ray Dalio say to invest in?

He believes the best tactic for investors to ensure risk management and asset performance is diversification across asset classes, sectors, and geography.

“I want a highly diversified portfolio of assets that are not cash and bonds. I want geographic diversification as much as I want asset class diversification.” – Ray Dalio [2]

Two of his most recent portfolio additions are The Beauty Health Company, ticker SKIN and Trimble navigation, ticker TRMB.

The Beauty Health Company takes a health-centered approach, and focuses on promoting healthy skin as the root of beauty; it’s products fill the gap between traditional cosmetics and medicinal skin treatments.

Trimble Navigation supplies software, hardware, and support services to industries, like agriculture, building and construction, geospatial, government, transportation, and utilities, connecting the physical and digital worlds. Their products include global navigation satellite system receivers, inertial navigation systems, laser rangefinders, unmanned aerial vehicles, scanners, and software processing tools.

However Dalio holds a wide variety of different positions and believes that diversification is his holy grail of investing as he explains here:

What does Ray Dalio think of Bitcoin?

In an environment of fiat currency devaluation and inflation bitcoin, with its gold-like properties, looks increasingly attractive as a savings vehicle, said Dalio. [3]

Dalio confirmed in May that he personally owns some Bitcoin, he has previously said that it’s “too volatile.” He also has expressed concern over the potential for the government banning it and its use in criminal enterprises like ransomware attacks.

“There are two purposes of money: A medium of exchange and a store holder of wealth. And Bitcoin is not effective in either of those cases now,” Dalio said in 2020 at the World Economic Forum in Davos.

Dalio has taken a small position in Bitcoin and is investing in a crypto company but he still sees Bitcoin as an unproven digital asset with a lot of potential in the future as volatility decreases and the price stabilizes.