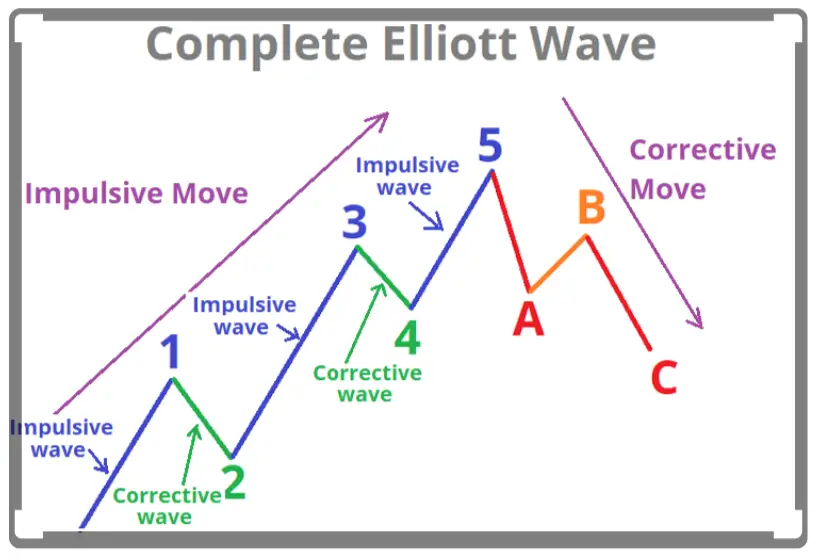

The Elliott Wave theory is a method of technical analysis that tries to quantify repeating long-term price action patterns correlated to changes in market psychology and sentiment. This theory attempts to identify primary impulse waves showing the long-term chart trend and also corrective reversal waves that are inverse to that larger trend.

Elliott Wave Principle

This market theory attempts to forecast market trends by identifying the extremes in trader’s collective psychology that create the highs and lows in price action. It looks for areas of exhaustion by buyers and sellers inside trends with inverse swings in price action.

Elliott Wave definitions below assume a bullish stock market; the characteristics apply as the inverse in bear markets.

Elliott Wave Pattern

Elliott Five Wave Pattern

Wave 1: Wave one is rarely obvious at the beginning. When the first wave of a new bull market begins, the fundamental news is almost universally negative. The previous trend is considered still strongly in force. Fundamental analysts continue to revise their earnings estimates lower; the economy probably doesn’t look strong. Sentiment surveys are decidedly bearish, put options are popular, and implied volatility in the options market is high. Volume might increase a bit as prices rise, but not by enough to alert many technical analysts.

Wave 2: Wave two corrects wave one, but can never extend beyond the starting point of wave one. Typically, the news is still bad. As prices retest the prior low, bearish sentiment quickly builds, and the majority reminds everyone through social media and television that the bear market is still deeply in place. Still, some positive signs appear for those who are looking: volume should be lower during wave two than during wave one, prices usually do not retrace more than 61.8% of the wave 1 gains, and prices should fall in a three wave pattern.

Wave 3: Wave three is usually the largest and most powerful wave in a trend, although some research suggests that in commodity markets, wave five is the largest. The news is now positive and fundamental analysts start to raise earnings estimates. Prices rise quickly, corrections are short-lived and shallow. Anyone looking to get in on a pullback will likely miss the move. As wave 3 starts, the news is probably still bearish, and most market players remain negative; but by wave 3’s midpoint, the crowd will often join the new bullish trend. Wave 3 often extends wave 1 by a ratio of 1.618:1.

Wave 4: Wave four is typically clearly corrective. Prices may meander sideways for an extended period, and wave four typically retraces less than 38.2% of wave 3. Volume is well below than that of wave 3. This is a good place to buy a pull back if you understand the potential ahead for wave 5. Still, 4th waves are often frustrating because of their lack of progress in the larger trend.

Wave 5: Wave five is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave 5 than in wave 3, and many momentum indicators start to show divergences, prices reach a new high but the indicators do not reach a new peak. At the end of a major bull market, bears may very well be ridiculed, recall how forecasts for a top in the stock market during 2000, 2007, and 2020 were all rejected.

Elliott Wave Corrective Patterns

Three wave pattern the corrective trend

Wave A: Corrections are typically harder to identify than impulse moves. In wave A of a bear market, the fundamental news is usually still positive. Most analysts see the drop as a correction inside an active bull market. Some technical indicators that accompany wave A include increased volume, rising implied volatility in the options markets and possibly a turn higher in open interest in related futures markets.

Wave B: Prices reverse higher, which many see as a resumption of the now long-gone bull market. Those familiar with classical technical analysis may see the peak as the right shoulder of a head and shoulders reversal pattern. The volume during wave B should be lower than in wave A. By this point, fundamentals are probably no longer improving, but they most likely have not yet turned negative.

Wave C: Prices move impulsively lower in five waves. Volume picks up, and by the third leg of wave C, almost everyone realizes that a bear market is firmly entrenched. Wave C is typically at least as large as wave A and often extends to 1.618 times wave A or beyond.

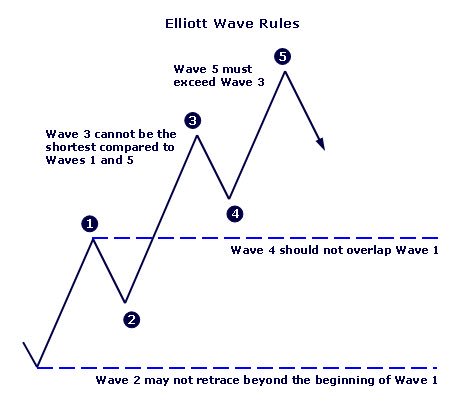

Elliott Wave Rules

A correct Elliott wave count must observe three rules:

- Wave 2 never retraces more than 100% of wave 1.

- Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

- Wave 4 does not overlap with the price territory of wave 1, except in the rare case of a diagonal triangle formation.

A common guideline called alternation observes that in a five-wave pattern, waves 2 and 4 often take alternate forms; a simple sharp move in wave 2, for example, suggests a complex mild move in wave 4. Corrective wave patterns unfold in forms known as zigzags, flats, or triangles. In turn these corrective patterns can come together to form more complex corrections. Similarly, a triangular corrective pattern is formed usually in wave 4, but very rarely in wave 2, and is the indication of the end of a correction.

*In reference to Wave 5 must exceed wave 3: Robert Prechter and other Elliott Wave practitioners say Wave 5 can be truncated. It is less common but allowable.

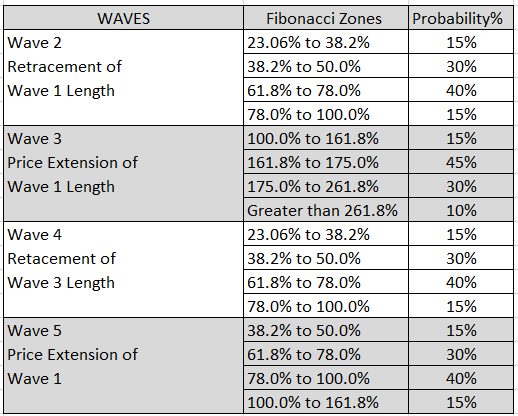

Elliott Wave Fibonacci

Below is a list of the different waves, the correlation to their Fibonacci zones to look for along with the probability that they will fall within different parameters based on price action research.

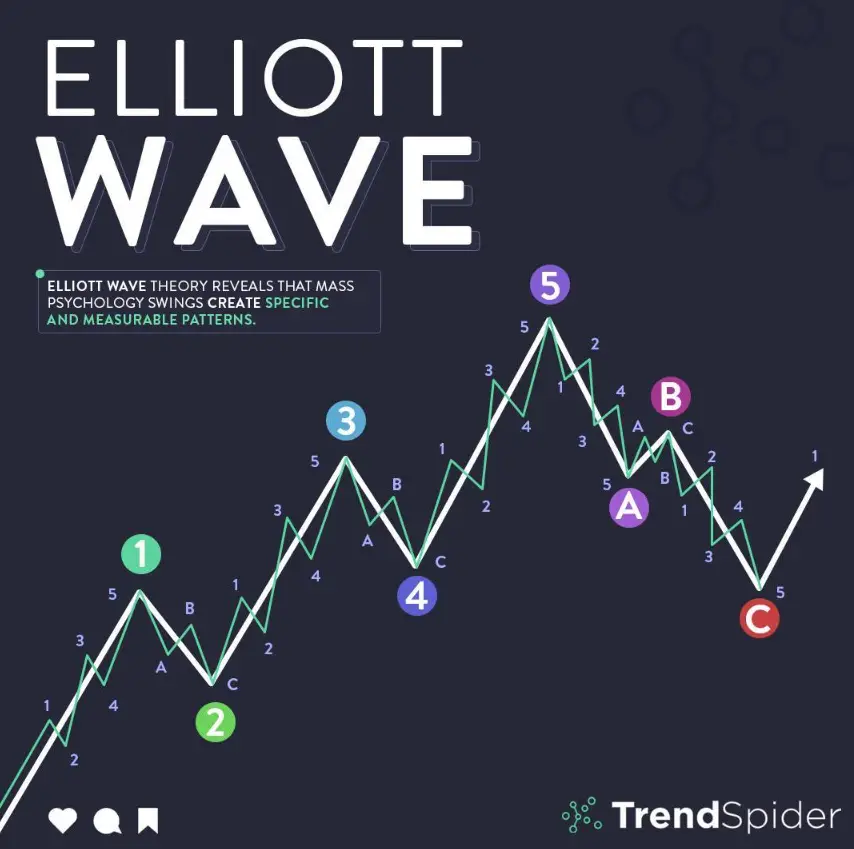

Elliott Wave Cheat Sheet

Elliott waves can occur on all time frames with patterns inside pattern as seen here.

Image courtesy of TrendSpider.com

For a more in depth look and understanding how to use technical analysis in your trading you can check out my book The Ultimate Guide to Technical Analysis here.