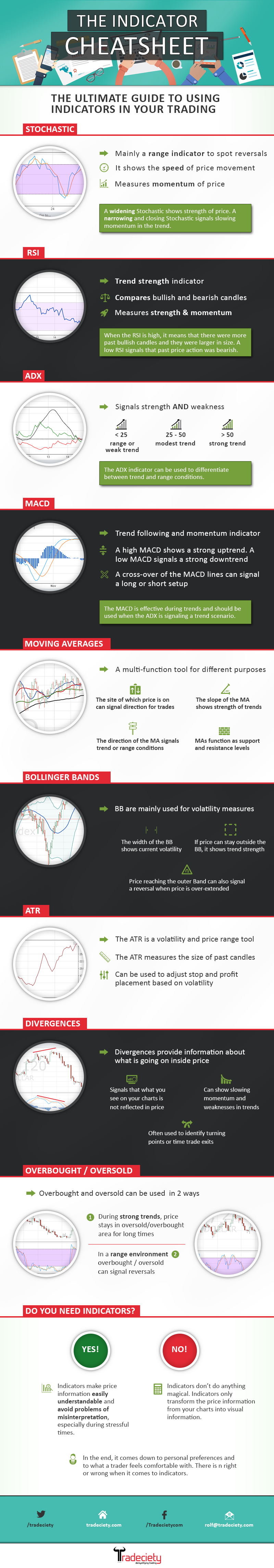

Here is a great technical indicators cheat sheet graphic created by Tradeciety.com

What are the 4 types of indicators?

Trend Indicators

These indicators measure the direction of price action through quantifying uptrends and downtrends on a chart. They include moving averages and parabolic SAR.

Momentum Indicators

These indicators measure the magnitude and strength of movement of price action on a chart. They include the Stochastic Oscillator and RSI.

Volatility Indicators

These indicators quantify the size of the trading range on a chart. They include Bollinger Bands and ATR.

Volume Indicators

These indicators quantify the price action in correlation to the volume. They include On Balance Volume and Volume Rate of Change.

What are the main technical indicators?

Stochastic

RSI

ADX

MACD

Moving Averages

Bollinger Bands

ATR

Divergences

Overbought/Oversold

On Balance Volume (OBV)

What are technical indicators strategies?

Technical indicators are tools used to quantify entry and exit signals to create good risk/reward ratios for trades. They are ways to measure risk by setting stop losses and set profit targets. They can be used to build strategies using them as filters inside a price action trading system.

For a more in depth step by step understanding of how to use indicators you can check out my book The Ultimate Guide to Technical Analysis here.