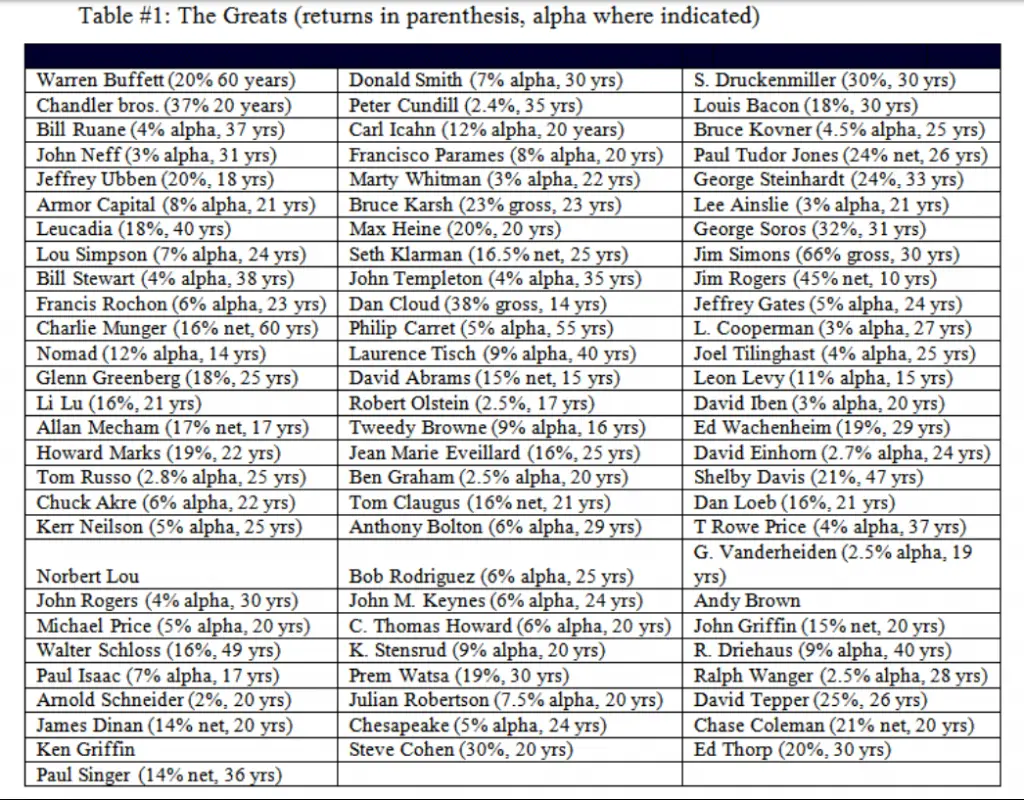

Image source www.dakotavalue.com

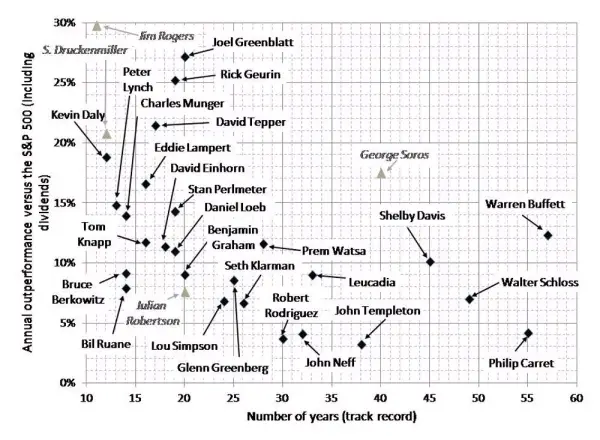

This chart shows top investors returns or their Alpha versus the market returns.

What is Alpha Return?

Alpha (α) is used in investing as a measure of performance of returns of an investment or investor returns that are higher than a relative benchmark index. Alpha is the term used in investing to describe an investment strategy’s ability to beat the average market returns with an edge. Alpha refers to excess return or abnormal rate of return is in contrast to the academic theory that markets are efficient and no way to beat them consistently.

Top 10 Investors

Alpha returns above the market charted in time.

Image via AAII

The top ten investors of all time based on both their magnitude and duration of alpha returns.

- Warren Buffett

- George Soros

- Shelby Davis

- Joel Greenblatt

- David Tepper

- Walter Schloss

- Glenn Greenberg

- Walter Schloss

- Seth Klarman

- Prem Watsa

Top Investment Strategies

Payoffs

Top investors look for huge upside potential payoffs in their investments. They want good risk/reward ratios in their investments at entry with a margin of safety in their measurable downside risk but virtually unbounded upside reward potential.

Sameness

The best investors like to bet on what will stay the same in a business over time. A durable edge a business has over its competitors can allow it’s price to appreciate and grow over the long term as patterns of value, price, and growth repeat in the markets historically.

Value Investing

Value investing is one of the most popular strategies with the top investors with approximately 65% using it to beat the market. The art of value investing is simply looking to buy dollars in value for pennies on the dollar on companies that are punished more than they should be in price depreciation. Value investors want an almost certainty that a stock price will revert to its true business value over time.

Deep Value

Deep value is looking at companies trading in the 7-10 time earnings ratio. These are companies that could have real business issues and more dangerous to own. This was Benjamin Graham’s original strategy looking for companies even trading below intrinsic value and worth more in liquidation of assets than the current stock price. It is like trying to get a few last puffs out of a cheap used cigar. Most deep value investments are short term just looking for a reversion to the mean of value.

Eternal Recurrence

Many of the top investors create their own strategies that use recurring market patterns around fundamentals and valuations. They look at what happened in the past to look at the best probability that will happen in the future.

All the best investors have created their own edge in the markets that allows them to beat it consistently through math, discipline, and consistency in action.