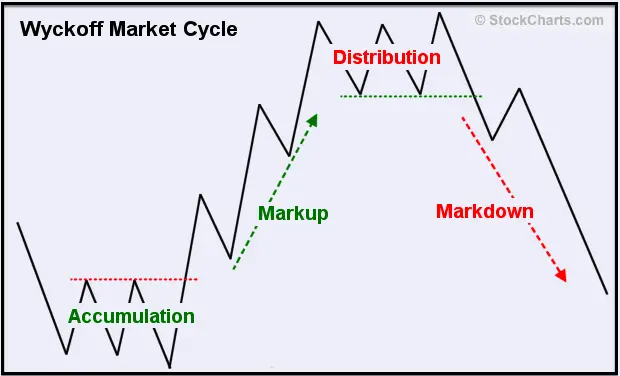

The four stages of a market cycle on a long-term chart are the phases of accumulation, uptrend, distribution, and downtrend. All markets tend to eventually go through all four of these phases as a full cycle plays out from the lows to the highs and back lower again.

Accumulation Phase

Accumulation occurs after the market has found a bottom and value investors and dip buyers begin to buy after the low is in, both believing the worst is over. The value investors like the low price of stocks versus the fundamental value of the companies and the traders buy the dip based on oversold technical readings on the chart. Hope is the primary emotion during this phase.

Uptrend Phase

Charts begin making higher highs and higher lows during the markup phase. This occurs after the market has put in a low price that has held and then creates a defined trading range over time before breaking out over resistance and moving higher in price. This is the phase that growth investors become interested in buying companies that could be new market leaders based on their revenue and products, momentum traders buy technical breakouts, and trend traders start trading the long side of the chart. Greed is the primary emotion during this phase.

Distribution Phase

The distribution phase begins as sellers take profits and charts fail to make new higher highs and begin to go sideways. Profit taking dominates this part of the cycle as charts reach their peak and bearish chart patterns form like the Head and Shoulders or a Double Top. Doubt is the primary thinking during this phase.

Downtrend Phase

The downtrend phase occurs when the price on the chart is making lower highs and lower lows due to relentless selling pressure. This the phase where stop losses are triggered causing lower and lower prices and rallies fail to go higher and are used as selling opportunities for holders. Fear is the primary emotion during this phase.

Stock Market Trading Cycle

It is important to know what phase of the market you are trading is in to understand the best strategy to use.

Basic trading strategies:

Buy support and short resistance in a rangebound market during accumulation and distribution phases.

Buy pullbacks and breakouts in an uptrend.

Short rallies and breakdowns in a downtrend.