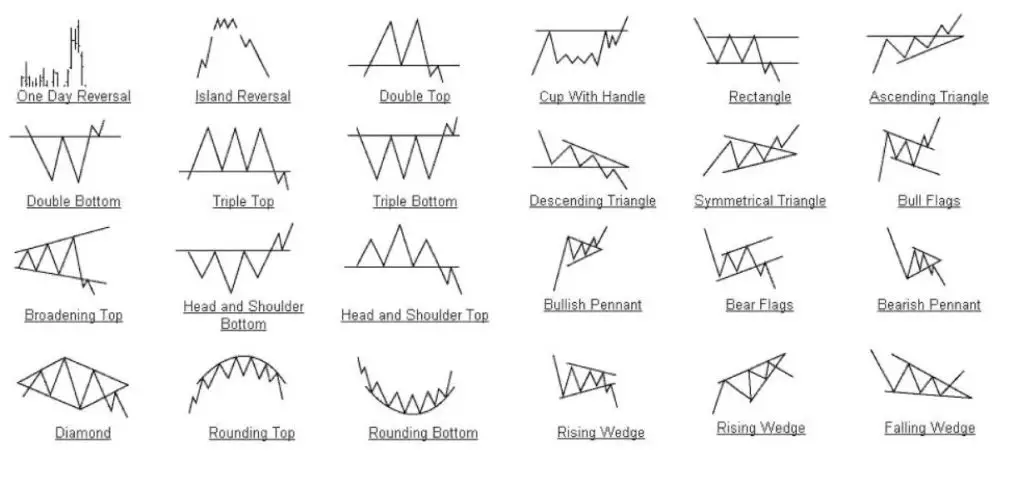

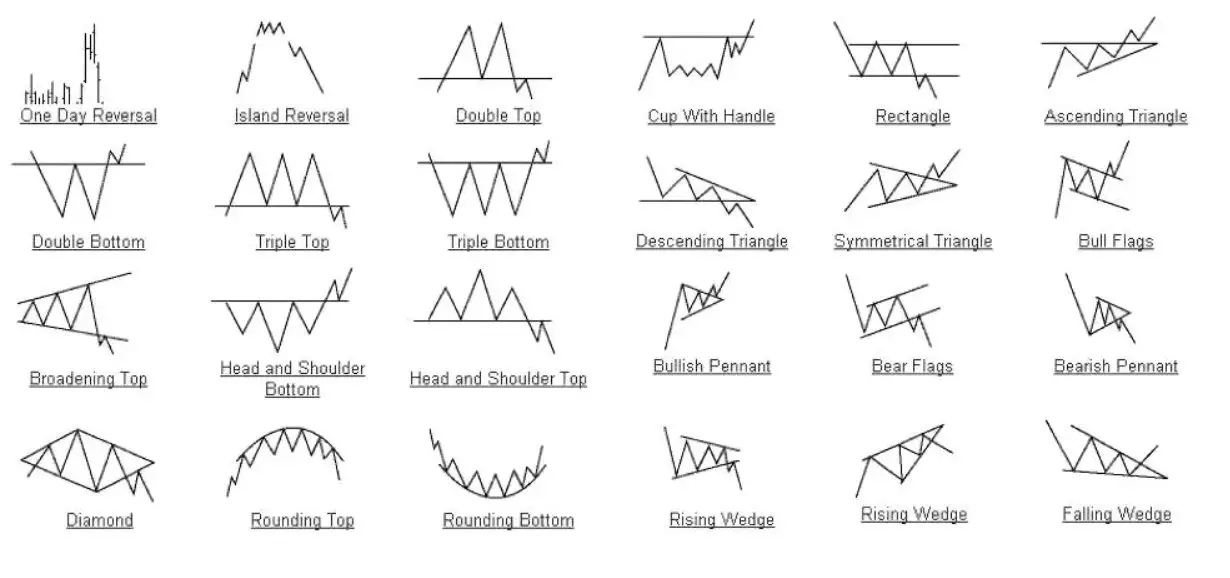

There are many different types of chart patterns in technical analysis. These patterns can show a chart is in an uptrend, a downtrend, going sideways or signal a potential reversal. The purpose of these patterns are to identify the path of least resistance so a trader can align their position in the direction of the highest potential for profits. The best use of chart patterns is to identify high probability entry points and show levels to set stop losses and profit targets to create good risk/reward ratios.

Bullish Chart Patterns

- Double bottom

- Triple bottom

- Rounding bottom

- Diamond bottom

- Bullish Flag

- Bullish Pennant

- Cup with Handle

- Ascending Triangle

- Symmetrical Triangle

- Measure Move Up

- Ascending Scallop

- 3-Rising Valleys

Bearish Chart Patterns

- Double top

- Triple top

- Rounding top

- Rectangle top

- Head and Shoulders top

- Bearish Flag

- Bearish Pennant

- Inverted Cup with Handle

- Descending Triangle

- Rising Wedge

- Falling Wedge

- Descending Broadening Wedge

- Diamond

- Measured Move Down

- Descending Scallop

- Three Falling Peaks

- Island Reversal

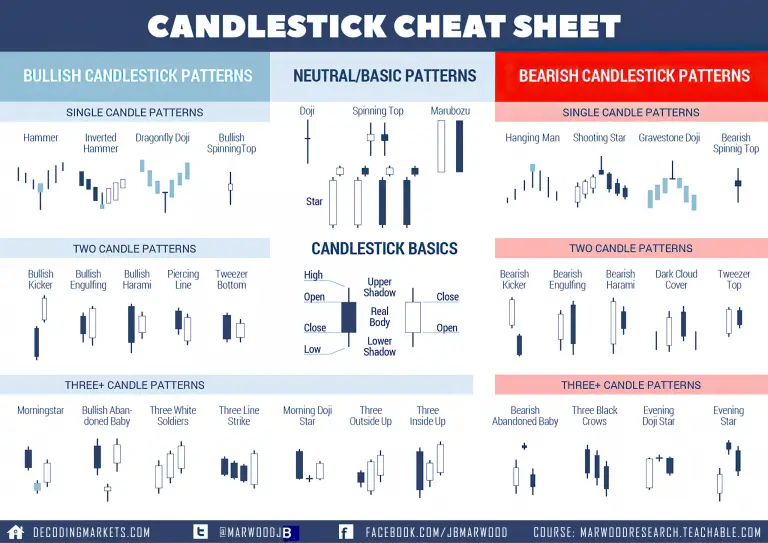

Candlestick Chart Patterns Cheat Sheet

Bullish Candlestick Patterns

- Hammer

- Inverted Hammer

- Dragonfly Doji

- Bullish Spinning Top

- Bullish Kicker

- Bullish Engulfing

- Bullish Harami

- Piercing Line

- Tweezer Bottom

- Morning Star

- Bullish Abandoned Baby

- Three White Soldiers

Bearish Candlestick Patterns

- Hanging Man

- Shooting Star

- Gravestone Doji

- Bearish Spinning Top

- Bearish Kicker

- Evening Star

- Bearish Engulfing

- Bearish Harami

- Dark Cloud Cover

- Tweezer Top

- Bearish Abandoned Baby

- Three Black Crows

- Evening Doji Star

- Evening Star

For a deeper look into all these different technical analysis patterns you can check out my books on chart patterns, candlestick patterns, and technical analysis here.