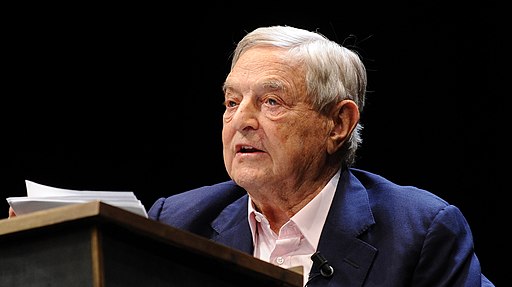

George Soros is a legendary trader with average annual returns of 29% during his 34 years as a hedge fund manager. He is known as “The Man Who Broke the Bank of England” because of his short sale of $10 billion (US) worth of pounds sterling, which made him a profit of $1 billion during the 1992 Black Wednesday UK currency crisis. Soros formulated the General Theory of Reflexivity for capital markets based on his own education in philosophy, he says it shows a clear picture of asset bubbles and fundamental/market value of securities, as well as value discrepancies used for shorting stocks. [1]

George Soros Portfolio

Below is Soros last position update after his 2022 Q1 update. This is a breakdown of his top 25 trading and investing portfolio positions from his fund’s 13F filings as of the 1st quarter of 2022 on 3/31/21. His top 10 holdings have a concentration of 48.93% of the total portfolio. George Soros top position is Rivian at 15.16%.

George Soros Top Holdings

Position Rank/Ticker/Percentage of portfolio[2]

- RIVN 15.16%

- QQQ(PUT) 5.52%

- LBRDK 5.49%

- RIVN(CALL) 4.62%

- CERN 3.89%

- AMZN 3.51%

- DHI 3.42%

- DEBT-SNAP(PRN) 2.56%

- SPY(PUT) FINANCE 2.40%

- DEBT-AMER(PRN) 2.36%

- DEBT-SEA(PRN) 2.11%

- ARMK 2.07%

- GOOGL 2.04%

- MGP REAL ESTATE 1.95%

- ZNGA 1.86%

- DEBT-SEA(PRN) 1.76%

- DEBT-ROYA(PRN) 1.72%

- DEBT-DISH(PRN) 1.64%

- BOWL 1.52%

- DEBT-WAYF(PRN) 1.44%

- SPY(CALL) 1.37%

- DEBT-MICR(PRN) 1.24%

- DEBT-NCL(PRN) 1.13%

- DEBT-CINE(PRN) 0.97%

- FIGS 0.95%

Current George Soros Net Worth 2022

He is currently ranked as the 226th richest person on Forbes list of wealth by rank. His current net worth is approximately $8.6 billion.