The average return for the stock market is generally measured using the S&P 500 index that holds over 500 of the biggest and most successful companies in the United States. Since 1957, when the S&P 500 was created it has returned an average of 10.31% a year counting all reinvested dividends and capital gains over the past 65 years.

The beginning of the first iteration of the S&P 500 index goes back to 1923 in its original form, when Standard & Poor’s introduced a series of indices that included 233 companies and covered 26 industries. The S&P 500 in it’s current form as an index was introduced in 1957.

What is a good stock market average return?

A return of 10% to 12% is considered a good annual return on capital in the stock market. Anything over 12% is considered outstanding. Over 20% is world class and similar to the returns of investing legends like Warren Buffett. There are Stock Market Wizards with annual returns between 40% – 100% but that is rare and even they don’t do that every year.

Average stock market return last 5 years

The 5-Year (2017-2021) average return of the S&P 500 has been 18.55%.

Average stock market return last 10 years

The 10-Year (2012-2021) average return of the S&P 500 has been 16.58%.

Average stock market return last 20 years

The 20-Year (2002-2021) average return of the S&P 500 has been 9.51%.

Average stock market return last 30 years

The 30-Year (1992-2021) average return of the S&P 500 has been 10.66%.

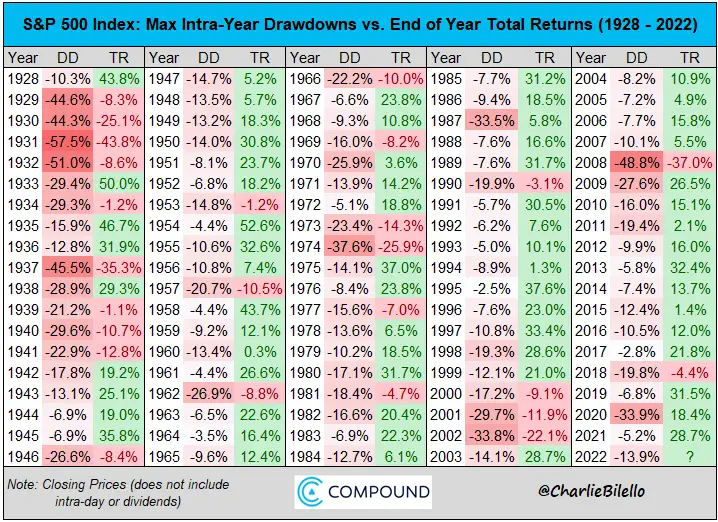

S&P 500 Index Returns and Drawdowns

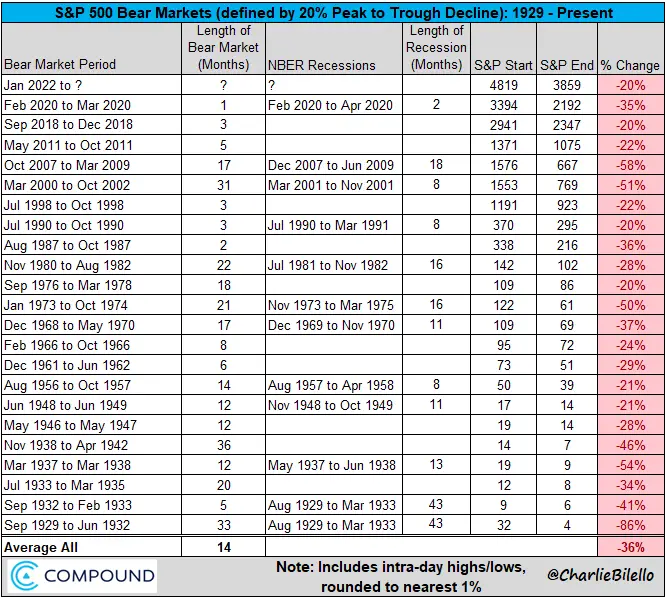

Bear Markets in History