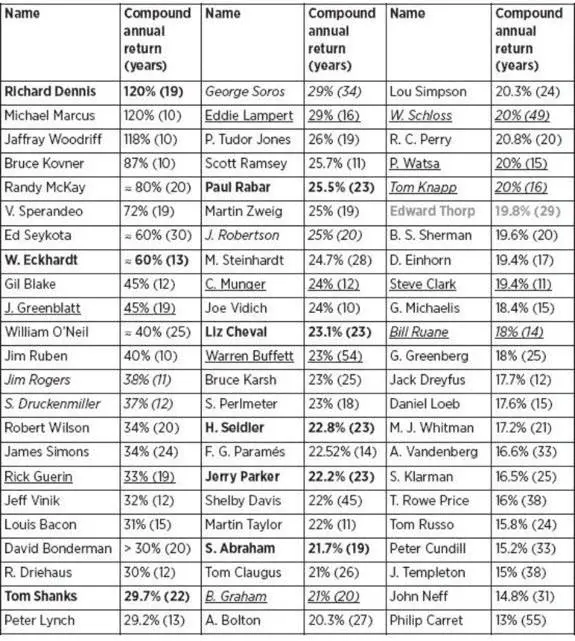

The best traders of all time should be measured by average annual returns, duration of years for those returns, and the amount of capital under management. Below is a chart of the best traders of all time based on these factors.

Here is more information about the top five traders on this list with the biggest annual returns for over a decade.

Richard Dennis

Market Wizard Richard Dennis was a legendary commodities trader nicknamed the “Prince of the Pit.” Early in his trading career in the 1970s, he was loaned $1,600 and is said to have grown it into $200 million in approximately a decade of trend following trading. He traded a lot of breakouts and momentum signals in his time frame and would let his winners run. He traded with size and benefited from the leverage that futures contracts allowed him for huge growth and compounding of capital.

Richard Dennis also partnered with William Eckhardt to create the famous Turtle Traders program that set out to prove whether good traders could be trained or if they just had natural born talent. The Turtle Traders program was both successful in training some world class traders that went on to manage their own funds and also found what appeared to be new traders with inherent talent for following systems.

Michael Marcus

Michael Marcus is a legendary commodities trader who is reputed to have turned his first $30,000 into $80 million.in less than 20 years. Marcus learned money management rules from Ed Seykota, who he met when working as an analyst. Marcus eventually became an executive vice president at Commodities

Marcus was featured by author Thomas A Bass, in his book The Predictors: How a Band of Maverick Physicists Used Chaos Theory to Trade Their Way to a Fortune on Wall Street. Marcus was also interviewed by Jack Schwager in the book Market Wizards. Marcus was described as a chartist who “keeps an eye on market penetration and resistance.” [1]

Jaffray Woodriff

Jaffray Woodriff knew three things: He wanted to be a trader; he wanted to use a computerized approach, and that he wanted to do it differently than others. Most futures traders (CTAs), use trend-following methodologies. Their systems seek to identify trends and take a position in the direction of that trend until their stop loss or trailing stop is signaled. A smaller number of systematic CTAs use mean reversion strategies. These types of systems seek to take trades opposite the trend when their system signals that the trend is overextended.

There is a third category of systematic approaches whose signals don’t seek to profit from either continuations or reversals of the trend. These types of systems are designed to identify patterns that show there is a greater probability for either higher or lower prices over the short term. Woodriff is among the few CTAs who use pattern-recognition approaches, and he does it using his own unique methodology. He is one of the most successful practitioners of systematic trading of any type in the financial markets. [2]

Woodriff is the co-founder and CEO of Quantitative Investment Management (QIM), a $3 billion hedge fund.

Bruce Kovner

Bruce Kovner was one of the biggest traders in the world in the interbank currency and futures markets during his career according to author Jack Schwager. He is the founder and chairman of Caxton Associates, a global macro hedge fund. Kovner retired from the hedge fund in 2011 after managing it for over 30 years.

In 1987 he had profits of over $300 million in the funds he managed. Kovner had a compounded average 87% annual return in the ten year period before he was featured in the Market Wizards book in 1989. Just $2,000 invested with Kovner in early 1978 would have grown to being over $1,000,000 ten years later through the magic of compounding returns.

Bruce Kovner’s current net worth is approximately $6.2 billion dollars.

Randy McKay

Randy McKay is an enormously successful trader who started his trading career by turning $2,000 into $70,000 in the newly formed currency futures market at the time. Randy McKay eventually parlayed his stake of under $10,000 into over $10 million over a 20-year period.

McKay’s style is different than most traders as he uses fundamentals in an unconventional way, which was a pivotal component to his success.

“I watch the market action using fundamentals as a back-drop. I don’t use fundamentals in the conventional sense, that is, I don’t think: supply is too large and the market is going down. Rather I watch how the market responds to fundamental information.” – Randy McKay (Market Wizards by Jack Schwager)

McKay didn’t fight price action but embraced it. He was not greedy and aimed to take the easy part of trades, and he was patient when it came to placing his trades. An unemotional, patient and objective plan for trading with an edge in the markets is the only way to be consistently profitable and McKay mastered his own strategy for huge gains.[3]

Final Comments

These total return records are really instructive to see what is possible in the financial markets with trading and investing. Also, what is unlikely as new traders become unrealistic about potential for returns and how consistent they will be. There are two lessons: the first is that it is possible to become wealthy as a professional trader or investor in the markets, and the second one is that the best traders in history returned between 12% – 120% annual returns over long periods of time and you must be among the best to get to this level.

To learn more about the principles that rich traders use check out my book New Trader, Rich Trader.