What is the best ETF to hold long term between SPY and VOO? Over the long term VOO slightly outperforms SPY by an average of 0.01% a year based on management expenses, yield, and likely the timing of how they track the underlying S&P 500 index when it changes holdings. VOO would be the best choice for buy and hold investors.

SPY vs VOO Expense Ratio

SPY ETF expense ratio is 0.09% and VOO has a 0.04% expense ratio as VOO charges less for management fees.

SPY vs VOO Dividend

SPY yields 1.30%, while VOO yields 1.34%, this slight yield variance is due mostly to the different expense ratios.

SPY vs VOO Liquidity

SPY trades an average of 108 million shares a day and VOO trades an average of 7.1 million, so SPY is a clear choice for traders for liquidity.

SPY is also the right choice for options traders as the SPY option chain has much tighter bid/ask spreads due to liquidity and higher open interest.[1][2]

SPY vs VOO ETF

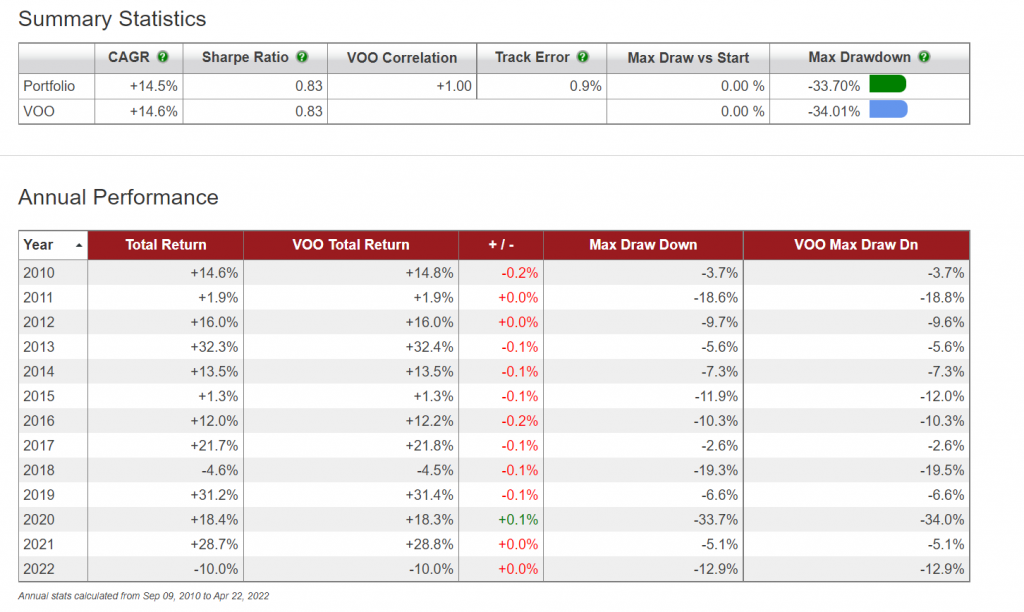

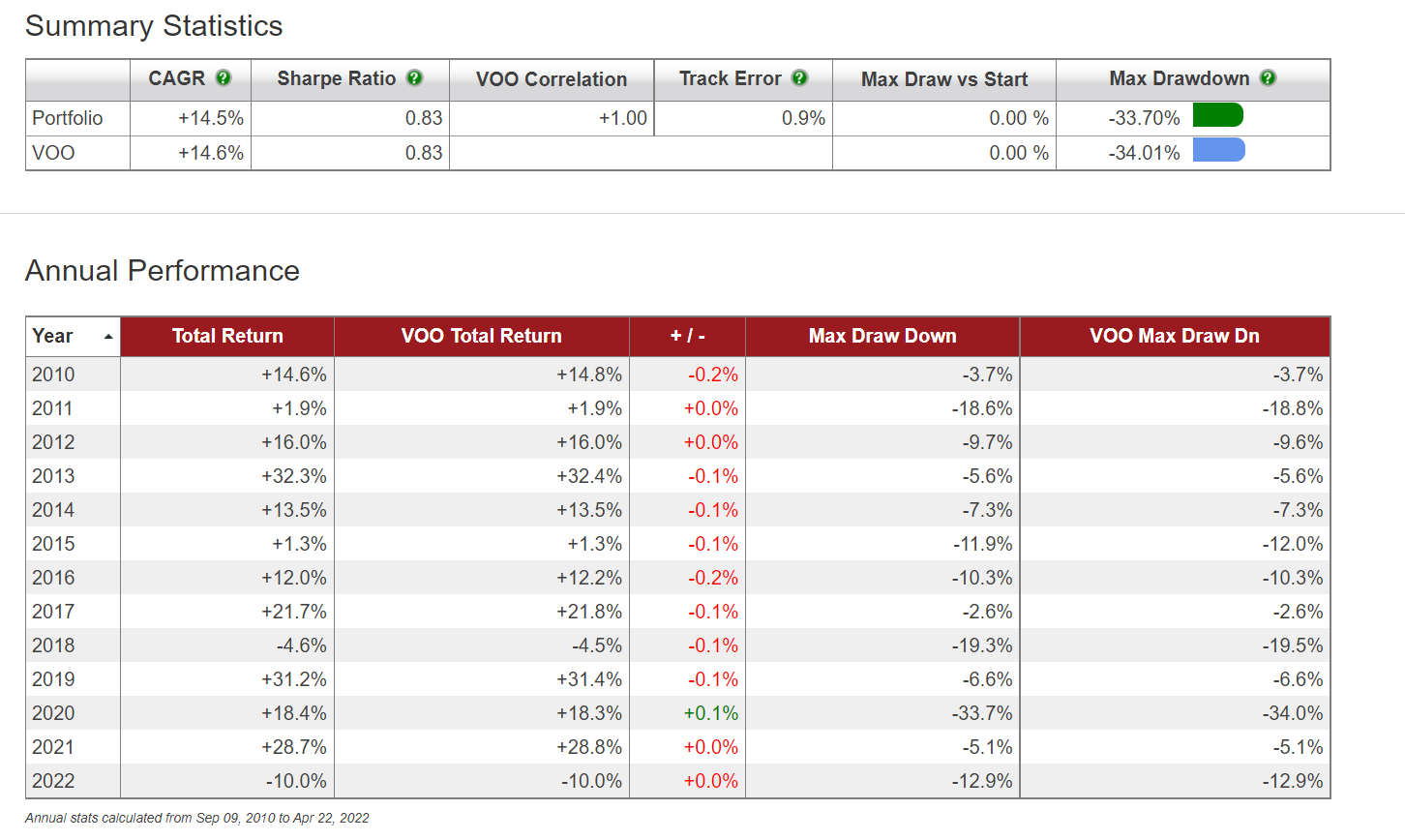

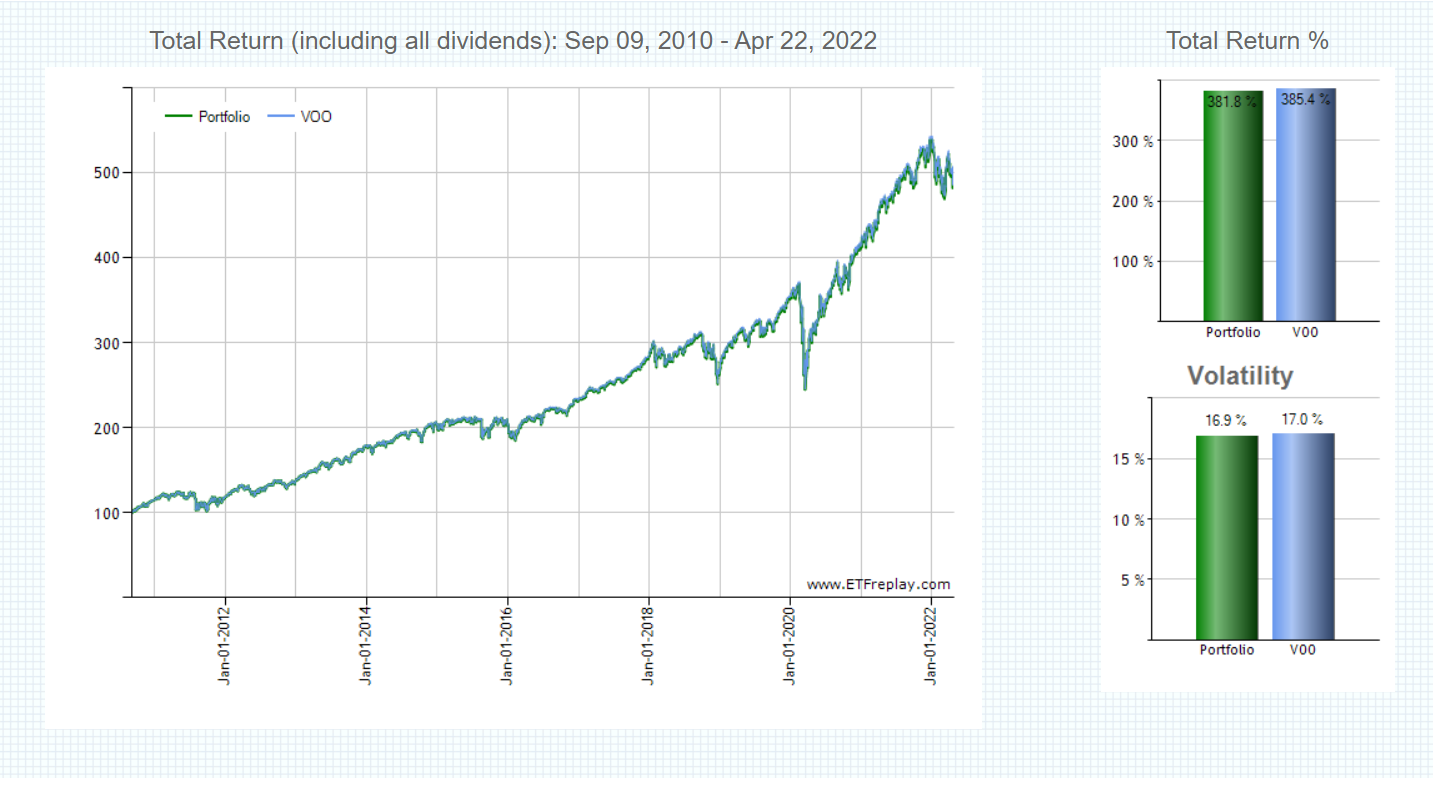

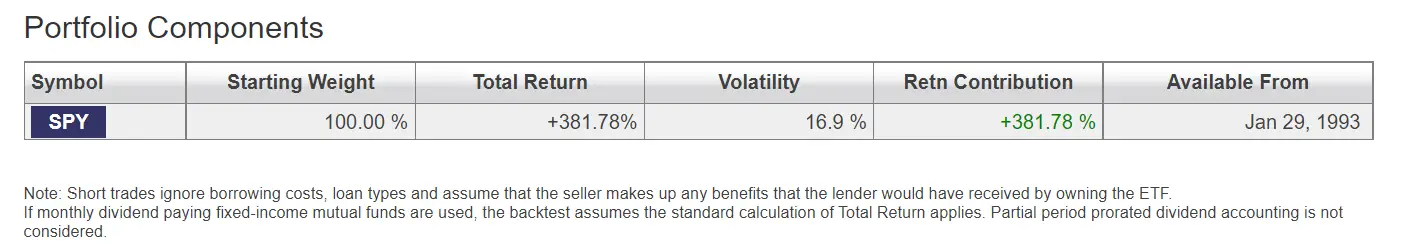

In this return data portfolio is SPY versus VOO.

SPY vs VOO Performance

VOO has outperformed SPY by +3.6% in total returns since VOO’s inception date on 09-07-2010.

Performance data courtesy of ETFreplay.com.