Here are ten of the best tips I believe can make you a better price action trader starting today.

Trading Price Action

The first step to becoming a better trader is abandoning you own opinions, predictions, and emotions in favor of trading the price action itself. Uptrends, downtrends, and trading ranges on charts become more clear when all personal biases are removed.

The second step is to create quantified price action signals to trade that create good risk/reward ratios on entry based on the stop loss versus the potential reward of the profit target.

Use backtesting and historical chart studies to analyze the quality of entry signals and exit signals to optimize profitability.

Trade with a position size that you can manage without emotions, ego, or stress interfering with executing your trading plan. Find the position size that manages risk and manages your emotions.

Create A Watchlist

Create a watchlist of securities and markets that are best suited for your trading method and your volatility tolerance. If you are a day trader you need intraday moves and stocks in play, a swing trader needs swings in price, and a trend follower needs longer-term trends.

Create a diversified watchlist to give yourself more opportunities to find the signals you are looking for. Equities, commodities, currencies, crypto, and sector ETFs can all move differently and you need to be ready to find the moves you’re looking for.

Trading Signals

Diversified trading signals give you more opportunities to trade different types of markets. You can have signals to buy the dips or the breakouts and trade the trends and the swings.

Consider volatility in trading when choosing your position sizing. The VIX and Average True Range (ATR) are the best guides to pick how much risk you want with your position size and stop loss. If a chart is twice as volatile as it was you may want to reduce your position sizing by half to reduce your risk of loss.

Identify the type of market it is you are trading. Charts go from uptrends to downtrends and settle into trading ranges, they go from low volume to high volume and back again. Knowing what type of price action is happening can greatly increase your odds of success by trading with the trend or the range.

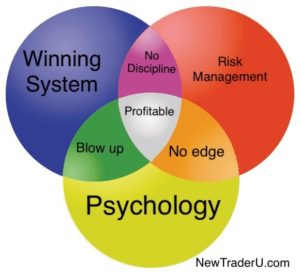

Create a Trading Plan

Usually any trading plan is better than no trading plan. You should quantity every trade before you take it. Know where you are getting in, how big you position size will be and when you are getting out win or lose, before you enter any trade. You make your best decisions before you become mentally engaged in a trading position.

These will be reminders for more experienced traders but can really help change trading results for new traders.